Distributors/Service Centers

January 11, 2015

Service Center Spot Steel Prices Trending Toward Capitulation?

Written by John Packard

In each and every flat rolled steel market survey Steel Market Update conducts, we ask both the flat rolled steel service centers and their manufacturing customers to comment on service center spot pricing. SMU believes spot prices being touted by the steel distributors is a microcosm of the health of the greater steel industry.

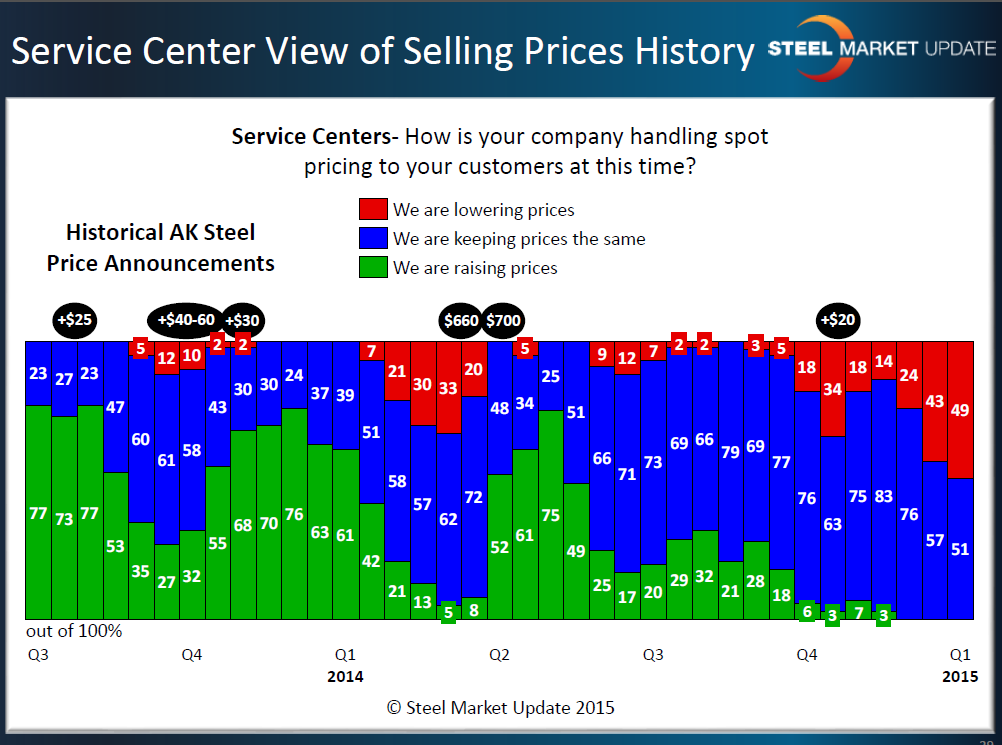

We also believe that at a certain point in time the negativity of the service centers reaches a point of capitulation – where it seems as though every distributor is dumping steel into the marketplace at lower and lower pricing. In the past we have identified “capitulation” to be that point when approximately 70 percent of the service centers are actually reporting their company as actively lowering spot prices to their customers.

Our Premium level members have access to this data twice per month after we finish crunching the numbers for our beginning of the month and middle of the month steel surveys. We haven’t written about spot prices in awhile and we are starting to see a major shift occurring within the distributors. So, let’s take a look at what we have measured this past week.

