Market Segment

February 19, 2015

MSCI Inventories & Shipment Data

Written by John Packard

According to data just released by the Metal Service Center Institute (MSCI), U.S. service centers shipped 3,523,600 tons of all steel products during the month of January 2015. The daily shipment rate was 167,800 tons per day which was a slight improvement over January 2014 when the daily shipment rate was 165,800 tons. However, last year had one more shipping day than January 2015. Total steel shipments were down 3.4 percent year over year.

Total steel inventories grew slightly from 9,902,000 tons reported at the end of December to 9,961,100 tons as of the end of January. Inventories were up 16.4 percent over the prior January. The number of months on hand stood at 2.8 months on a non-adjusted basis, this is down from the 3.2 months reported at the end of December. On a seasonally adjusted basis inventories actually rose to 2.9 months as compared to 2.7 months in December. In January 2014 the months on hand stood at 2.3 and 2.5 (non-adjusted and SA respectively).

Carbon Flat Rolled

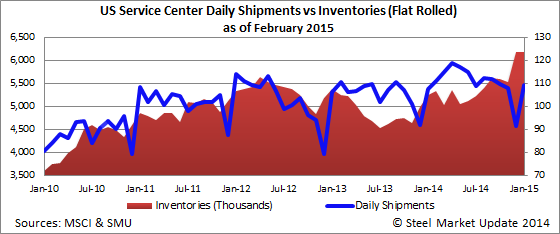

Distributors shipped 2,295,500 tons of carbon flat rolled during the month of January. This was 3.1 percent lower than one year ago. The daily shipment rate of 109,300 tons per day was 1,700 tons more than one year ago.

Flat rolled inventories stood at 6,175,900 tons at the end of January. This 10,200 tons less than what was reported at the end of December. Inventories are now 17.6 percent higher than what was reported in January 2014. The months on hand were reported to be 2.7 months (both unadjusted and SA). On a non-adjusted basis the months on hand dropped from 3.1 months while on a seasonally adjusted basis they rose from the 2.6 months reported at the end of December. Last year flat rolled steel inventories stood at 2.2 (non-adjusted) and 2.3 months (seasonally adjusted).

Carbon Plate

U.S. distributors shipped a total of 361,300 tons of plate products during the month of January. This was 2.7 percent less than what was shipped during January 2014 (with its extra shipping day). The daily shipment rate was 17,200 tons which was an improvement over last year’s 16,900 tons per day rate.

Plate inventories stood at 1,303,100 tons which is up 28.2 percent over one year ago (1,016,700 tons). The months on hand continue to be high with 3.6 months (unadjusted – down from 3.8 months) and 3.7 months on a seasonally adjusted basis (up from 3.5 months at the end of December). Last year inventories on hand were much lower having been reported at 2.7 months (unadjusted) and 2.9 months (SA).

Pipe & Tube

U.S. service centers shipped 227,900 tons of pipe and tube during the month of January. This was 2.8 percent lower than last year. The daily shipment rate for the month was 10,900 tons which was slightly better than the 10,700 tons per day shipped during January 2014.

Inventories of pipe & tube at the distributors stood at 673,600 tons, which is 1.4 percent higher than one year ago. Inventories were also 3,000 tons higher than what was reported at the end of December. The months on hand were reported to be 3.0 months (both unadjusted and seasonally adjusted). On an non-adjusted basis inventories were down from the 3.2 months reported in December but up from the 2.8 months reported on a seasonally adjusted basis.