Market Data

December 18, 2014

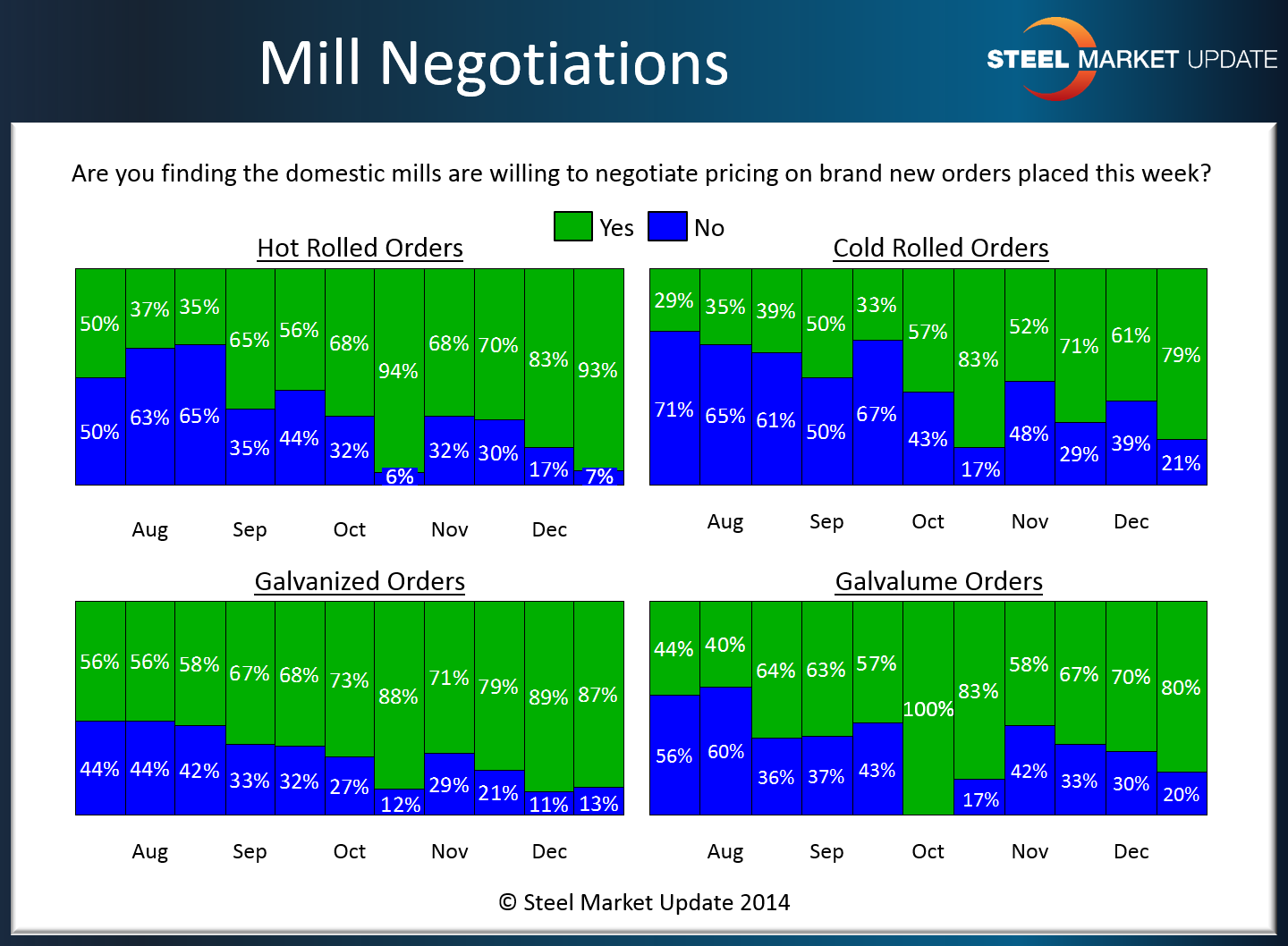

Steel Mills More Willing to Negotiate Flat Rolled Steel Prices

Written by John Packard

U.S. and Canadian steel mills are more willing to negotiate this week than they were during the first week of December, according to the respondents of our latest SMU flat rolled steel market survey.

We found 93 percent of the respondents to our survey reporting hot rolled mills as willing to negotiate hot rolled pricing. This is up from 83 percent from two weeks ago.

Cold rolled went from 61 percent two weeks ago to 79 percent this week.

Galvanized remained relatively stable with 87 percent reporting the mills as willing to negotiate. This is 2 points lower than the 89 percent reported during the first week of December.

Galvalume jumped from 70 percent to 80 percent as willing to have prices negotiated. All numbers are based on the results of this week’s flat rolled steel market analysis conducted by Steel Market Update.

Below is an interactive graphic of our Steel Mill Price Negotiations History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”113″ SMU Negotiations by Product- Survey}