Prices

January 25, 2015

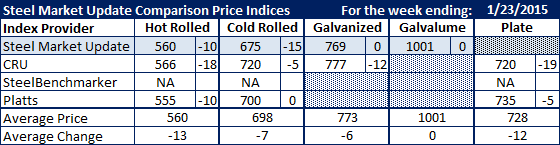

Comparison Price Indices: Double Digit Price Drops

Written by John Packard

According to the flat rolled steel price indexes followed by Steel Market Update, many of the flat rolled steel products are seeing their mill pricing erode by $10 per ton or more this past week.

The spread between the indexes is relatively modest on hot rolled coil, but is much more pronounced in cold rolled, coated and plate. SMU believes the variations are due to collection techniques, the number of pricing providers in any one week and FOB points.

Benchmark hot rolled coil prices dropped $10 per ton at SMU and Platts and by $18 per ton at CRU. The three indices: SMU, Platts and CRU average for HRC is now $560.33 per ton. SMU is choosing to not include the SteelBenchmarker numbers during the weeks when they do not provide data. You will know that is the case as we have put a “NA” in the column indicating price movement and we will not include their old numbers in the CPI average for the week.

SMU Note: Hot rolled is considered to be the benchmark for all flat rolled products as the mills must first roll HR which is then the source material from which cold rolled and coated products are rolled. Cold rolled and coated base prices tend to be $100 to $120 per ton higher than the hot rolled average. The galvanized numbers include $69 worth of extras for .060” G90 and Galvalume numbers include $291 worth of extras for .0142” AZ50 Grade 80.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.