Market Data

January 22, 2015

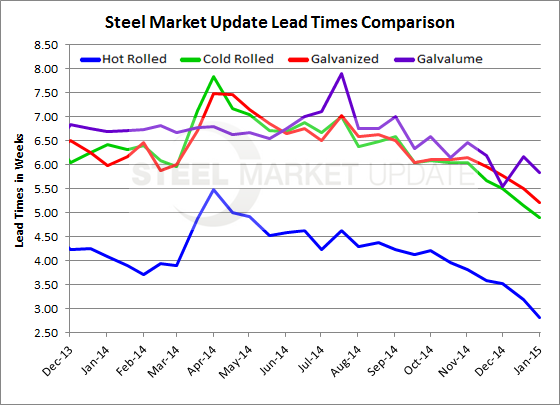

Mill Lead Times Continue to Falter

Written by John Packard

Domestic flat rolled steel mill lead times continued to shrink based on the responses received in our most recent steel market survey.

Steel Market Update conducted our mid-January flat rolled steel market analysis this week. We invited over 600 companies to participate in the survey and, based on the average of the responses received, lead times fell on all four products tracked by SMU: hot rolled, cold rolled, galvanized and Galvalume.

Hot rolled lead times were reported to be averaging 2.81 weeks, down from the 3.19 reported two weeks ago and well below the 4.09 weeks at this time last year. The 2.81 weeks is actually the shortest lead time we have seen since mid-April 2013.

Cold rolled lead times were reported to be averaging 4.90 weeks, down from 5.15 weeks at the beginning of January and well below the 6.41`weeks we saw in mid-January 2014.

Galvanized lead times are averaging 5.21 weeks, down from 5.50 weeks reported at the beginning of January and well below the 5.98 weeks reported at this time last year.

Galvalume lead times were reported to be averaging 5.83 weeks which is slightly lower than the 6.18 weeks measured at the beginning of January and almost a full week shorter than one year ago when we reported mid-January lead times on AZ as averaging 6.70 weeks.