Prices

December 19, 2014

Global Steel Production and Capacity Utilization

Written by Peter Wright

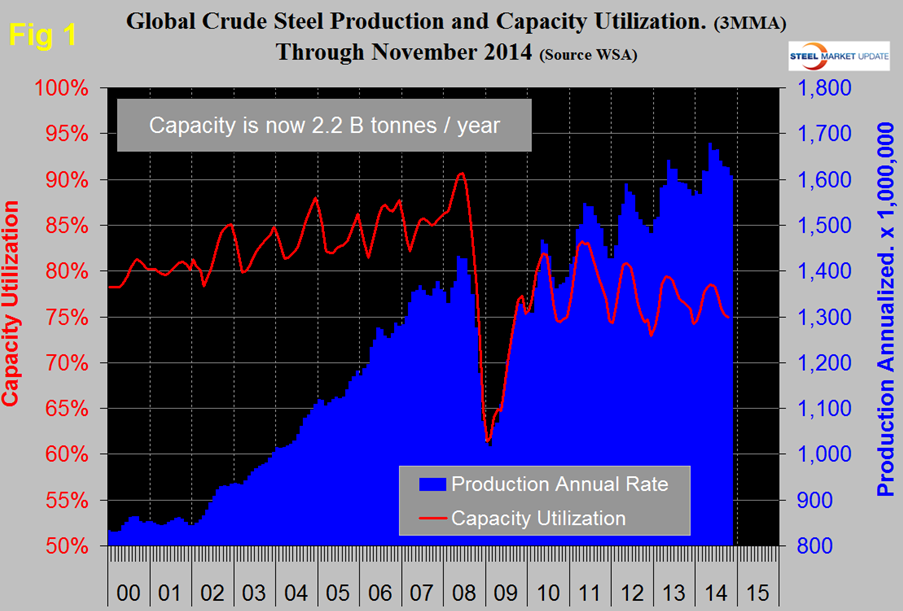

Production in November on a tons per day basis was 4.351 million tonnes, down from 4.411 in October. November had one fewer production day than October and the month’s total decreased from 136.363 million to 130.525 tons. Since January 2008 on average, November monthly production has decreased by 5.36 percent, this year November decreased by 4.28 from October. The three month moving average (3MMA) of production in November on an annualized basis was 1.607 billion tonnes and a capacity utilization of 74.3 percent, (Figure 1).

Capacity is now 2.2 billion tonnes. Since 2010 production has progressively increased and capacity utilization has decreased. The gap is widening. Sooner or later there has to be a correction which will probably be a major slowdown in capacity construction in China if not an actual Chinese capacity decrease. The same data for the US is shown in Figure 2.

