Market Data

February 9, 2015

Federal Reserve Senior Loan Officer Opinion Survey on Bank Lending Practices

Written by Peter Wright

The Q1 2015 February Senior Loan Officer Opinion Survey on Bank Lending Practices was released on February 2nd. This survey addresses changes in the standards and terms on, and demand for, bank loans to businesses and households on a quarterly basis and is based on the responses from 73 domestic banks and 23 U.S. branches and agencies of foreign banks. The Federal Reserve generally times the quarterly survey so that results are available for the January/February, April/May, August, and October/November meetings of the Federal Open Market Committee.

The following is an abridged version of the Federal Reserve report followed by SMU comments and graphs:

Lending to Businesses

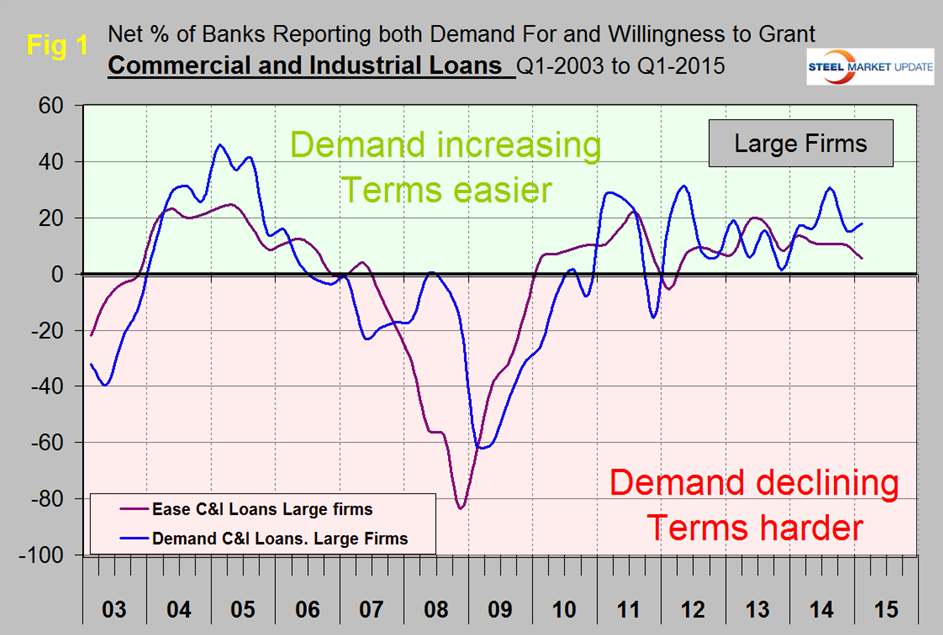

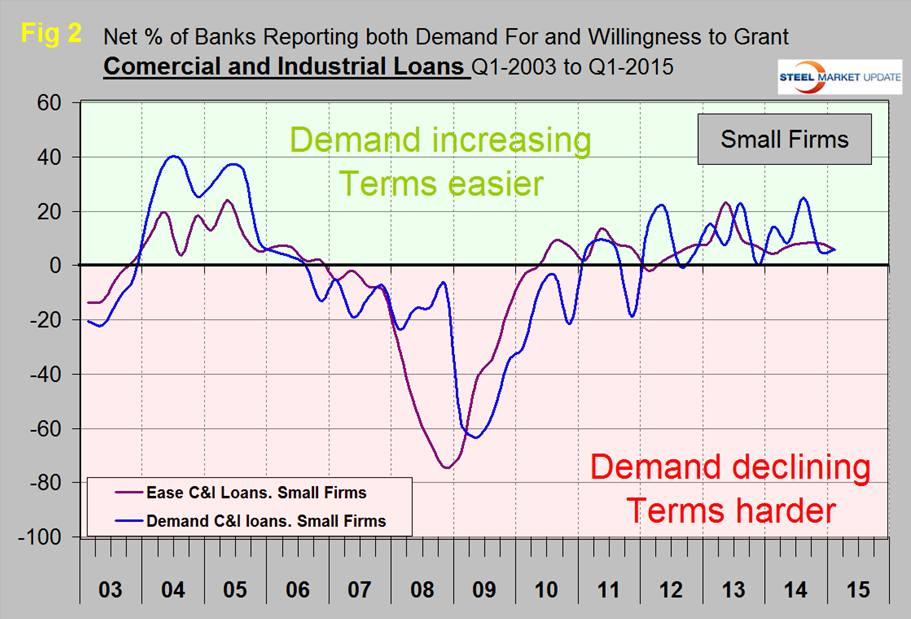

Questions on commercial and industrial lending: On balance, banks reported little change in standards for C&I loans (Commercial and Industrial) to firms of all sizes over the past three months. Moderate net fractions of banks continued to report having eased spreads, interest rate floors, and the cost of credit lines. However, the number of banks that had eased price terms was noticeably lower than in prior surveys. Non-price terms generally remained about unchanged, except for a modest net fraction of banks which indicated having eased loan covenants. Foreign banks described most of their C&I lending policies as little changed on net, except for a modest net fraction which reported having increased the maximum size of credit lines.

