Market Data

January 25, 2015

SMU Survey: Buyers & Sellers of Steel Expect Prices to Erode Further

Written by John Packard

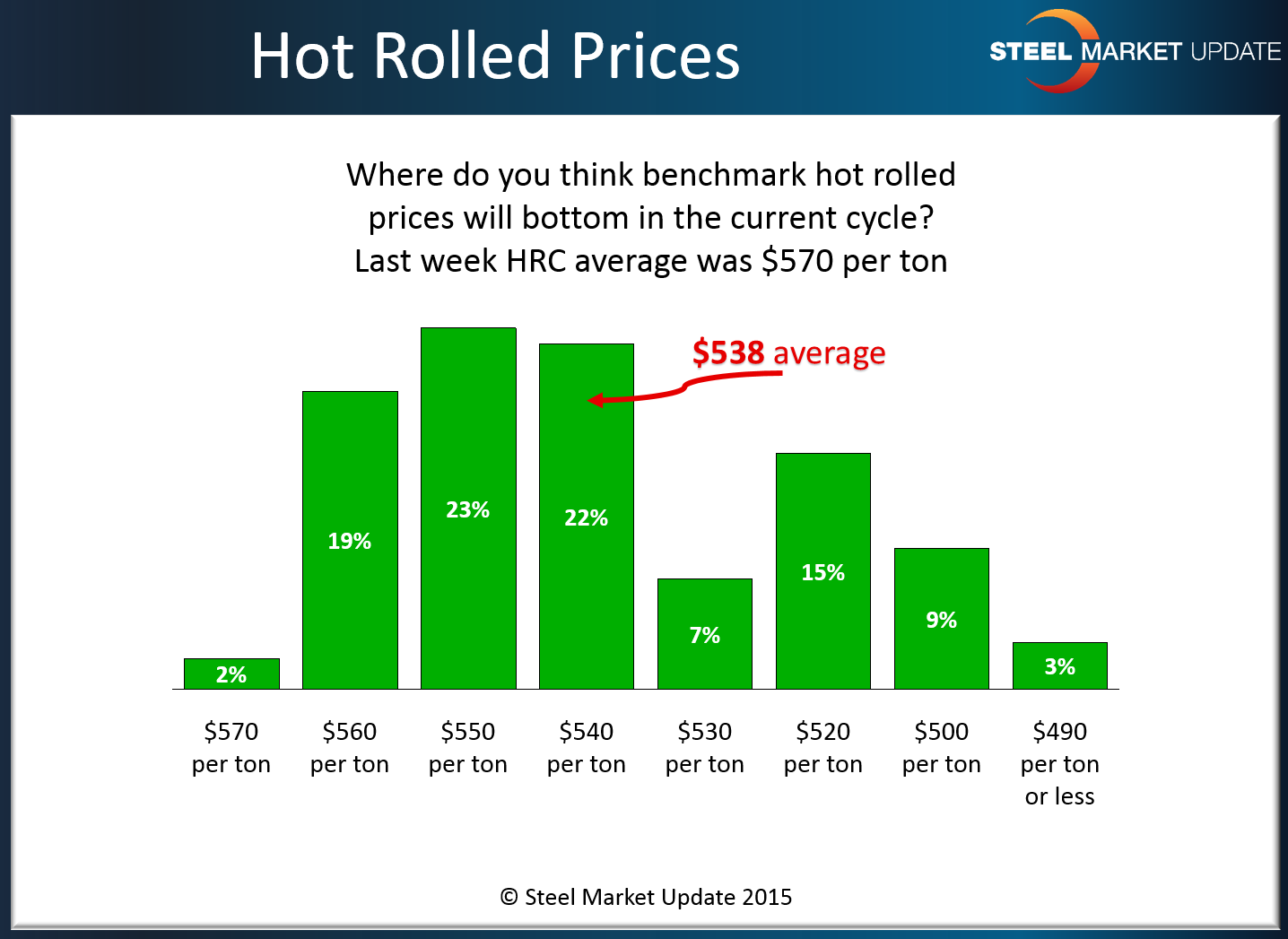

One of the questions asked during last week’s Steel Market Update (SMU) flat rolled steel market survey was, where do you think benchmark hot rolled prices will bottom in the current cycle? Last week HRC average was $570 per ton (survey began before our index average adjusted to $560 per ton).

The responses ranged from a high of $570 (2 percent) to a low of $490 (3 percent) with the weighted average being $538 per ton.

A manufacturing company left a comment which probably echoes the sentiment of many of those taking our survey (or in the general steel industry population):

“We waited a long time for the market to drop, hopefully we can enjoy it for awhile. Something will happen and cause the market to stabilize, it always does. The question is will it be planned or unplanned?”