Market Data

January 27, 2015

Durable Goods Shipments, Inventories and Orders

Written by Peter Wright

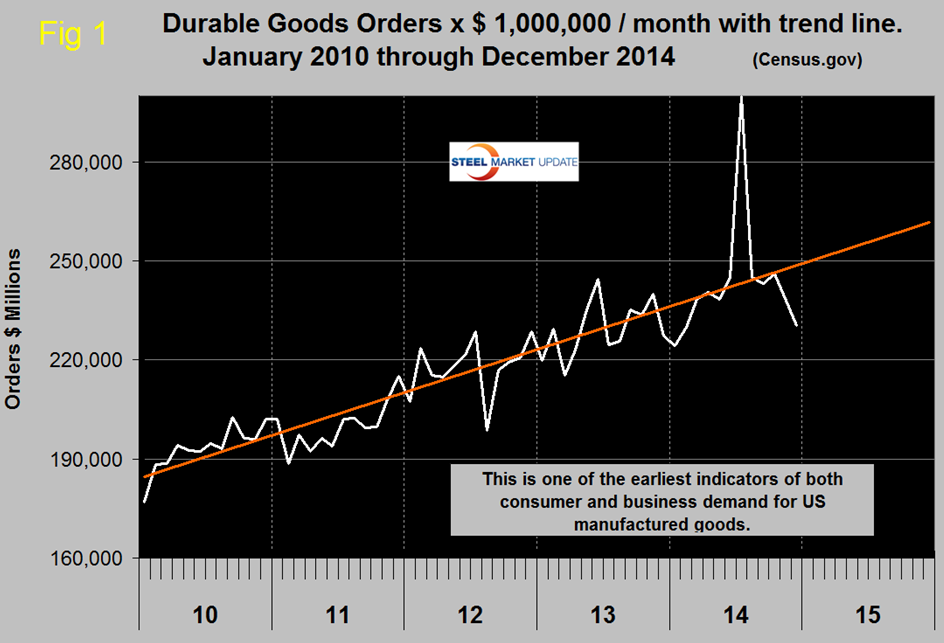

New orders for durable goods in December fell by 3.4 percent from November’s level to $230.5 billion, economists had expected a 0.5 percent gain. The three month moving average (3MMA) fell by 1.7 percent. The December result is a sharp deviation from the trend line that has existed since the recession, (Figure 1).

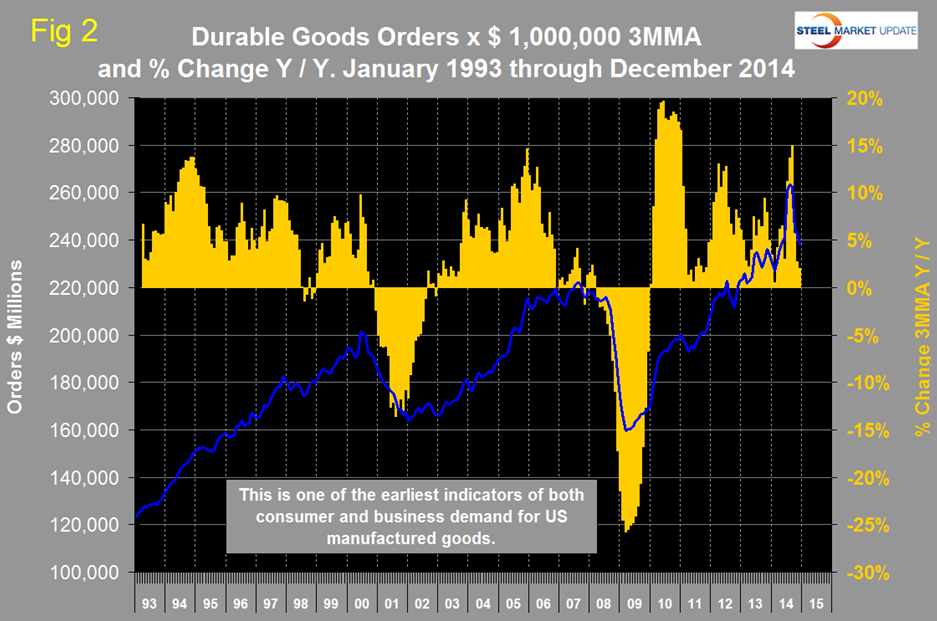

The huge spike in the 3MMA in August was a manifestation of the surge in civil aircraft orders in July. The 3MMA is shown in Figure 2 for the period January 1993 through December 2014. The year over year growth rate of the 3MMA was 2.0 percent which is one of the lowest months since the recession. This index is routinely whipsawed by both civil and military aircraft orders but we include it in our steel analyses because it is a reality check for other manufacturing data and is described by the Census Bureau as one of the earliest indicators for US manufactured goods. In December civil aircraft orders were down by 55.5 percent and military by 19.9 percent.

The Census Bureau press release issued on Wednesday read as follows:

New orders for manufactured durable goods in December decreased $8.1 billion or 3.4 percent to

$230.5 billion, the U.S. Census Bureau announced today. This decrease, down four of the last five months, followed a 2.1 percent November decrease. Excluding transportation, new orders decreased 0.8 percent. Excluding defense, new orders decreased 3.2 percent.

Transportation equipment, also down four of the last five months, led the decrease, $6.8 billion or 9.2 percent to $66.7 billion.

Shipments of manufactured durable goods in December, up following two consecutive monthly decreases, increased $2.6 billion or 1.1 percent to $246.8 billion. This followed a 0.7 percent November decrease. Transportation equipment, up three of the last four months, led the increase, $2.2 billion or 3.1 percent to $74.5 billion.

Unfilled orders for manufactured durable goods in December, down following ten consecutive monthly increases, decreased $8.9 billion or 0.8 percent to $1,167.6 billion. This followed a 0.2 percent November increase. Transportation equipment, also down following ten consecutive monthly increases, led the decrease, $7.8 billion or 1.0 percent to $740.0 billion.

Inventories of manufactured durable goods in December, up twenty of the last twenty-one months, increased $2.0 billion or 0.5 percent to $410.8 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.5 percent November increase. Transportation equipment, also up twenty of the last twenty-one months, led the increase, $0.6 billion or 0.5 percent to $134.1 billion.

Non-defense new orders for capital goods in December decreased $7.9 billion or 9.7 percent to $73.3 billion. Shipments increased $0.1 billion or 0.2 percent to $78.9 billion. Unfilled orders decreased $5.7 billion or 0.8 percent to $732.4 billion. Inventories increased $1.0 billion or 0.5 percent to $187.5 billion. Defense new orders for capital goods in December decreased $0.5 billion or 5.3 percent to $8.7 billion. Shipments increased $0.2 billion or 2.2 percent to $10.2 billion. Unfilled orders decreased $1.5 billion or 0.9 percent to $156.2 billion. Inventories decreased $0.1 billion or 0.3 percent to $24.1 billion.