Prices

January 11, 2015

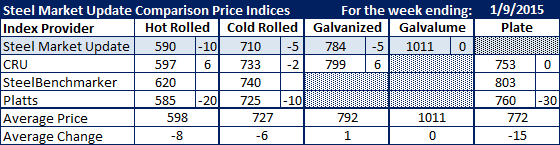

Comparison Price Indices: Will HRC Prices Break 2013 Low?

Written by John Packard

All the indexes followed by Steel Market Update have breached the $600 per ton ($30.00/cwt) average level on benchmark hot rolled steel prices in North America (one exception being SteelBenchmarker who has not yet reported any pricing for the month of January). The average of SMU, CRU and Platts for this past week was $590.67 per ton.

We saw one unusual event this past week on hot rolled as the CRU index rose by $6 per ton while Steel Market Update and Platts both dropped $10 & $20 per ton respectively. CRU was at $591 per ton the week prior to these most recent numbers.

The question in the steel industry now is how far can steel prices fall? We went back to our historical interactive pricing graphs to see when and at what number the cycle low points were below current pricing levels on past cycles. The next low point would be $565 per ton which was last achieved on May 21, 2013, based on the SMU historical averages. Prior to that you would have to go back to November 2, 2010 when HRC pricing bottomed out at $535 per ton.

Cold rolled numbers also dropped with the average of SMU, CRU and Platts now at $722.66 per ton ($36.13/cwt).

SMU saw galvanized numbers as being down $5 per ton this past week to $784 per ton ($39.20/cwt on .060” G90 with $69 in extras added to our $35.75/cwt average base price). CRU, on the other hand, saw galvanized pricing as being up $6 per ton to $799 per ton ($39.95/cwt on the same item with the same extras which puts their average base on galvanized at $36.50/cwt).

Platts had a major move on plate prices this past week, moving their average to $760 per ton which is down $30 per ton and is now closer to the $753 per ton average at CRU.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.