Market Segment

February 20, 2015

Service Center Intake, Shipments and Inventory in January

Written by Peter Wright

Total service center carbon steel shipments in January increased by 372,400 tons to 3.368 million tons. There was a decrease of one shipping day to 21 in January. On a tons per day basis (t/d) shipments increased from 126,200 in December to 160,400 in January.

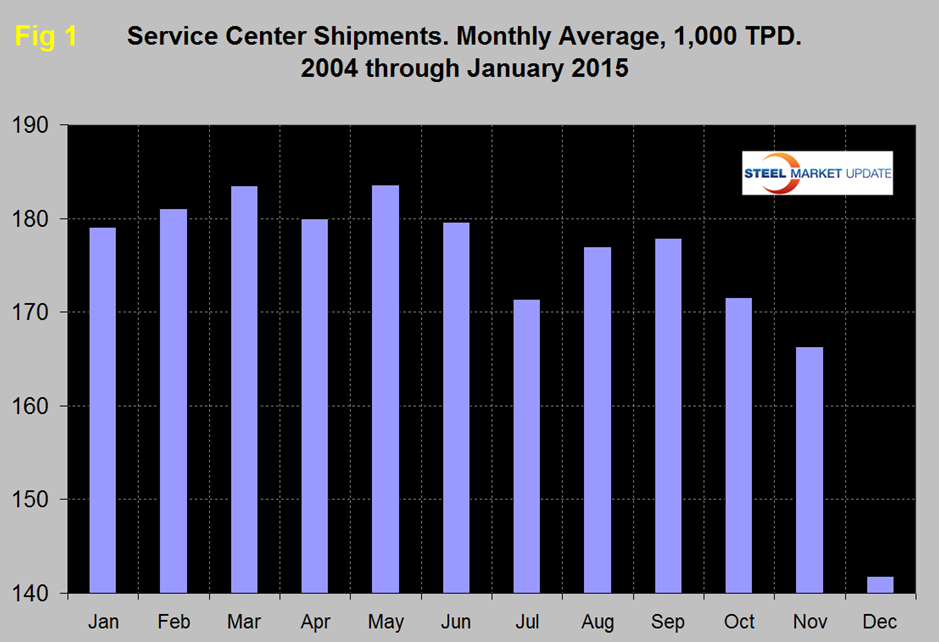

![]() In the eleven years since 2004 January shipments on average have been 26.3 percent higher than December. This year January was only 17.8 percent higher than December so this was not a particularly good result. Figure 1 demonstrates the seasonality of service center shipments and why comparing a month’s performance with the previous month is usually misleading. For this reason in the SMU analysis we always consider year over year changes.

In the eleven years since 2004 January shipments on average have been 26.3 percent higher than December. This year January was only 17.8 percent higher than December so this was not a particularly good result. Figure 1 demonstrates the seasonality of service center shipments and why comparing a month’s performance with the previous month is usually misleading. For this reason in the SMU analysis we always consider year over year changes.

