Market Data

March 5, 2015

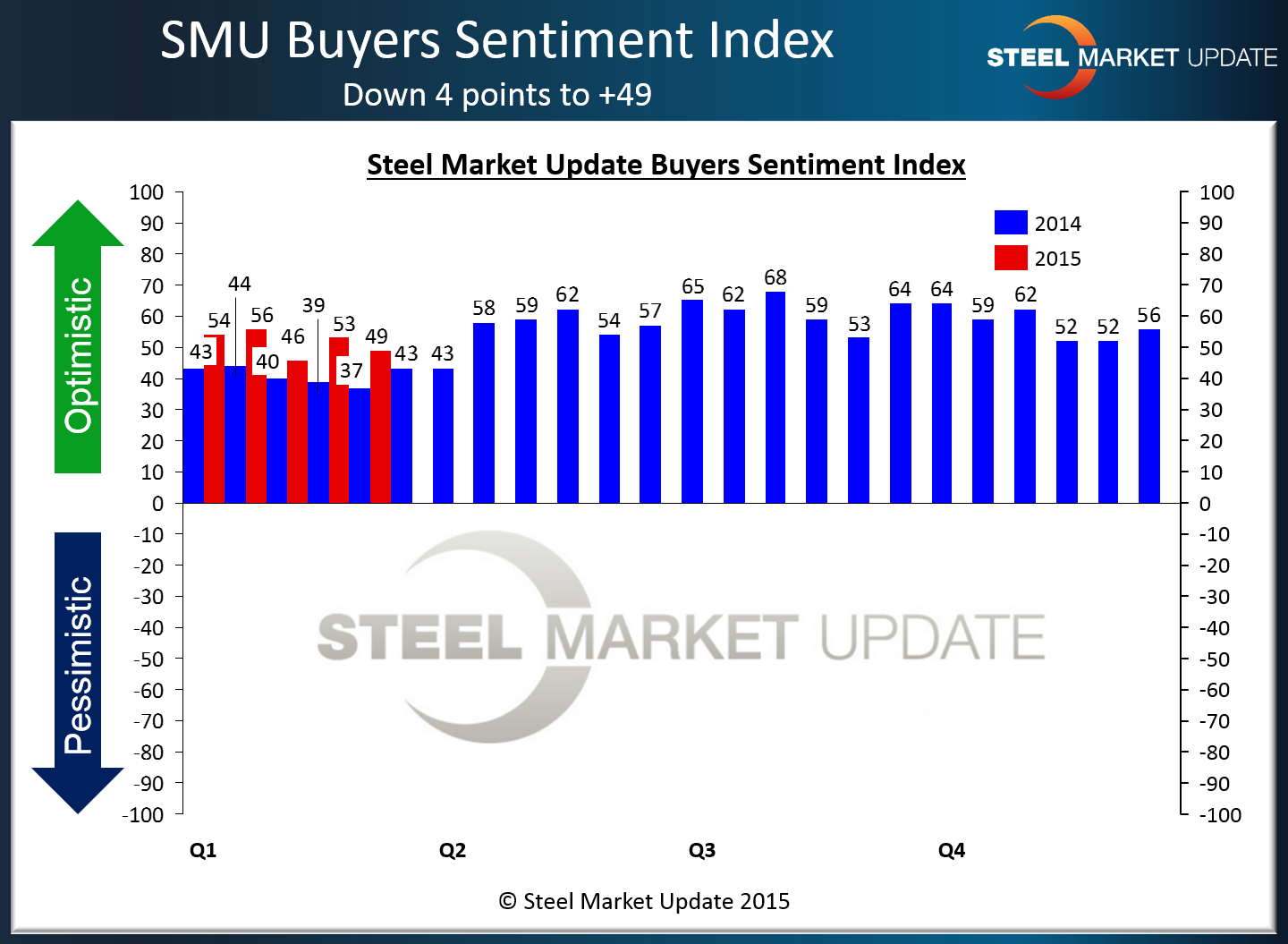

SMU Steel Buyers Sentiment Index Sees Modest Decline

Written by John Packard

Steel Market Update (SMU) concluded our 5th flat rolled steel market survey earlier today. After evaluating the responses we found buyers and sellers of flat rolled steel continue to be optimistic about their company’s ability to be successful both in the current as well as the future steel markets (3-6 months out).

The SMU Steel Buyers Sentiment Index (current) is being reported to be +49. This is down 4 points from our last market analysis during the middle of February, but is well above the +37 measured during the first week of March 2014. The +49 is well within the optimistic range of our index (explanation to follow).

Looking at the Current Index from a three month moving average perspective (3MMA), we found the +52.33 is slightly less optimistic than what we saw two weeks ago (+52.83) and is a little lower than one month ago (+52.67). One year ago our 3MMA was reported to be +40.0 or 12.33 points below this week’s number.

The SMU Future Steel Buyers Sentiment Index is being reported at +59, also 4 points less optimistic than what we measured two weeks back as well as at the beginning of February. One year ago Future Sentiment was measured at +51.

We continue to see better year over year metrics and we believe this is a net positive for the overall health of the flat rolled steel markets as we head into 2nd Quarter and the second half 2015.

To be honest, we are surprised that the collapse of the energy markets has not had a bigger negative impact on our indices. We will need to watch this to see if there is a change in trend in the coming weeks.

What our Respondents are Saying

“We are still shipping our contract customers at solid levels, but spot orders have slowed.” Service Center

“Demand is a bit better, lower steel prices should help us.” Manufacturing Company

“Weather in the south has been an issue.” Wholesaler

“Demand is great, but as the incumbent in many segments competitors are buying cheaper steel now while we sit on existing inventory needed to sustain our customer’s demand. Profit levels in Q1 are really being squeezed.” Manufacturing Company

“Plate demand remains “decent” across the board… Plate demand is steady (could be better) however clients are ONLY buying what they need as they need it. No fluff.” Service Center

“Slowing down it appears.” Service Center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the right hand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment.

Negative readings will run from -10 to -100 and the arrow will point to the left hand side of the meter on our website indicating negative or pessimistic sentiment.

A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic) which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys which are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to enjoy.

Currently, we send invitations to participate in our survey to almost 600 North American companies. Our normal response rate is approximately 110-170 companies. Of those responding to this week’s survey, 41 percent were manufacturing and 40 percent were service centers/distributors, the balance of the respondents are made up of steel mills, trading companies and toll processors involved in the steel business.