Most respondents that reported having eased either standards or terms on C&I loans over the past three months cited more-aggressive competition from other banks or non-bank lenders as an important reason for having done so. Smaller numbers of banks also attributed their easing to a more favorable or less uncertain economic outlook, increased tolerance for risk, or improvements in industry-specific problems.

Banks which reported having tightened either their standards or terms on C&I loans predominantly pointed to industry-specific problems as the main reason for having tightened their lending policies to non-financial businesses. Some survey respondents specifically noted their concerns about the oil and gas sector resulting from the sharp decline in the price of oil as a reason that they had tightened their lending policies. In addition, half of the banks reporting tightening indicated increased concerns about the effects of legislative changes, supervisory actions, or changes in accounting standards.

On the demand side, a modest net fraction of domestic banks reported having experienced stronger demand for C&I loans from large and middle-market firms. In addition, a modest net fraction of banks reported an increase in the number of inquiries from potential business borrowers regarding the availability and terms of new credit lines or increases in existing lines. Banks reported that loan demand from small firms had remained about unchanged on net. To explain the reported increase in loan demand by larger firms, banks cited a wide range of customers’ financing needs, particularly those related to mergers or acquisitions, as well as inventories, accounts receivable, and investment in plant or equipment. Foreign banks also reported having seen stronger C&I loan demand on net.

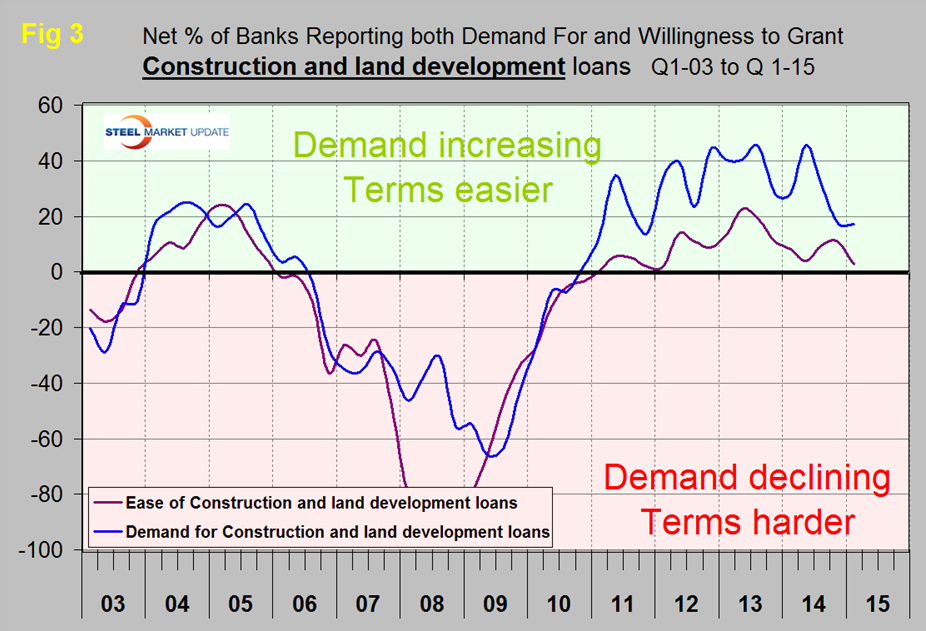

Questions on commercial real estate lending: On balance, most banks reported little change in lending standards on all three categories of CRE, (Commercial real estate) loans: construction and land development loans, loans secured by non-farm nonresidential structures, and loans secured by multi-family residential properties. As has been the case for the past several surveys, a few large banks reported having eased standards for all three categories of CRE loans. Regarding changes in demand for CRE loans, modest net fractions of banks indicated that they had experienced stronger demand for construction and land development loans and loans secured by non-farm nonresidential properties. A somewhat larger net fraction of banks reported stronger demand for loans secured by multifamily residential properties. A modest net fraction of foreign banks reported having eased lending standards on CRE loans and having seen stronger demand for such loans over the past three months.