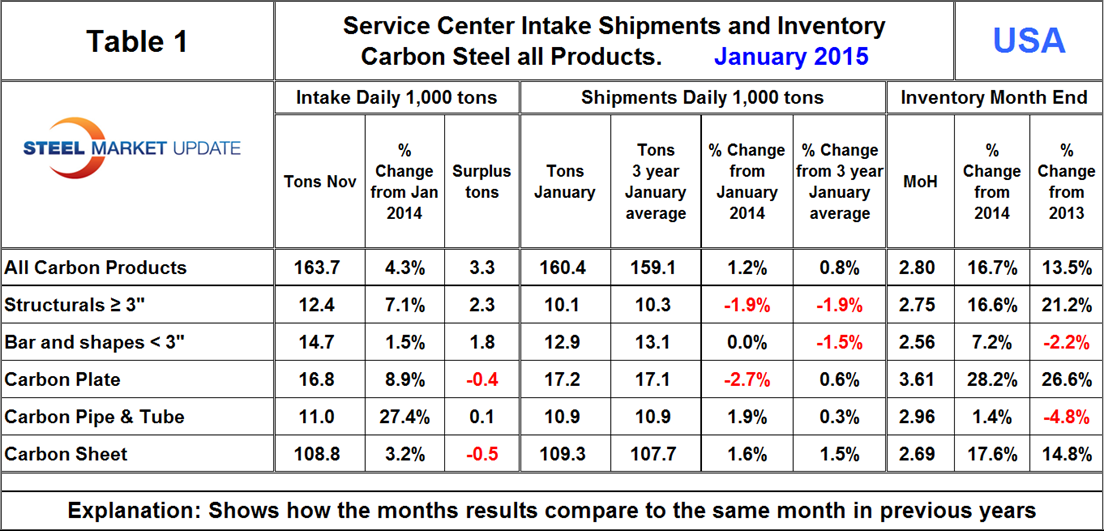

Table 1 shows the performance by product in January compared to the same month last year and also with the average t/d for January 2015, January 2014 and January 2013. We then calculate the percent change between January 2015 and January 2014 and with the 3 year January average. We hope this give the best view of market direction. In January intake at 163,700 tons exceeded shipments by 3,300 tons. Flat rolled products (sheet and plate) had a deficit as long products (bar and structurals) had a surplus intake. Pipe and tube also had a surplus intake. Shipments of all products on a t/d basis were up by 1.2 percent from January last year and up by 0.8 percent from the average January shipments for 2015, 2014 and 2013. The fact that the single month growth comparison is higher than the three year comparison is an indication that momentum is positive and growth is accelerating which was the same conclusion we came to in November and December.

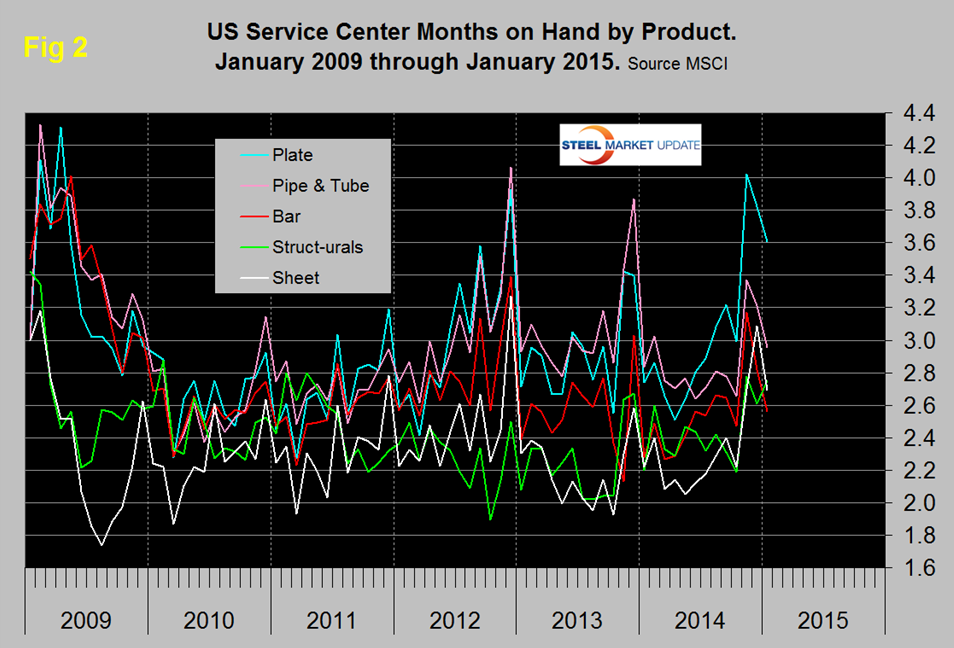

January closed with months on hand (MoH) at 2.80, down from 3.13 at the end of December. Compared to the end of January last year, moth end inventories were up by 16.7 percent in total. All products had a year over year inventory increase led by plate which was up by 28.2 percent. Figure 2 shows the MoH by product since January 2009. Plate products shot up to over 4 MoH at the end of November and were still high at 3.61 at the end of January.

