Logistics

March 12, 2015

Freight Shipments Rise in February

Written by Sandy Williams

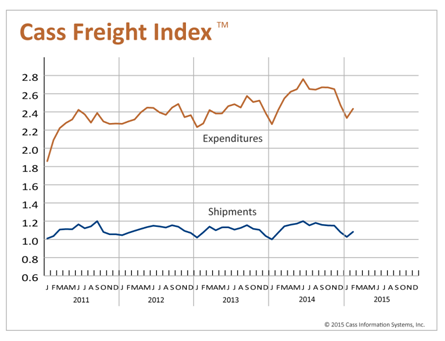

The Cass Freight Index Report shows freight shipments increased in February along with freight expenditures.

Shipments were up 5.5 percent last month and 0.9 percent year over year, driven by seasonal demand for heating oil, coal, and sand. The American Trucking Association (ATA) reported trucking rose 1.2 percent in January. The For-Hire Truck Index stood at an all-time high of 135.7 with the largest year over year gain in more than 12 months.

Freight expenditures declined from December through January but increased 4.3 percent in February. The change was due to increased shipments rather than rate increases, with spot rates flat or down during the month.

DAT Trendlines reports national average flatbed rates down 8 percent in February. Diesel fuel prices dropped 4.7 percent in February but eased upward 1.2 percent in the first week of March. Freight rates for both rail and trucking are expected to rise along with demand during March.

According to Cass Information Systems, the West Coast port conflict will cost retailers as much as $7 billion in increased carrying costs and lost sales. Much of the delayed cargo on the docks will be discounted immediately, said Cass, due to being out of season, and will contribute to mounting inventories. The slow start to 2015 is a temporary one and freight shipments will pick up as the port back-up resolves and warmer weather moves in.