Market Data

December 11, 2014

Rail Freight Shipments Increase in November

Written by Sandy Williams

Railroad traffic increased in November for both carload and intermodal volume. Class 1 freight railroads carried 1,161,820 carloads in November, up 1.4 percent year-over-year, according the American Association of Railroads.

Intermodal traffic in increased by 2.7 percent with a weekly average volume of 258,765 containers and trailers for the month, the highest level in history for a November.

Coal shipments were flat in November despite recent calls by utility companies for government intervention to force BNSF railway to increase capacity for coal shipments. Approximately two thirds of the coal for power plants is shipped by rail. Recent congestion due to high grain and oil shipments has left utility companies short on coal inventory to cover the winter months.

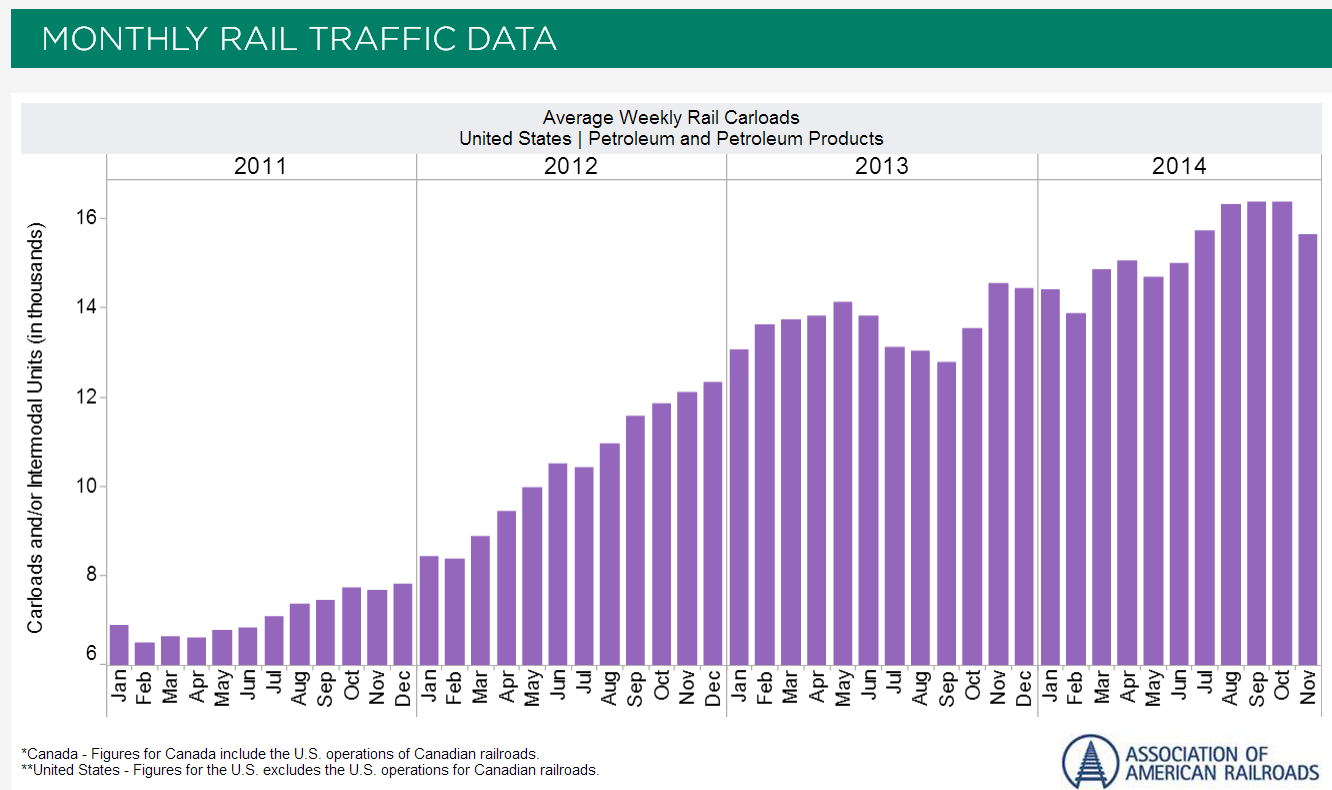

Crude oil shipments in the third quarter were 10.6 percent higher than second quarter 2014. Oil has been getting the major share of blame for rail capacity shortage and congestion. The chart below from AAR shows the dramatic increase in petroleum shipments since 2011.

AAR reports November metallic ore shipments were up 5,241 carloads or 19.8 percent year-over-year. Crushed stone, sand and gravel was up 16.8 percent, petroleum products 7.6 percent, and coke 5 percent.

“It’s not always easy to tell from available indicators how the economy is performing and that is true for rail traffic in November when some traffic categories showed solid growth, others not so much,” said AAR Senior Vice President John T. Gray. “A healthy and efficient freight rail network is vital to delivering America’s changing economy. Today, railroads are moving more traffic than at any time since 2007.”