Market Data

March 8, 2015

Steel Mill Negotiations: Lets Make a Deal...

Written by John Packard

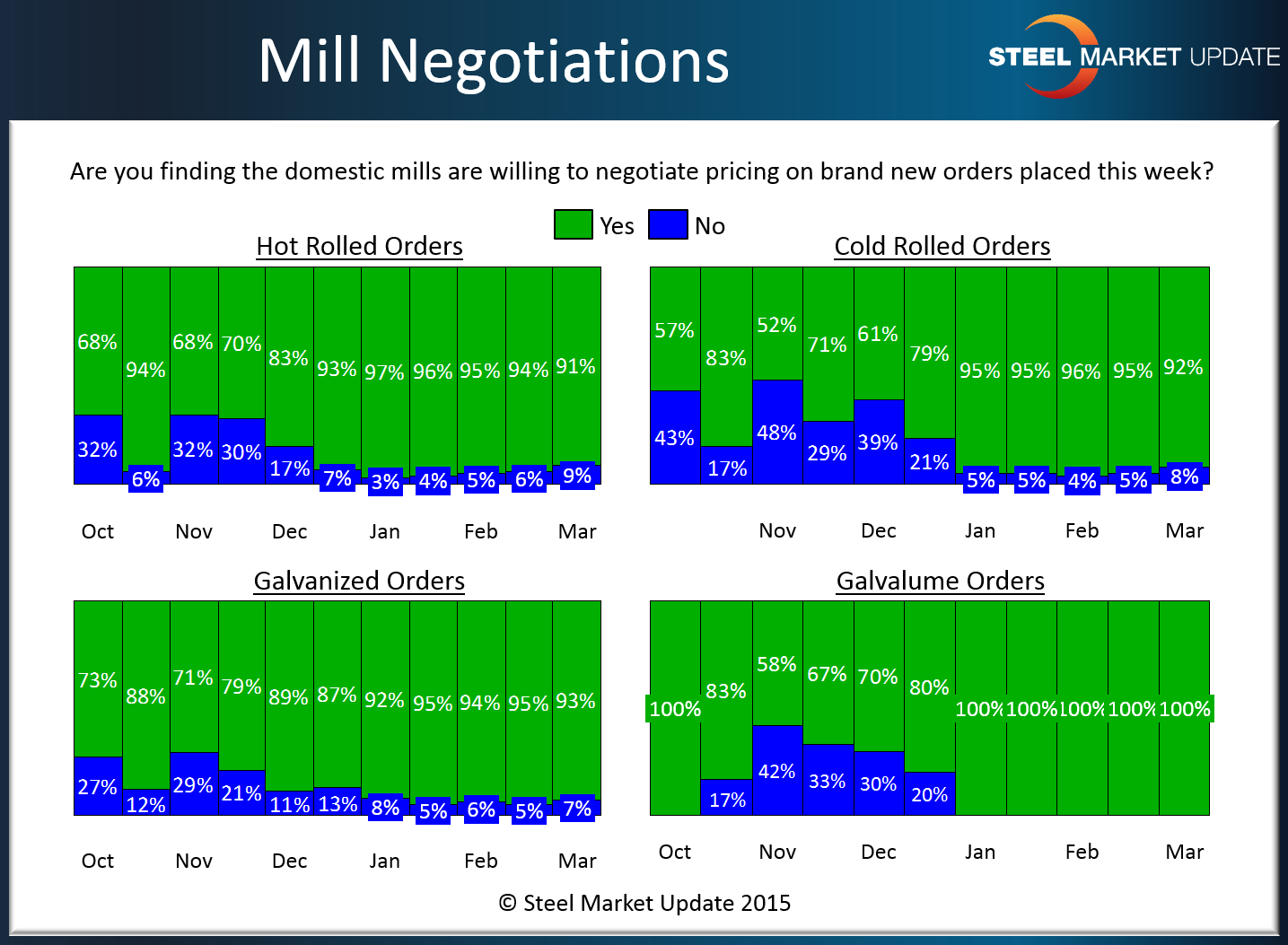

Buyers and sellers of flat rolled steel have been advising Steel Market Update during our flat rolled steel market survey process that the domestic steel mills are willing to negotiate steel prices. Since the beginning of the year the percentage of agreement amongst our respondents (which average 110 to 170 companies) has been almost unanimous. Lead times are short (not extended), foreign steel is plentiful, inventories are high (thus the need to buy is limited) and buyers are insisting on “competitive” numbers on the tonnage which is being bought in the spot markets.

Ninety-one percent of our respondents are reporting the domestic mills as willing to negotiate hot rolled pricing, 92 percent on cold rolled, 93 percent on galvanized and 100 percent on Galvalume.

Below is an interactive graphic of the SMU Mill Lead Times History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”113″ SMU Negotiations by Product- Survey}