Product

July 29, 2013

Spot Price Cycle Breaks Pattern

Written by John Packard

Written by: John Packard

Steel Market Update has been conducting our twice monthly steel surveys for approximately five years now. When we started, we chose people and companies with whom we trusted and had worked with knowing we could depend on the quality of the information gathered. Having worked within the industry for over 30 years our pool of contacts was quite deep and we continued to develop and add to them over the years. We currently have 689 people representing approximately 675 companies on the invitation list.

We have two main focus groups – manufacturing companies and service centers – the two groups which purchase and utilize most of the product produced by the North American steel producers. These two groups have an interesting relationship with one another – one which SMU is keenly aware – our publisher having been intimately involved in it during his 30-year career. In our opinion, the relationship between the two groups provides an excellent barometer to the industry as a whole – especially the spot market.

SMU has been tracking the spot market relationship from the perspective of each party during this five year period. We have also been tracking steel mill price increases – their success and failures – and have compared them to our spot price scenarios between the service centers and the manufacturing companies.

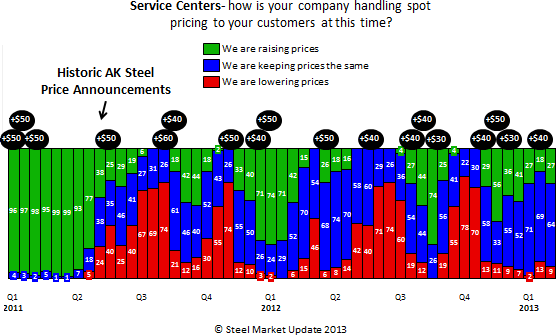

In the past we have spoken about service centers reaching a point of capitulation – the point when more than 70 percent of the service centers are lowering prices in an effort to sell spot inventory. What we found is a correlation between that point and when steel mills can announce price increases and be successful.

The Cycle of Pain

Now we are continuing our research through our surveys and looking at the cycles over a period of time and specifically at what has changed recently to break the Cycle of Pain.

What we are finding is what SMU is calling the Cycle of Pain (see graphic below) as mill prices are being pushed higher – and the service centers are believers prices will continue to rise they then will push their spot prices higher on a consistent basis – eventually the cycle is broken as demand has not improved and order flows back off and mills are forced to begin discounting which causes service centers to drop their spot selling prices fearing their inventories are about to be devalued by their suppliers. This continues in earnest until the service centers reach the point of capitulation, at which time the mills also reach a point whereby they no longer can take prices any lower, lead times are too short and the cycle starts again. The service centers support the increases and the cycle repeats itself.

If true supply and demand does not change then the cycles tend to be short-lived similar to what we saw during Q3 2012 where we had capitulation followed by three price increase announcements over a short period of time – by the time the third announcement had been made the market was already starting to collapse and we went right back to a strong discounting market and another capitulation within a short time frame (see graphic below).

Breakdown of the Cycle

Based on last week’s survey results manufacturing companies reported their service center suppliers as being in the early stages of attempting to raise spot flat rolled steel prices. For that matter, the service centers have been in the early stages of attempting to raise prices (based on their responses to our survey) since the first week of November (the first survey taken since the mill increase announcements were made in mid-October). As you can see by the graph below the mill price announcements did not have the desired impact as in past successful announcements when service centers reported much higher results to our spot pricing questions – usually getting up into the mid-70 percent range or higher for the increases to be “sticking.”

But, as we look at the price increase announcements and the attempts by the service centers to raise prices since the first AK Steel announcement back on October 17th (we use AK Steel as our example since they publish their announcements on their website), our hot rolled coil price average was $580 for that week. The AK announcement was for $40 per ton. During the remainder of 4Q 2012 AK Steel announced a total of $120 per ton in price increase announcements. The highest our HRC index hit was $640 per ton or, up $60 per ton from our low. We are now at $620 after dropping to $610 during the last two weeks of January – we are now up $40 from the low in October.

One of the problems, as we see it, is the lack of support by the domestic service centers for pushing spot prices higher. As you can see by the graph, the highest level of support service centers reported for their spot pricing was 56 percent in mid-November and then it dropped from there. After the recent announcement the support level is 27 percent. We have not had a successful price announcement in the past two years with that kind of service center support.

We believe this response is due to competitive pressures within the service center industry, a need to lower inventories, lagging CRU discounted contracts which bleed into the spot markets and short mill lead times which lead to discounted spot deals (and why push prices higher when you are buying at discounted pricing).

With scrap prices trading sideways for two of the last three months (and now down $5-$20 per gross ton in the Midwest markets – depending on product and the exact region) the cycle has flattened out. We are seeing the flattening of the cycle in our indices and we are seeing the flattening of the cycle in the service center spot prices (see graphic below).

We haven’t seen the cycle like this in over two years and we expect the cycle to “spike” once scrap prices begin to gyrate significantly higher – which we expect to happen as early as the first week of March. However, until then – prices could (and probably will) continue to fluctuate as mills “negotiate” in order to keep their order books as full as possible.