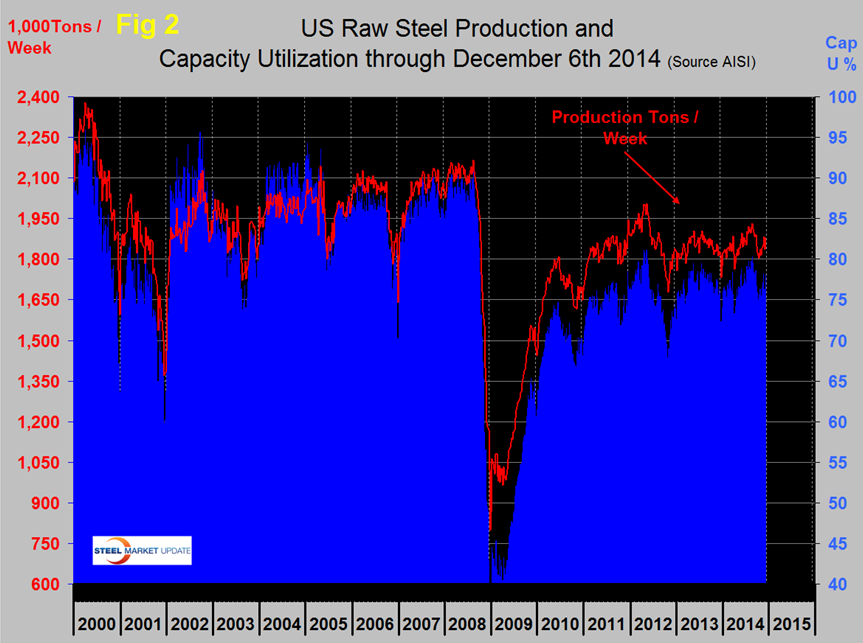

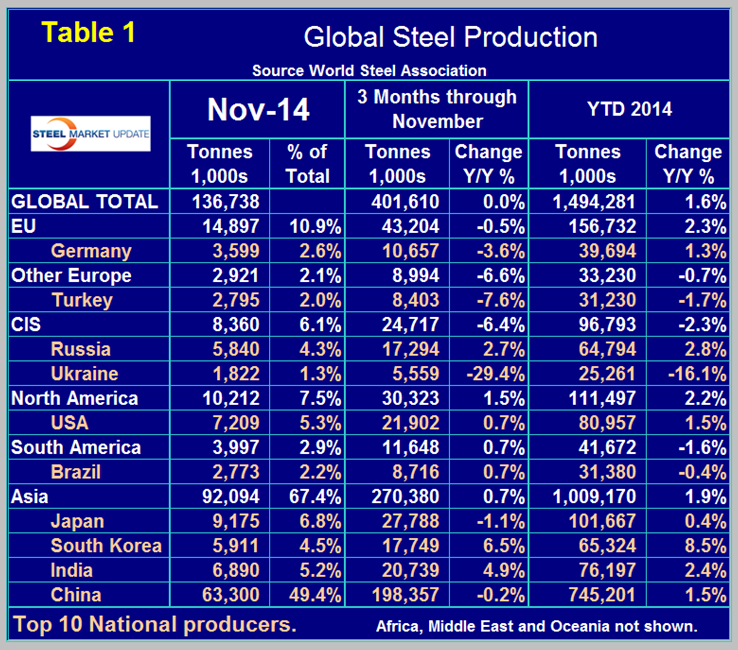

The US data is weekly and not smoothed so the graph is much spikier, but the situation is clear. Production and capacity utilization have remained in balance though neither has made much progress since 2011. Table 1 shows regional global production in the single month of November with regional share of the global total, also three months production through November and YTD production. Regions are shown in white font and individual nations in beige.

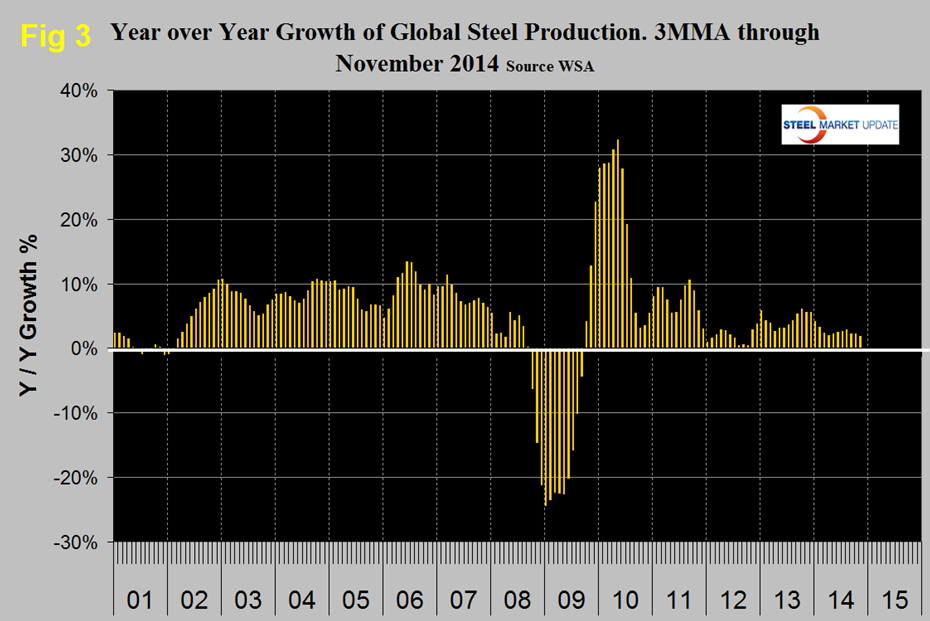

In three months through November, y/y global growth declined to exactly zero. Year to date growth through November was 1.6 percent, since the 3 month growth is less than the 11 month YTD growth it means that production is slowing. This is not a seasonal effect as our comparison is year over year. Asia which previously was the growth engine slowed to 0.7 percent in three months through November. South Korea grew at a 6.5 percent rate down from 9.5 percent in last month’s analysis. China’s growth was negative 0.2 percent in three months through November y/y. Japan had a negative 1.1 percent growth. China’s growth rate has stalled as a result of lower domestic demand their exports are now at an all-time high. The EU, CIS and other Europe had negative y/y growth in three months through November. North and South America had positive growth. The effect of the war in Ukraine is clear in the contraction of that country’s steel production. The European Union which had the fastest growth rate in early 2014 continued to slow and contracted at 0.5 percent in three months through November, Germany contracted by 3.6 percent. Year over year growth of output in the NAFTA was 1.5 percent in three months through November with the US at 0.7 percent. South America had positive 0.7 percent growth through November with its largest producer, Brazil also up by 0.7 percent. In November China’s share of total global production stayed below 50 percent at 49.4 percent and North America’s was 7.5 percent. Figure 3 shows that the 3MMA of the monthly global production y/y which steadily increased from 2.0 percent in April to 2.8 percent in August, fell to 2.2 percent in September, stayed at 2.2 percent in October and declined again to 1.8 percent in November. It seems undeniable now that the growth of global steel production is slowing and along with the price of oil and the Baltic Dry Index is indicative of a slowing global economy.