Market Data

February 17, 2015

China’s Economic Statistics Q4 2014

Written by Peter Wright

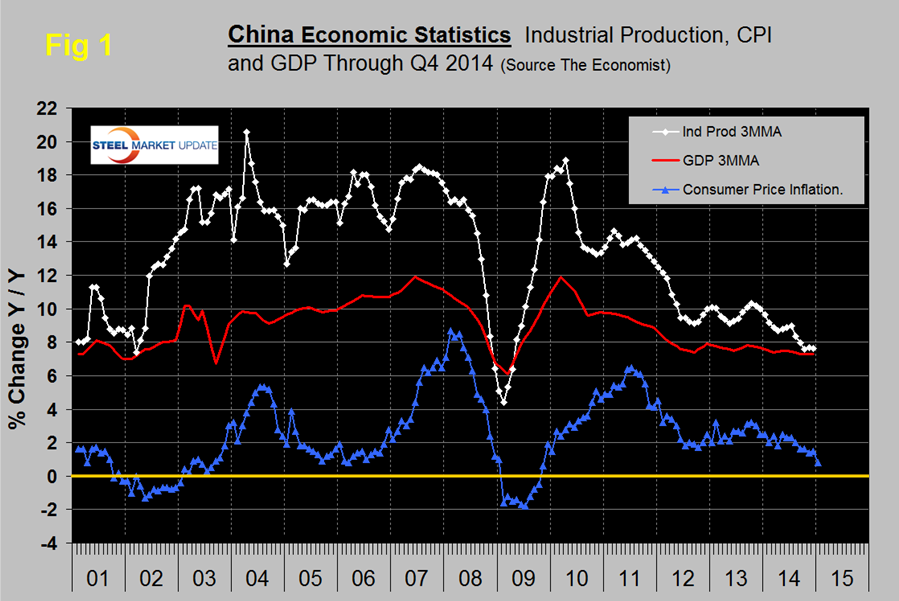

The first graphic depicted below shows published Chinese data for the growth of GDP, industrial production and consumer prices through Q4 2014. The GDP and industrial production portions of this graph are three month moving averages. GDP grew 7.3 percent y/y in both the 3rd and 4th quarters and has been declining since Q1 2010. The growth of industrial production year over year on a three month moving average basis which had been averaging 16 percent from early 2003 to mid-2008 decreased in December to 7.6 percent continuing a five month period of continuous contraction.

The annual pace of exports in the Chinese economy has weakened in recent years as the global economy slowed. In the fourth quarter, the export figure grew by a 3.54 percent annual pace, up from the previous quarter’s figure of 1.11 percent. Since 2011, however, export growth has slowed from nearly 30 percent, to now less than 5 percent. Weakness in exports to both Japan and the euro area weighed on the overall figure.

Consumer price inflation has been falling for over a year and reached 0.8 percent in January as both food and core-product prices declined. Over the last year, the inflation measure has fallen by nearly two-thirds from a 2.5 percent annual pace, to now below 1 percent, shown in Figure 1. Prices of goods from pork, to electricity broadly declined over the last year. Home prices, export growth, and inflation measures all weakened in 2014, and have yet to show signs of bottoming.

Figure 2 shows the growth of fixed asset investment y/y. The decline experienced in 2013 has accelerated through all of 2014. We understand that this data includes real-estate purchases so is not a direct reflection of constructional steel demand. We are assuming that the steel on the ground portion of this data follows the overall trend and that the contraction in FAI is in accordance with the stated objective to re-balance the economy in favor of consumer consumption.

The Chinese Ministry of Industry and Information Technology reported in late January that the Chinese steel industry phased out 31.1 million tonnes of outdated capacity in 2014. New environmental protection laws went into effect on January 1st which the Ministry expects will increase the pressure on obsolete plants. In January, Chinese home prices declined at an annual pace of -5.1 percent, below the previous reading of -4.3 percent. Since the start of 2014, home prices have fallen from over a 10 percent annual increase, to now contraction. Moreover, home prices have declined for nine consecutive months. Investors have favored equities over real estate, as many believe there is currently an oversupply of real estate projects in the Chinese economy. Home prices fell in 64 of the 70 cities tracked by the National Bureau of Statistics,” according to the BBC.

Chinese equities increased in 2014, at some point economic weakness in the region will lead to capital flows elsewhere.

SMU Comment: The fears of the global steel industry that Chinese overcapacity would eventually become critical are coming to pass. In 2014 the growth in China’s steel production was only 0.9 percent but this performance has been erratic. In Q4 2014 y/y growth was 2.8 percent. As yet there is no sign of an actual contraction. Chinese steelmakers will increasingly attempt to dispose of their excess production in any markets that will accept them.