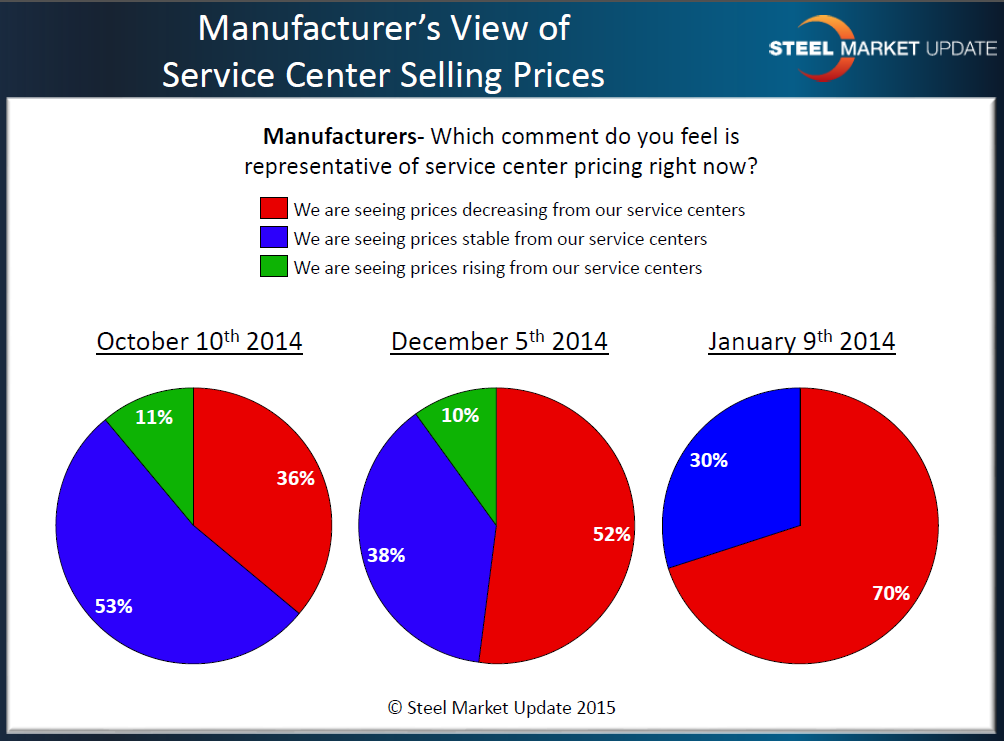

Our steel market surveys break out the different market segments (manufacturing, distribution, trading companies, steel mills, toll processors and suppliers to the industry) during the survey process. At that point we ask the manufacturing companies to comment about service center spot prices into their company. As you can see by the Power Point slide below, manufacturers have been reporting decreasing spot prices from their service center suppliers at a growing rate since early October. Last week 70 percent of the manufacturing respondents reported their distributors as lowering spot prices with the balance reporting spot numbers as being stable.

