Prices

February 1, 2015

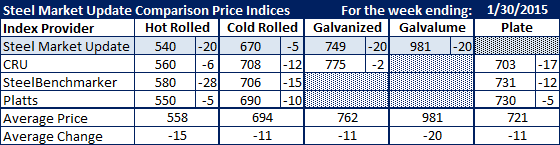

Comparison Price Indices: More Drama as Prices Continue to Slide

Written by John Packard

Mark Millett, CEO of Steel Dynamics pointed out the inconsistencies in the steel prices being referenced by two of the steel indexes followed by Steel Market Update. Millett spoke about the erosion of pricing and referenced the indexes in this comment, “…But I think our optimism is that American pricing has eroded and it has eroded we’ll see a little more than you would see from perhaps Platts and CRU data….”

To be fair to Mr. Millett, he then went on to speak to the spread between Chinese spot pricing and that of the domestic steel mills has been eroding, especially when considering material that must be moved from the ports to the Midwest.

Steel Market Update saw the pricing drama continuing this past week as all of the indexes saw flat rolled steel prices as down on all products (including plate). The average price for hot rolled coil dropped to $558 including the $580 per ton provided by SteelBenchmarker. If we remove SteelBenchmarker the average dropped to $550 per ton.

We have quite the spread between the four indexes. Steel Market Update (SMU) at $540 is the lowest followed by Platts at $550, CRU at $560 and SteelBenchmarker at $580 per ton.

We have a wide spread in cold rolled as well with SMU at $670 and CRU +$38 higher at $708 per ton.

Galvanzed also has a wide spread between SMU ($749) and CRU ($775).

The spread was also quite high on plate from a low of $703 (CRU) to $731 (SteelBenchmarker).

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.