Market Data

January 5, 2015

Global Manufacturing Slows as 2014 Exits

Written by Sandy Williams

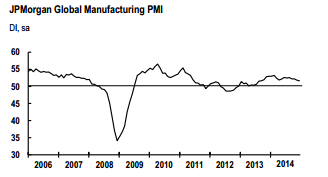

Manufacturing growth across the globe slowed as 2014 drew to a conclusion. The December JP Morgan Global Manufacturing Purchasing Managers Index (PMI) registered 51.6 in December, down from 51.8 the previous month and its lowest level since August 2013.

North America remained the primary driver of manufacturing growth for the world as the Eurozone and Asia weakened. India was an exception reaching a two-year peak along with Japan which showed modest expansion.

Manufacturing in the Eurozone was described as “near-stagnant” by Markit as the PMI finished the year at 50.6, just slightly above November’s low of 50.1. The quarter average for the region was 50.4, the weakest since recovery began in Q3 2013.

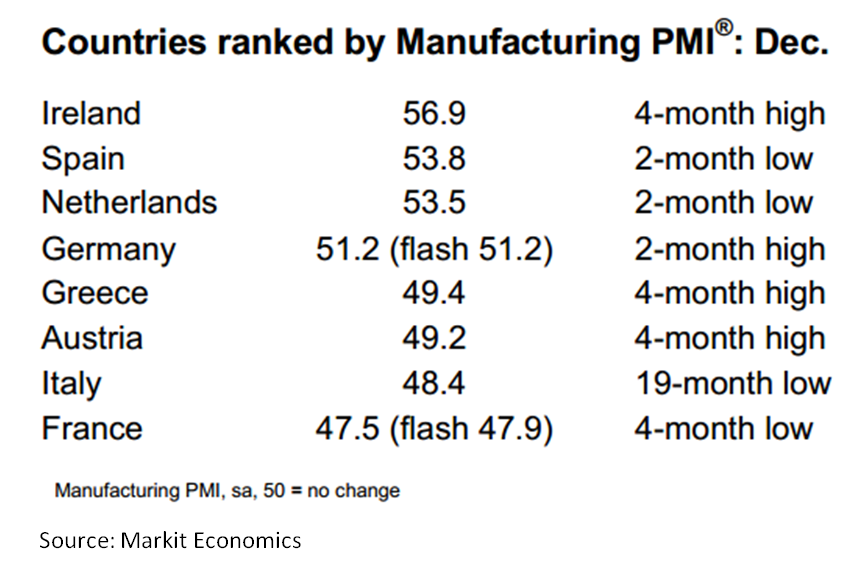

Positive growth was reported in Ireland, Spain and the Netherlands while Greece, Austria and Italy remained in contraction. France hit the bottom of the Eurozone chart with a PMI of 47.5. Germany pulled back out of November’s contraction on the strength of modest new domestic and export orders.

Weak factory output, and subdued service sector growth, according to Chris Williamson, Chief Economist at Markit, led to stagnant growth in the fourth quarter (+0.1 percent). The Ukraine crisis and lack of confidence in policy makers led to economic uncertainty, causing companies to avoid expansion and risk.

“We should hopefully see growth pick up in coming months. Lower costs, linked to falling oil prices, are helping manufacturers to reduce their selling prices, and the drop in fuel prices should also boost consumer spending,” wrote Williamson. “Expectations have risen that the ECB will also announce more aggressive policy stimulus in the New Year once it has had time to assess current policy initiatives. The overall weakness of the Eurozone PMI supports the case for more stimulus, though some policymakers may see the signs of life in countries such as Ireland and Spain as indications that existing policy measures are already taking effect and more patience is needed before new measures are instigated.”

In China output and new orders decline slightly as domestic demand softened while new export orders rose for the eighth month. The deterioration in conditions was the first since May with the HSBC PMI falling to 49.6 from 50.0 in November. Backlogs increased and input costs and prices charged both fell slightly as did employment levels. HSBC believes “weaker economic activity and stronger disinflationary pressures warrant further monetary easing in the coming months.”

Solid growth was seen in Japan in December with production and new orders both rising at a firm pace. The PMI rose for the seventh month to register 52.0. Input prices and raw material costs rose steeply due to the depreciation of the yen. Output charges did not keep pace, rising only slightly. New orders increased both domestically and in the export market.

South Korea manufacturing conditions stabilized in December as new orders rose fractionally after falling the previous three months. Exports growth remained negligible with anecdotal reports of increased competition with China. Production output fell on weaker domestic and foreign demand. The HSBC PMI for South Korea rose to 49.9 from 49.0 but still at the “no change” mark.

In North America, Canada manufacturing continued to improve with output and new orders rising. Hiring and buying activity increased to meet demand. Cost inflation was relatively weak while and factory gate charges increased at the quickest rate in seven months. Export orders rose with strong demand from the U.S., Mexico and Brazil.

“The PMI continues to register improvement in manufacturing business conditions, though it finished the year slightly lower than the last few months – at 53.9 – indicating some moderation in the pace of improvement in December,” said Paul Ferley, assistant chief economist, RBC. “Despite the recent fluctuation in commodity prices, particularly for oil, we continue to be constructive on the overall economic environment in Canada, including exports, which should mean good things for manufacturing going forward.”

Mexico had an excellent month in December with output and new orders increasing at their fastest rate in two years. The PMI increased to 55.3 from 54.3 indicating manufacturing activity is gaining momentum. Export orders were at the highest rate since July. Higher inflation was the only burden reported, reaching a five month high in December. Currency depreciation was reported as adding to imported raw material costs.