Market Data

January 8, 2015

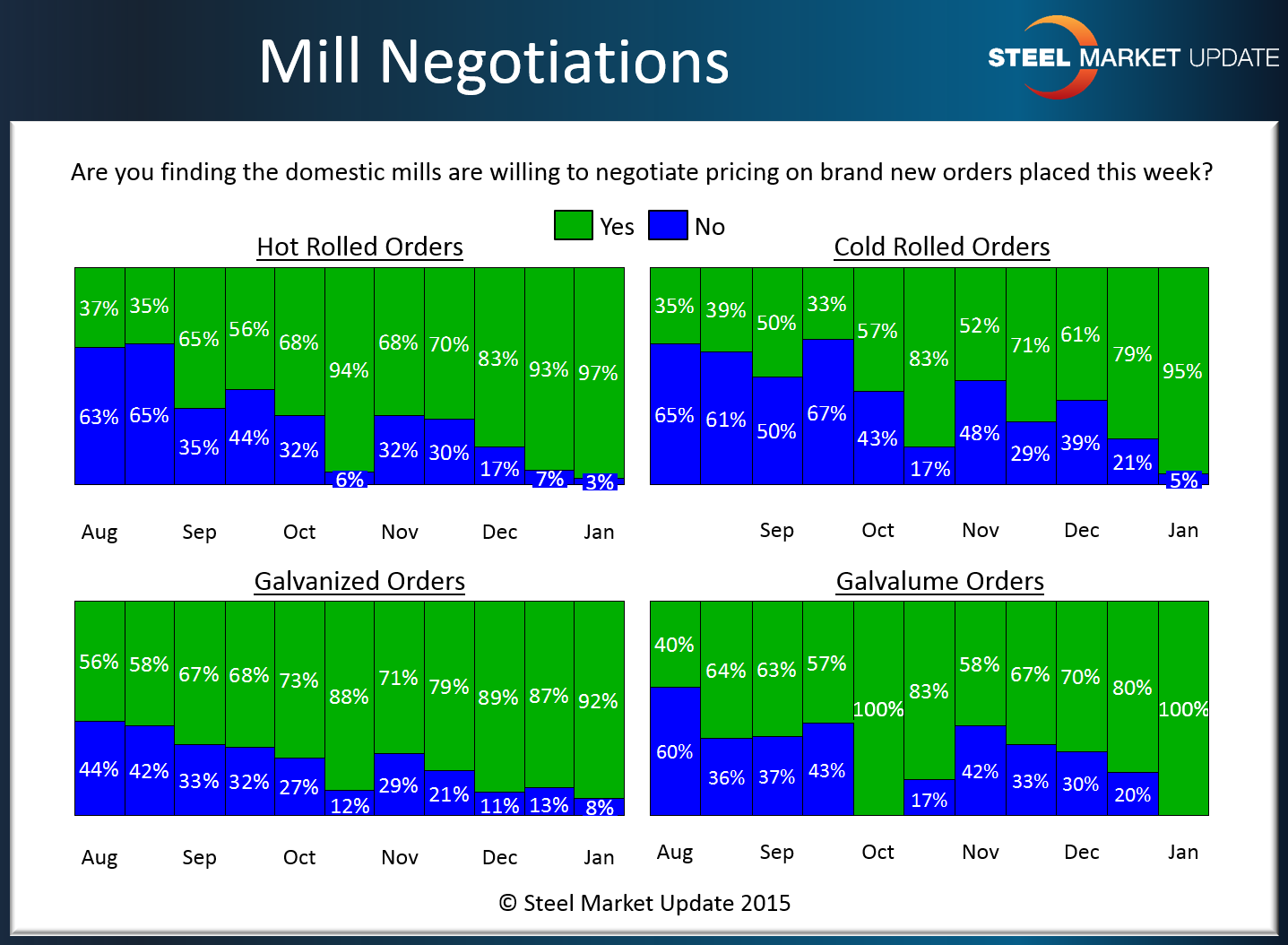

SMU Survey: Steel Mills Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

The previous article about steel mill lead times being one week shorter than what we saw one year ago set the stage for what we are seeing when it comes to mill negotiations. Our survey respondents almost unanimously reported the domestic mills as willing to negotiate pricing on all flat rolled products.

We had 97 percent of our hot rolled respondents reporting the mills as willing to negotiate. It was 83 percent one month ago and 68 percent at the beginning of November. One year ago was the peak of the “up” cycle when only 35 percent of the respondents reported the domestic mills as willing to negotiate pricing (this popped up to 63 percent two weeks later).

Cold rolled saw 95 percent of our respondents reporting the mills as willing to negotiate pricing. This is up from 61 percent at the beginning of December and 52 percent at the beginning of November. One year ago only 31 percent of our respondents reported the domestic mills as willing to negotiate pricing on cold rolled (two weeks later cold rolled actually dropped to 19 percent).

We saw 92 percent of our respondents reporting galvanized prices as negotiable. This is up 3 percent from the beginning of December and 21 percentage points compared to the first week of November. One year ago only 38 percent reporting the mills as willing to negotiate galvanized pricing (two weeks later it rose to 61 percent).

Everyone responding to our query on Galvalume reported the mills as willing to negotiate. This is up 30 percent from the beginning of December and 42 percent compared to the beginning of November. One year ago only 20 percent reported the mills as willing to negotiate AZ pricing (two weeks later it jumped to 44 percent).