Market Data

December 18, 2014

Excess Inventories a Concern for Early 2015

Written by John Packard

Steel Market Update conducted our last flat rolled steel market survey earlier today (Thursday, December 18th). During the survey process we asked some new questions in an effort to see what will be the new trending issues once we move into calendar year 2015.

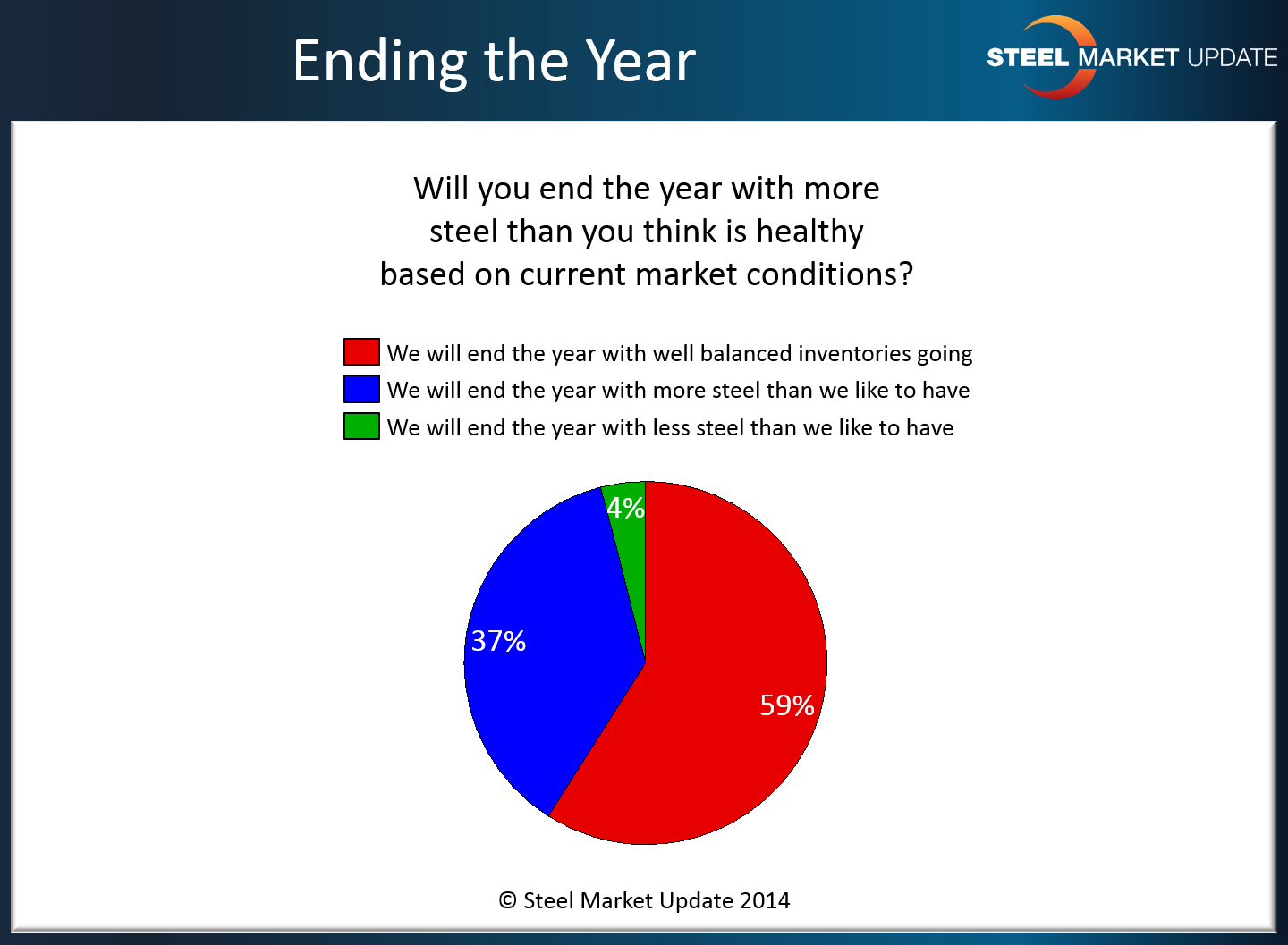

One of the questions posed to those who participated in our steel survey was, “Will you end the year with more steel than you think is healthy based on current market conditions?”

We found the majority of our respondents (59 percent) believed inventories would be “well balanced” as they moved into the New Year.

What concerns SMU are the 37 percent who responded that their company would be entering 2015 with more steel than they would like.

Only 4 percent reported that they will have less steel than they would like to have as they go into the New Year.