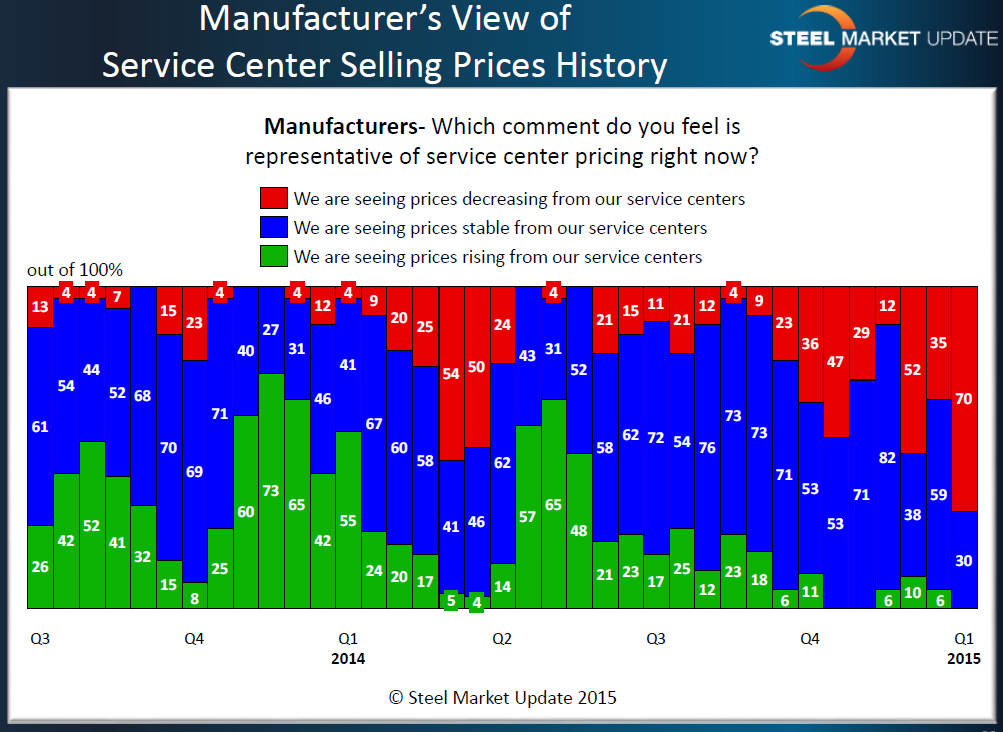

When looking at the responses of the manufacturing community regarding spot pricing, we find the 70 percent response rate is unusual and has not been present over the past 18 months. During the past 18 months the manufacturers reported spot prices as declining (50-54 percent) in late first quarter 2014.

When reviewing our average hot rolled prices, we found they were falling from their peak achieved on January 7th ($680 per ton) and they fell until they bottomed at $620 per ton during the middle of March. The decline ended with a price increase announcement suggesting selling prices should rise to $660 per ton (AK Steel 3/20/2014). As you can see by the graphic below, the move by AK Steel (and others) prompted the service centers to move their spot prices higher, which they did in support of the increase.

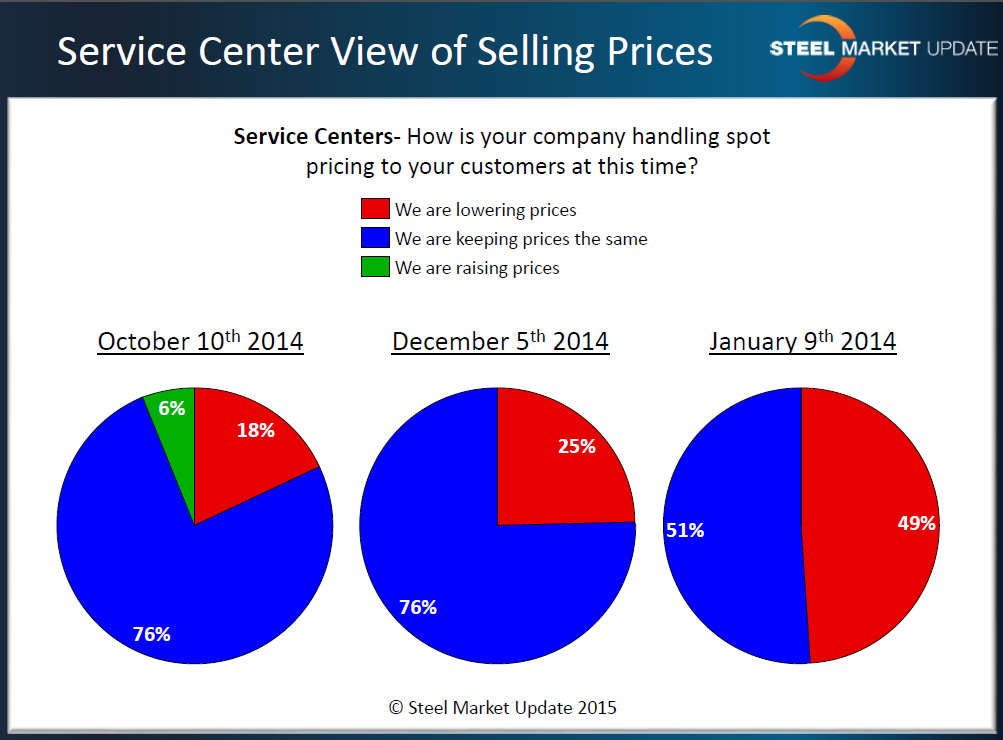

Now let’s take a look at the flat rolled spot market from the service center viewpoint, which can be quite different than that of the end users – although rarely does the trend differ between the two. Our opinion is the service centers don’t like to admit they are discounting or dropping spot prices until after the fact.