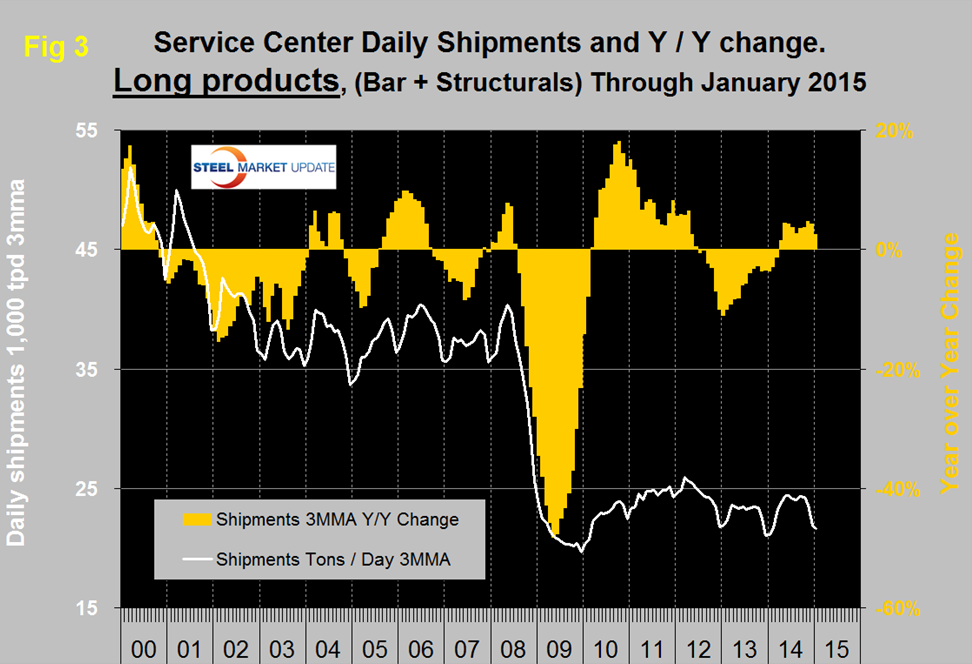

There continues to be a wide difference between the performances of flat rolled (sheet + plate) and long products (structurals + bar) at the service center level. Long products have had a very poor recovery from the recession. On a 3MMA basis y/y, the growth of shipments was negative for 21 straight months until April this year which was the first of nine straight months of growth, (Figure 3).

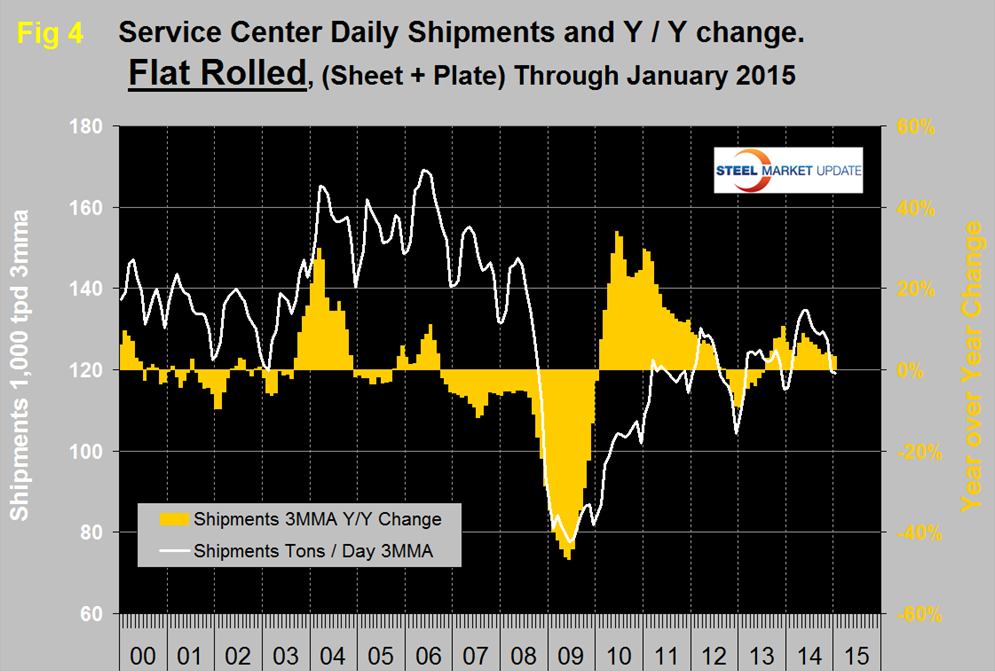

Flat rolled has had a much better recovery since mid-2009 and has had positive y/y growth in each of the last eighteen months, (Figure 4).

