Market Data

February 22, 2015

Steel Mill Negotiations: Stuck in Muck...

Written by John Packard

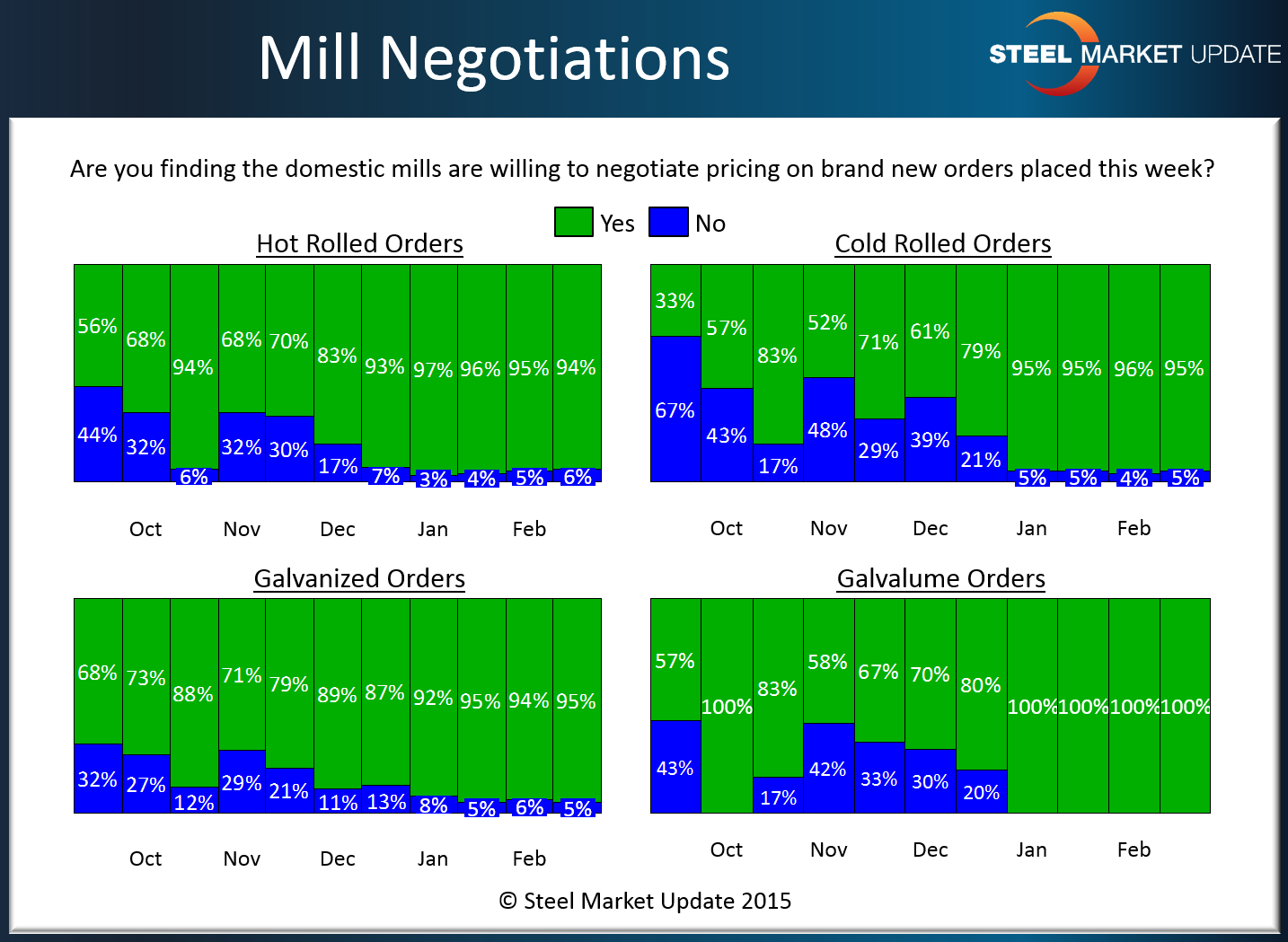

Lead times may be showing signs of reaching a bottom (too early to tell if only a dead cat bounce) but there is no question that the steel mills are willing to negotiate pricing on all flat rolled products. We have been hearing it from the flat rolled steel buyers and executives as we speak with them on daily basis. However, we are always interested in what we collect out of our flat rolled steel market analysis (survey) where there is no pressure to sing along with the rest of the crowd.

As you can see by the graphic below, both buyers and sellers of hot rolled, cold rolled, galvanized and Galvalume are almost unanimous in their reporting the domestic steel mills as being receptive to listening to counter-offers (or any offers) from those customers who are actually going to place flat rolled steel tonnage.

Below is an interactive graphic of the SMU Mill Lead Times History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”113″ SMU Negotiations by Product- Survey}