Prices

January 4, 2015

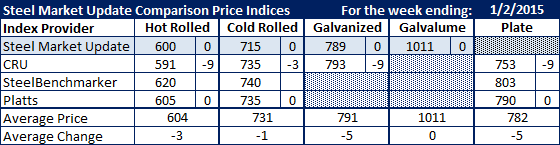

SMU Comparison Price Indices: No One Moved Except CRU

Written by John Packard

All was quiet this past week as steel buyers dreamed of Sugar Plum Ferries, lower prices and better times for the New Year. Mill sales people attended to their families and toasted higher prices and better times in the New Year. All of this means not much happened last week as SMU and Platts kept our indices the same due to the lack of meaningful price point adjustments for the week.

CRU, on the other hand, did publish new prices for the week and they were lower across the board. SteelBenchmarker was absent from the market as they only report pricing twice per month.

SMU Price Momentum Indicator ended 2014 pointing toward lower prices over the next 30 days. Here is how the last few days of 2014 ended and the first day of the New Year began:

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.