Prices

February 9, 2015

Investigation of Steel Import License Data Accuracy

Written by Peter Wright

Import data is reported three times for each month. These reports are licensed, preliminary and final tonnages for each product. The Steel Import Monitoring system has been a widely used tool to provide an advanced look at import volumes using data compiled from import licenses. These licenses can be applied for at any time between when the vessel ships to ten days after it arrives so there is not a good overlap with an individual calendar month of receipts. The total licensed tonnage for any product in a given month is available on the first Tuesday of the following month which is about three weeks before the preliminary numbers and about five weeks before the final numbers are released. We decided to investigate the degree to which the license numbers for flat rolled products accurately predict the final volume throughout the course of 2014 expecting that as the year progressed with the inclusion of more months of data the total license and final data for the year to date would converge.

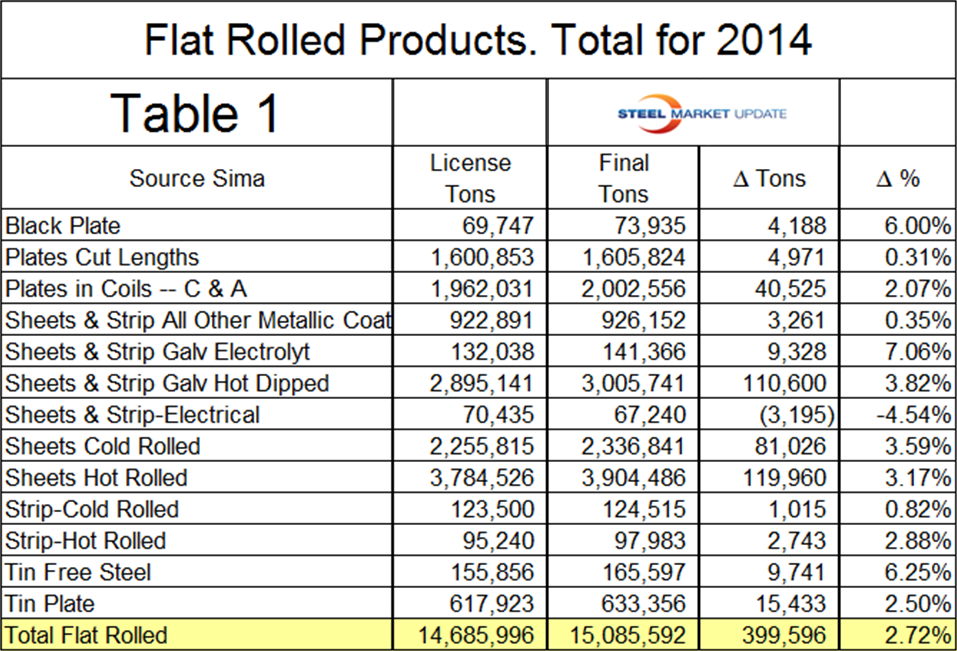

We first published this analysis using data for the first four months of 2014 and saw how close the preliminary and final numbers are. Sometimes they are identical over large volumes. Moving on to examine the licensed data we saw that through April the total final tonnage of flat rolled products was 4.6 percent greater than the licensed volume. We have now updated this analysis three times, through June, through October and now for the full year. As we expected the licensed tonnage and the final tonnage did converge as the period under consideration increased. Through June, October and December the final tonnage was 3.79 percent, 3.07 percent and 2.72 percent, respectively, more than the licensed tonnage. It can be assumed that if we were to continue this analysis for 24 months, (which we don’t plan on!) the numbers would converge even more. Suffice to say that we are satisfied and impressed by the ability of the licensing system to project with reasonable accuracy the final import volume by product.

Table 1 shows the difference between final and licensed tonnage by product for the full year of 2014. Of the big 3, hot rolled, cold rolled and HDG sheet, hot tolled has the smallest discrepancy at 3.17 percent followed by cold rolled at 3.59 percent and HDG at 3.832 percent. In all cases except electrical sheet and strip the discrepancy is positive meaning that more arrived than was licensed. We assume that actual can be more than licenses because permits can be obtained after the steel has arrived in the US. In a study such as this the problem is that the date of the license can vary by weeks but the date of arrival is a fact. Our conclusion from this license accuracy investigation is that the ability of the licensed data to predict the final volume is good. This is important because in the SMU import analysis we use a three month moving average which includes the latest final, preliminary and licensed tonnage for three consecutive months and we perform this analysis in the first week of each month. So for example in the first week of March our import analysis will include the February licensed data, the January preliminary data and the December final data. We think this gives the earliest possible indication of the import situation and both evens out monthly noise and dilutes the small inaccuracies in the licensed data. As this current investigation indicates the licensed data is surprisingly accurate so we are happy about the methodology we are using.