Market Data

December 18, 2014

Steel Mill Lead Times: SMU Survey Has Them Shrinking

Written by John Packard

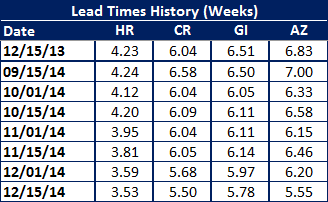

Lead times at the domestic steel mills continue to be shorter than what we saw this time last year (when prices were rising). The average lead time for benchmark hot rolled coil dropped to an average of 3.53 weeks based on the results from this week’s SMU flat rolled steel market survey. As you can see by the table below the 3.53 weeks is 0.7 weeks shorter than mid-December 2013.

Cold rolled lead times are also shorter than last year at 5.50 weeks vs. 6.04 weeks. Galvanized lead times slipped below 6.0 weeks and now average 5.78 weeks. This is less extended than the 6.51 weeks reported in mid-December 2013. Galvalume lead times also shrunk dropping 0.75 weeks just since the beginning of December 2014. Galvalume is now more than 1 week easier to get in 2014 than what we saw in mid-December 2013.

Below is an interactive graphic of our Steel Mill Lead Time History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”112″ SMU Lead Times by Product- Survey}