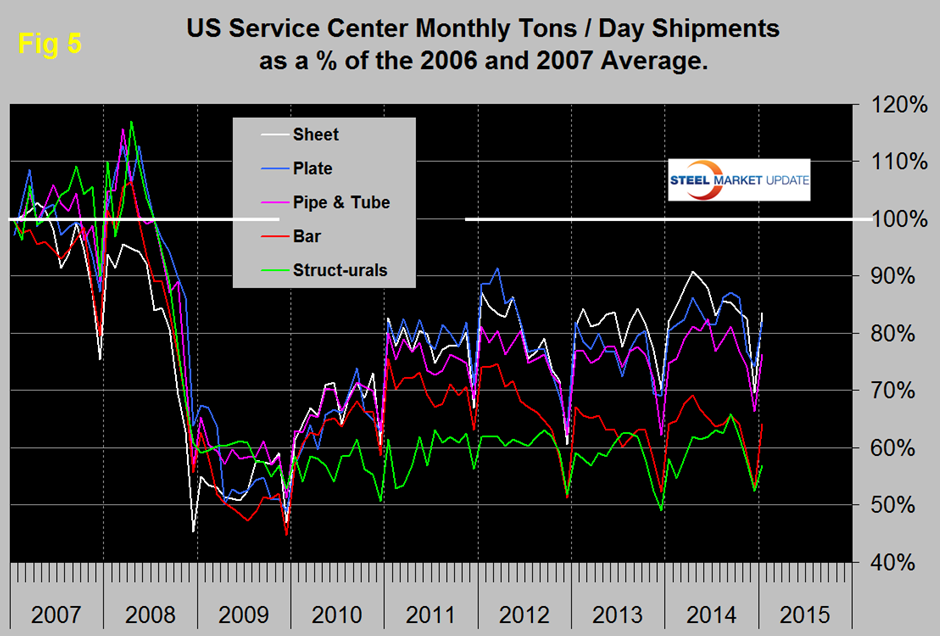

In 2006 and 2007, the mills and service centers were operating at maximum capacity. Figure 5 takes the shipments by product since that time frame and indexes them to the average for 2006 and 2007 in order to measure the extent to which service center shipments of each product have recovered. Again it can be seen that bar and structurals have the worst record. Sheet and plate have had the best recovery since the recession followed by tubulars. Even so the recovery of sheet is only at 83.5 percent and plate at 81.9 percent.

The total of carbon steel products is now at 75.6 percent of the shipping rate that existed in 2006 and 2007, with structurals and bar at 56.9 percent and 64.2 percent respectively. The recovery of the service center sector has been much slower than has been experienced by the mills. Presumably this is because more buyers are purchasing mill direct and this is probably particularly true of long products. In addition long products being more construction oriented are suffering from the slow recovery of that business sector.

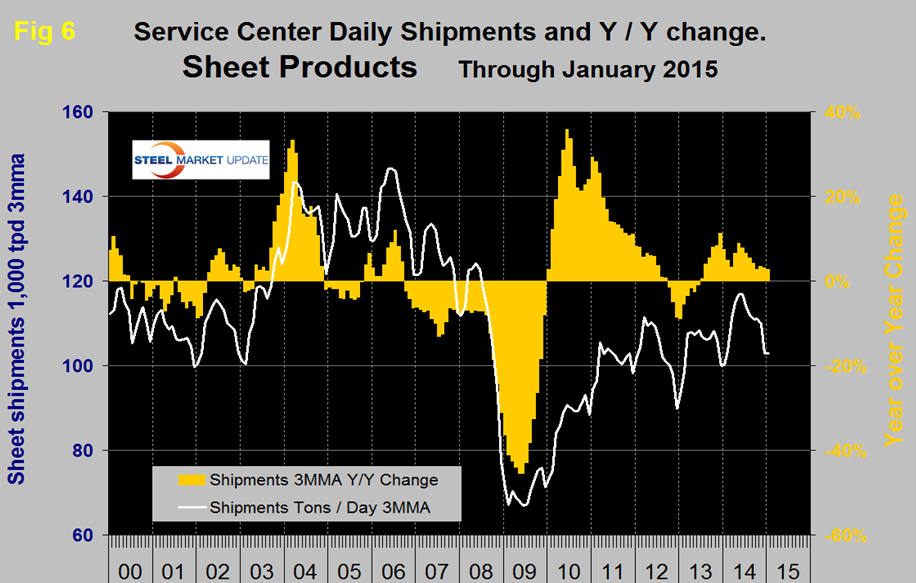

MSCI uses product nomenclature flat and plate. In this analysis at SMU we replace the term flat with sheet. By our interpretation of the MSCI’s data their definition of “flat” is all hot rolled, cold rolled and coated sheet products. Since most of our readers are sheet oriented we have removed plate from Figure 4 to highlight the history of sheet products which are shown in (Figure 6). Positive year over year growth has occurred in each of the last eighteen months following nine consecutive months of decline.

The SMU data base contains many more product specific charts than can be shown in this brief review. For each product we have ten year charts for shipments, intake, inventory tonnage and months on hand. Readers are welcome to these on request.