Market Data

March 8, 2015

Service Centers in Major Inventory Reduction Mode

Written by John Packard

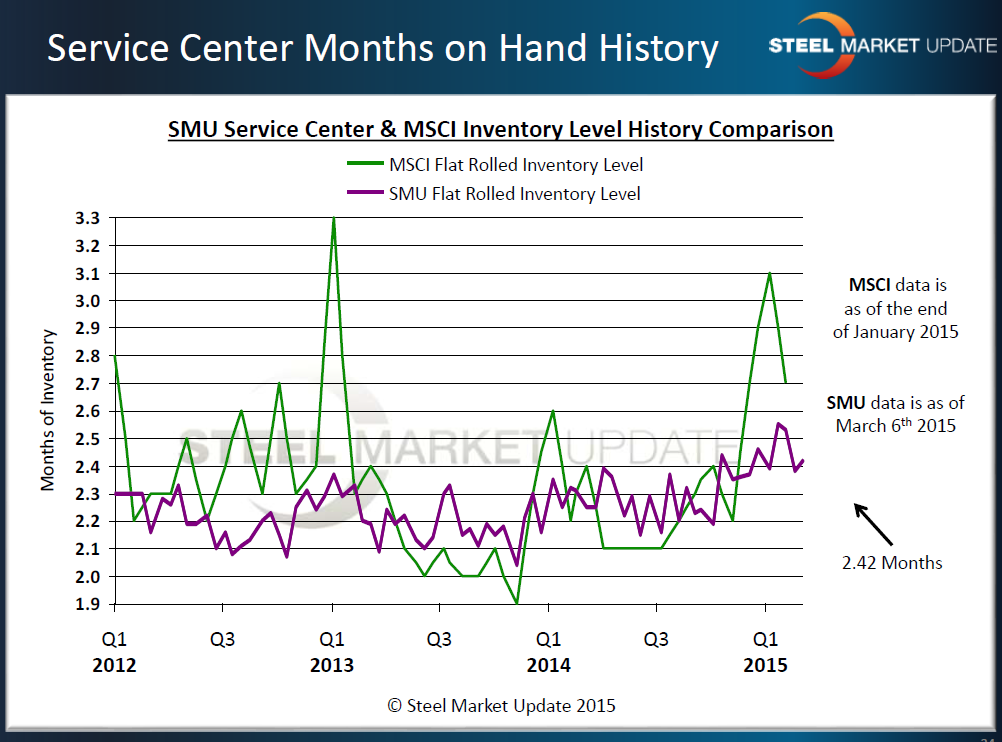

When it comes to the laws of supply and demand within the steel industry, many steel executives in their quarterly conference calls will reference steel service center inventories. As you look at the graphic below you can clearly see the trend change as steel service center inventories began to balloon in 4th Quarter 2014 and 1st Quarter 2015. Based on our proprietary calculations, we have the U.S. flat rolled service centers as carrying 1.1 million tons of excess flat rolled inventories as of the end of January (Apparent Excess/Deficit analysis is available to our Premium members every month).

