Prices

December 21, 2014

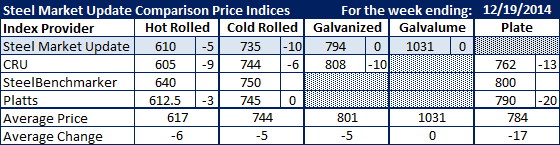

SMU Comparison Price Indices: $600 Hot Rolled Within Reach…

Written by John Packard

All of the flat rolled steel indexes which reported pricing this past week saw benchmark hot rolled prices as being down and another step closer to touching $600 per ton. From Steel Market Update’s vantage point, the lower end of our range has broken down to $580 per ton ($29.00/cwt). Our HRC average for the week is down $5 per ton.

CRU was down $9 per ton and Platts $3 per ton compared to where they were one week earlier. SteelBenchmarker did not report prices last week and continues to be well outside the market ranges at $640 per ton.

Cold rolled dropped $10 per ton according to our index and $6 per ton at CRU. Platts kept their CRC price average the same as what they reported the previous week.

We did see Platts drop plate prices to $790 per ton, down $20 per ton compared to the prior week. They are still well off the plate averages being touted by CRU which was down $13 per ton to $762 per ton.

SMU kept galvanized and Galvalume prices unchanged from the prior week. CRU, which is $14 per ton higher than SMU on Galvanized did see the market down $10 last week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.