Market Data

February 3, 2015

Slight Uptick in Global PMI in January

Written by Sandy Williams

Global manufacturing continues to grow steadily with expansion in production and new orders in January. The JP Morgan Global Manufacturing PMI rose slightly last month to 51.7 from 51.5 in December.

“The PMI turned higher in January, including moderate gains in the indexes of output and new orders,” commented David Hensley, Director of Global Economics Coordination at JP Morgan. “At the current level, the output PMI is consistent with production gains of about 3.5% annualized, which is somewhat above the long-term potential. The January PMI featured a big drop in input costs, as the slump in oil prices drove down costs and provided some useful respite for margins across much of the global manufacturing sector.”

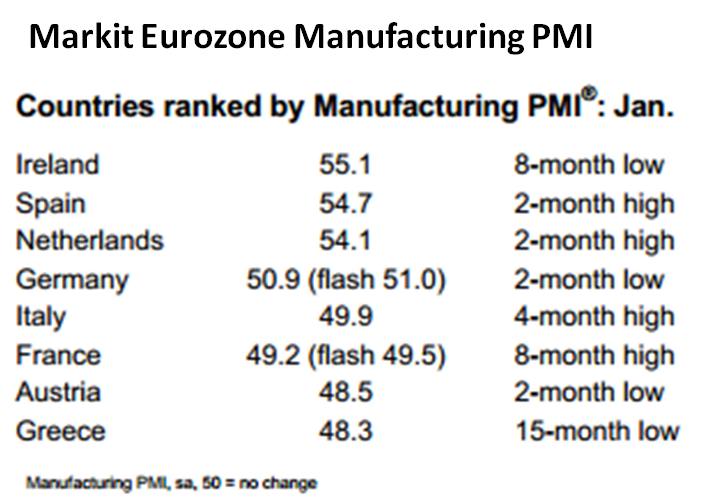

Manufacturing growth was mixed in the Eurozone in January. Expansion occurred in Germany, Spain, the Netherlands and Ireland while the rest of the region was in contraction. The rate of contraction moved closer to stabilizing in France and Italy, but in Austria and Greece the downturn steepened. Eurozone manufacturers faced weak domestic demand and restrained export growth in January. The Eurozone PMI for January inched up 0.4 points to 51.0.

Manufacturing growth was mixed in the Eurozone in January. Expansion occurred in Germany, Spain, the Netherlands and Ireland while the rest of the region was in contraction. The rate of contraction moved closer to stabilizing in France and Italy, but in Austria and Greece the downturn steepened. Eurozone manufacturers faced weak domestic demand and restrained export growth in January. The Eurozone PMI for January inched up 0.4 points to 51.0.

Chris Williamson, Chief Economist at Markit said: “Eurozone manufacturing showed signs of pulling out of the doldrums at the start of the year, but the rate of expansion remained disappointingly meager, vindicating the ECB’s decision to take drastic action to revive the economy. The ECB’s ‘bazooka’ of full-scale quantitative easing should boost the euro area economy via improved business and consumer confidence and the weakening of the euro. The currency’s fall should benefit exporting manufacturers in particular over coming months. Lower oil prices will also help reduce manufacturers’ costs, with reduced fuel costs also freeing up more consumer income to spend on goods.”

Russia’s manufacturing PMI fell to a 67 month low in January, registering 47.6. New Orders declined for the second consecutive month with new export orders dropping for the seventeen month in a row and at the strongest rate since October. Production dropped for the first time since May taking employment levels with it. Input and output price inflation both accelerated in January.

Manufacturing conditions remained in the contraction zone in China at the start of 2015. The composite HSBC China Manufacturing PMI registered 49.7, compared to 49.6 in December. Output increased fractionally, rising for the first time in three months. Weak domestic and export demand subdued new order growth. Employment levels fell slightly. Input costs declined at the fastest rate since 2009 along with an accelerated drop in output charges.

“We think demand in the manufacturing sector remains weak and more aggressive monetary and fiscal easing measures will be needed to prevent another sharp slowdown in growth,” commented Hongbin Qu, Chief Economist, China & Co-Head of Asian Economic Research at HSBC.

Japan manufacturers saw their sixth consecutive month of production growth in January. The year is off to a good start with increases in output and new orders. Inflationary pressures remain due to yen depreciation, driving up input prices and, subsequently, output charges. New export orders picked up due to stronger advertising, demand and new products. The Markit/JMMA PMI was 52.2, above the no-change 50 mark for its eighth month in a row.

The South Korea PMI returned to growth territory in January, posting at 51.1, up from 49.9 in December. New orders picked up domestically and internationally with export demand increasing for the first time in ten months. New foreign clients and increased trade with Russia were linked with the higher new export orders.

In North America, the U.S. posted modest growth while Canada dropped to a 21 month low. The RBC Canadian Manufacturing PMI fell from 53.9 in December to 51.0 in January. Output and new business growth both slowed in the past two months. Oil and gas customers were reported

“The latest data indicates that Canada’s manufacturers started the year with concerns around uncertainty about global growth prospects, financial market volatility and a sharp drop in oil prices,” said Craig Wright, senior vice president and chief economist, RBC. “As we look ahead, we expect an eventual recovery in oil prices alongside a strong U.S. economy and a more competitive currency. These factors will support economic growth similar to the 2 ½ per cent rate achieved last year and the manufacturing sector offsetting weakness in the energy sector.”

Mexican manufacturing showed increased rates of output, new orders and employment in January. The HSBC Manufacturing PMI rose to 56.5, its highest level since December 2012. A weak exchange rate drove input prices up with cost inflation at its strongest pace in six months. Higher production volumes contributed to increased employment levels to meet current and future demand.