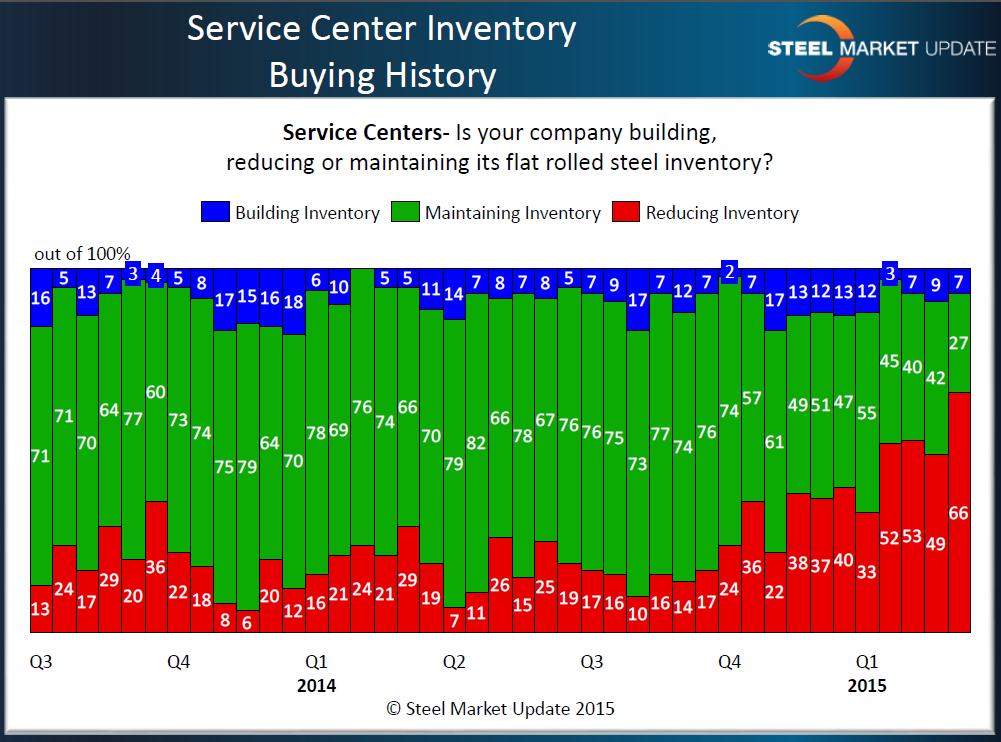

SMU is forecasting that inventory excess levels at the service centers will be shrinking over the next couple of months due to the efforts being made now by the distributors. As you can see from the graphic below, the percentage of service centers reporting they are reducing inventory has grown to levels not seen since the Great Recession (2008/2009). Our flat rolled steel market analysis (survey) from this past week had 66 percent of the service centers responding that their company was reducing inventories.

Based on the responses of these same service centers, our SMU Steel Service Center inventory levels averaged 2.42 months as of this past week. This is down from the 2.55 months seen in our early and mid-February results.

The graphic below depicts service center months of inventory on hand through this past week (SMU) with the green line representing the MSCI months on hand as of the end of January (2.7 months).

We do not give larger service centers more weighting as we compile our data, nor do we seasonally adjust the data.

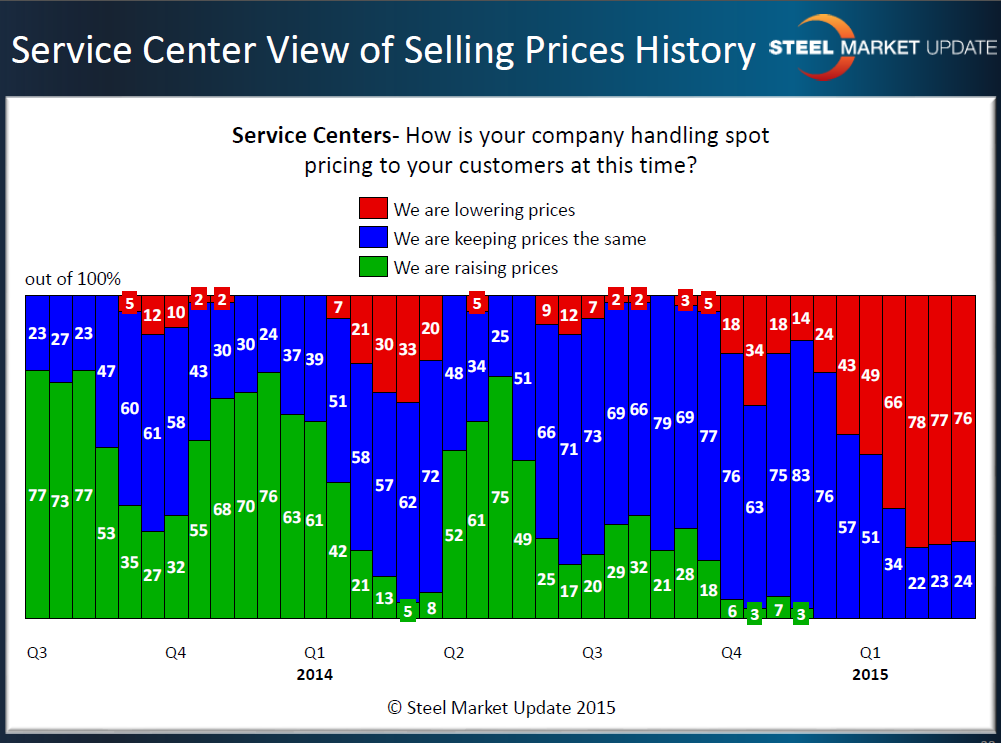

The major weapon used by distributors when attempting to move off inventory is to lower steel prices into the spot markets. This is exactly what we have been seeing for the past three months, and in earnest since the beginning of the New Year.

As you can see by the next graphic, we have crossed over into an area which Steel Market Update has coined “capitulation,” the point at which service centers are moving inventory at whatever price level possible. In the process, they sacrifice margins in the hope that they will be able to replace inventory at ever lower prices. At the same time, we have found it is at this point that the distributors become more receptive to steel mills increasing prices.

The biggest issue we see with the current market cycle is, due the large amounts of foreign steel purchased over the past nine months (and still incoming), the amount of time needed to balance is not quite known (or over-correct which is the normal tendency for the distributors when moving in one direction of the other). Our forecast calls for the reductions to continue through the end of this month and, potentially, into April before the need to replenish arises (based on a number of assumptions related to service center shipments and receipts of new steel).