Of the distributors responding to last week’s survey, 49 percent reported their company as lowering spot pricing on flat rolled steel products. That is twice as many as what we saw in early December and more than five times as many as what we measured in early October.

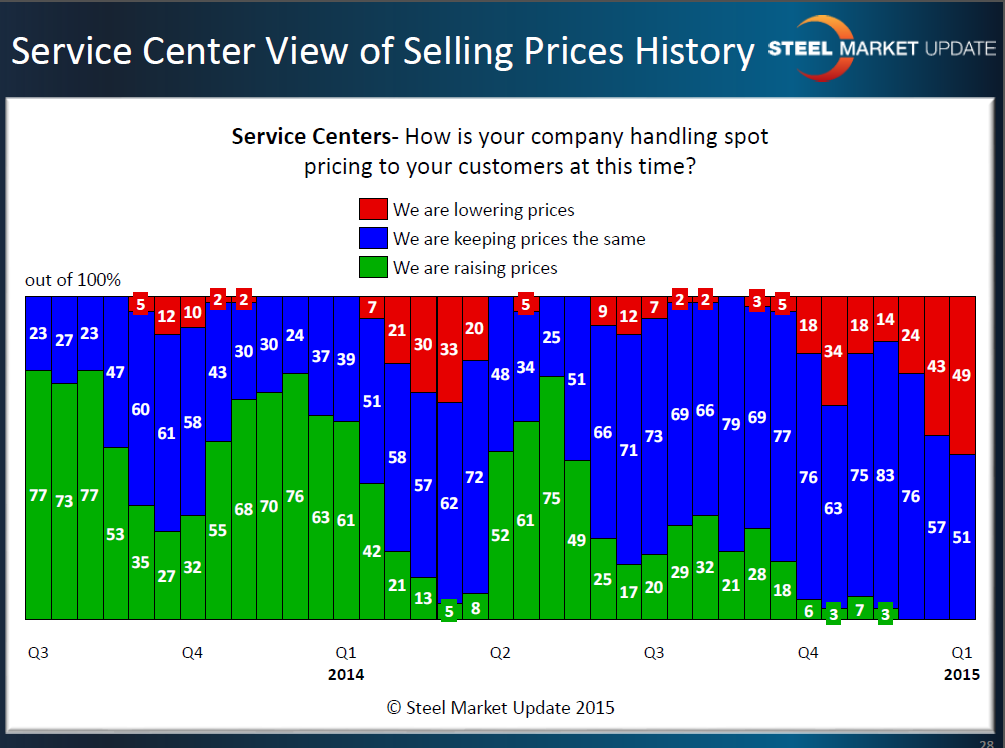

So what does this data look like spread over the past 18 months?

As you can see there hasn’t been any support for higher spot prices in a few months. At the same time the service centers (from their perspective) have not reached the “cycle of pain” threshold which results in capitulation – selling steel and moving off inventory. But, they are getting closer and, in SMU opinion, are on that path.

We remind our readers, and steel buyers in particular, to remember history. Those of you who are Premium members can dig back further into the data to see what has transpired over the past few years and how accurate our distributor spot market trend is regarding calling the bottom of the flat rolled steel market. We will see if the trend for lower prices continues (and based on the high inventory levels we believe it will) and at what point will the service centers roll over (capitulate) and start begging the domestic mills to raise prices. If you want to read more about capitulation and SMU theories on the subject you can click on any of the links contained in this article or, you can type in the word: capitulation into the search function at the top of our website which will result in a number of articles being brought up from our archives.

In case you don’t remember our graphic with the AK Steel price announcements noted here it is:

The above Power Point slides were taken directly from last week’s survey results which are shared with our Premium level members as well as those who participated in the survey.

If you would like information about how to upgrade your Executive level membership to Premium, please contact our office: 800-432-3475 or by email: info@SteelMarketUpdate.com.

If you would like to be added to our flat rolled steel market survey invitee list please send an email to John Packard: John@SteelMarketUpdate.com with your name, company, position, email address and phone number.