Lending to Households

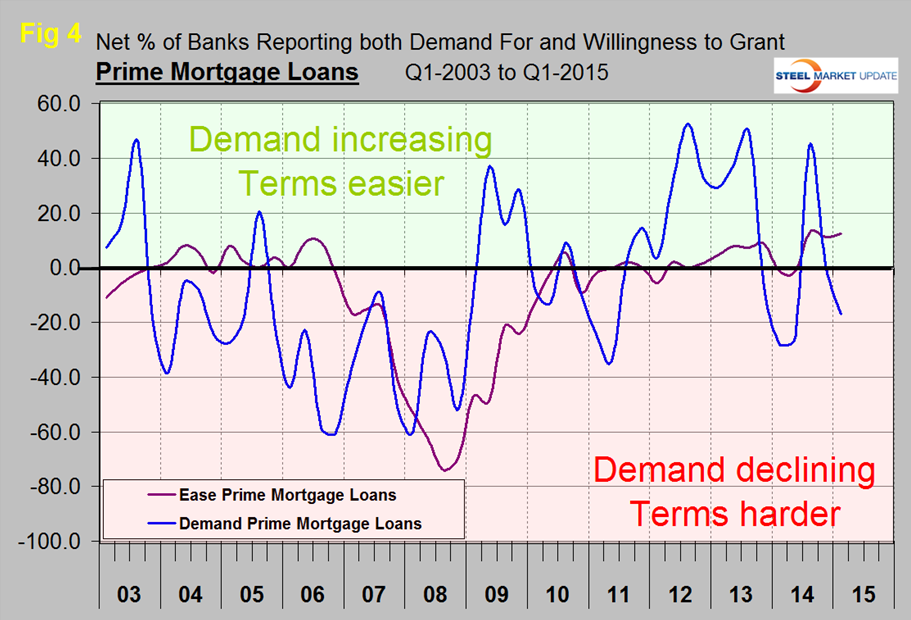

Questions on residential real estate lending: The January 2015 survey revised and expanded the residential mortgage loan categories to reflect the Consumer Financial Protection Bureau’s qualified mortgage (QM) rules and provide additional detail on important developments in the residential mortgage market both now and in the future. Modest net fractions of large banks indicated that they had eased standards on mortgage loans. Regarding changes in demand, modest net fractions of banks of all sizes reported weaker demand across most categories of home-purchase loans. Few banks reported having changed their standards on home equity lines of credit, and while survey respondents indicated, on balance, that they had experienced little change in demand, several large banks reported stronger demand for such loans.

Questions on consumer lending: A small net fraction of large banks indicated that they were more willing to make consumer installment loans over the past three months. Few banks reported having eased their standards for auto loans, while standards for approving applications for credit card and other consumer loans were about unchanged on net. Moreover, most terms on credit cards were reported to have changed little. Very few banks reported changes on any of the terms on auto loans or other consumer loans, except for a small net fraction of banks that reported having reduced the spreads of loan rates over cost of funds for both loan types. Modest net fractions of large banks reported having experienced an increase in demand for auto loans and credit cards over the past three months. In contrast, demand for other consumer loans was reported to have remained about unchanged.

There is a huge amount of valuable data in this report which can be accessed here by those readers who wish to dig deeper.

At SMU we extract and graph the major elements in the survey. Regarding loans to businesses, the February survey indicated that demand for commercial and industrial (C&I) loans from both large (>$50MM revenue) and small (<$50MM revenue) firms was almost unchanged. There was a tightening of lending standards to large firms to which a net 5.5 percent of banks reported an easing of standards, down from 10.5 percent in Q4 2014. To small firms, a net 5.7 percent reported easing, down from 8.2 percent in Q4, (Figure 1 and Figure 2).

What this means for example is that the number of banks reporting an easing of standards to large firms was 5.5 percent higher than the proportion reporting a tightening of standards. In reality most banks are not changing their standards. There was almost no change in the number of banks reporting a change in demand for construction and land development loans, demand is at the bottom of the range that has existed since mid-2011. The net percentage of banks reporting an easing of standards for construction loans decreased from 10.8 percent to 2.9 percent, (Figure 3).

Demand for prime real-estate mortgages has been extremely erratic for two years. This may be because banks are not the major vehicle for such loans. Demand is now almost back down to where it was at this time last year with a net negative 17.1 percent of banks reporting a decline in demand. This level of variability is not mentioned or explained in the official write up by the Fed, (Figure 4).

Except for the decline in demand for prime mortgage loans the implications of this report are reasonably good for steel people. There are still a net positive percentage of banks reporting increased demand for and easier terms for industrial (C&I) and construction (CRE) loans.