Market Segment

December 16, 2014

U.S. Steel Service Center Inventories 15.2% Higher than Last November

Written by John Packard

The Metal Service Center Institute (MSCI) reported total steel inventories of 9,195,700 tons. This represents an increase of 15.2 percent above last year and when taking the current shipment rate into consideration, MSCI reported inventories as being 33.1 percent higher than November 2013.

The daily shipment rate dropped from 170,100 tons per day (all products) during October to 163,900 tons per day in November. There were 19 shipping days during the month of November. Shipments were up 10,500 tons per day compared to November 2013.

The number of months on hand now stands at 3.0 months on a non-seasonally adjusted basis (2.4 months in October) and 2.6 months on a seasonally adjusted basis (2.5 months last month).

Carbon Flat Rolled

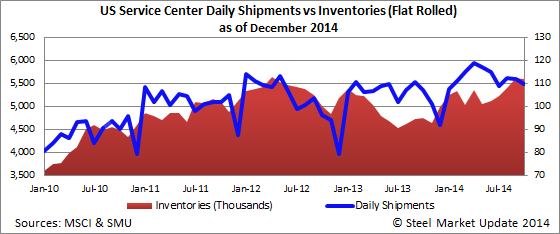

The daily shipment rate dropped to 108,000 tons per day in November. This is down 1,600 tons per day compared to October 2014 but well above the November 2013 daily shipment rate of 100,900 tons per day. The total flat rolled shipments out of U.S. distributors was 2,051,600 tons.

SMU forecast for our Premium level members shipments of 2,100,000 tons for the month of November. Our forecast was off 2.4 percent as shipments were weaker than the 4.0 percent we projected.

Inventories stood at 5,530,600 tons at the end of November. This is slightly higher (1.2 percent) than our forecast of 5,464,000 tons. The increase in inventories was due to a higher domestic receipt rate than the 5 percent YOY increase we forecast plus an additional 50,000 tons we added as a foreign steel adjustment. Flat rolled receipt rates were actually 8.8 percent higher than one year ago.

We will provide more details and our new Apparent Excess/Deficit Inventory Forecast for our Premium level members in a special Premium level newsletter later this week.

Inventories of flat rolled steel were up 19.1 percent compared to November 2013 and the number of months on hand rose from 2.2 to 2.7 on a non-seasonally adjusted basis and remained at 2.4 months seasonally adjusted.

Carbon Pipe & Tube

The daily shipping level for pipe & tube was 10,600 tons per day, with total shipments reaching 201,900 tons. This is below the October daily rate of 11,200 tons per day and a slight improvement compared to last year when distributors shipped 10,300 tons per day.

Inventories ended the month at 680,300 tons down 4.1 percent over the prior year. The number of months on hand increased to 3.4 months (non-seasonally adjusted) or 2.9 months on an adjusted basis.

Carbon Plate

U.S. distributors shipped a total of 305,400 tons of carbon plate during the month of November. This was 4.1 percent better than the same month last year. The daily shipment rate was exactly the same as October at 18,100 tons per day. Last November the shipment rate was 14,600 tons per day.

Plate inventories stood at 1,229,000 tons at the end of November. This is down slightly from the 1,243,800 tons reported at the end of October but 23 percent higher than the 998,800 tons on the service center floors at the end of November 2013.

The number of months on hand rose from 3.0 months to 4.0 months on a non-seasonally adjusted basis and 3.1 to 3.3 months seasonally adjusted.