Market Segment

January 20, 2015

Service Center Inventories Jump

Written by John Packard

The Metal Service Center Institute (MSCI) reported steel distributor shipments and inventories on Monday. The MSCI reported U.S. shipments of all steel products totaled 3,135,700 tons during the month of December which was 6.3 percent higher than December 2013. The daily shipment rate was 142,500 tons per day.

Total steel inventories (all products) were reported at 9,902,000 tons as of the end of December. U.S. distributors were holding 18.3 percent more steel at the end of December 2014 than they were holding one year earlier. The number of months on the floor totaled 3.2 on a non-seasonally adjusted basis. This is an increase from the 3.0 months being held at the end of November and is well above the 2.8 months supply being held at the end of December 2013.

U.S. steel service center shipments totaled 43,108,700 tons for the year. This is 4.2 percent better than the 41,359,900 tons reported at the end of 2013.

Carbon Flat Rolled

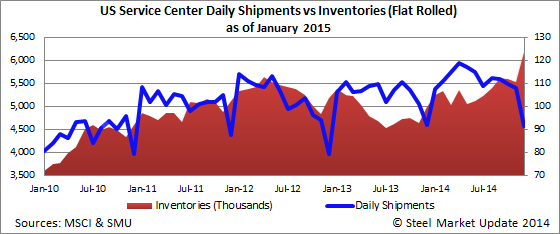

Distributors in the United States shipped a total of 2,005,300 tons of carbon flat rolled steel sheet or coil during the month of December which is 3.9 percent higher than the prior year but down 2.3 percent from the month of November 2014. The daily shipment rate for flat rolled was 91,200 tons per day down from November’s 108,000 tons per day and slightly lower than December 2013 91,900 tons per day.

Flat rolled inventories grew as did the month’s supply. Flat rolled steel service centers were holding 3.1 months of inventory at the end of December. This is up from 2.7 months supply in November and 2.2 months at the end of October. Flat rolled inventories are up 14.4 percent month over month and 19.5 percent over the previous year.

A note to our Executive level members, Steel Market Update has been forecasting this surge in inventories for our Premium level customers for a number of months. For example, in August SMU forecast the Apparent Inventory Deficit which existing at that point in time (-200,000 tons) would grow into an excess by November and continue to grow from there. In August we forecast service centers in the U.S. would be carrying 508,000 tons of excess inventory. The actual excess number is 1.2 million tons (based on SMU proprietary analysis and calculations) but we had no idea in August that oil prices would collapse taking OCTG and line pipe business with it. The new Service Center Inventory Excess/Deficit report will be published for our Premium members on Wednesday of this week.

Carbon Plate

Plate shipments out of the U.S. service centers totaled 343,100 tons during the month of December. Shipments were 12.3 percent higher than the prior month and 12.3 percent better than December 2013. The daily shipping rate for December was 15,600 tons down from 16,100 tons in November. However, the daily shipment rate is up from the 14,500 tons per day shipped last December.

Plate inventories being held at the U.S. distributors totaled 1,311,700 tons which is 6.7 percent higher than the month of November 2014 and 26.5 percent higher than one year ago.

The number of month’s supply for plate stood at 3.8 months at the end of December. This is down slightly from the 4.0 month’s supply held at the end of November but well above the 3.4 months held at the end of December 2013.

Pipe & Tube

Distributors shipped 208,900 tons of carbon pipe & tube during the month of December. Pipe and tube shipments were up 3.5 percent compared to November and 12.0 percent over the previous December. The daily shipment rate was 9,500 tons per day, down from 10,600 tons in November and up from the 8,900 tons per day shipped during December 2013.

Pipe and tube inventories finished the year at 670,600 tons which is 1.4 percent lower than at the end of November and 6.5 percent lower than 1 year ago. The months on hand dropped from 3.4 months at the end of November to 3.2 months.