Market Data

December 10, 2014

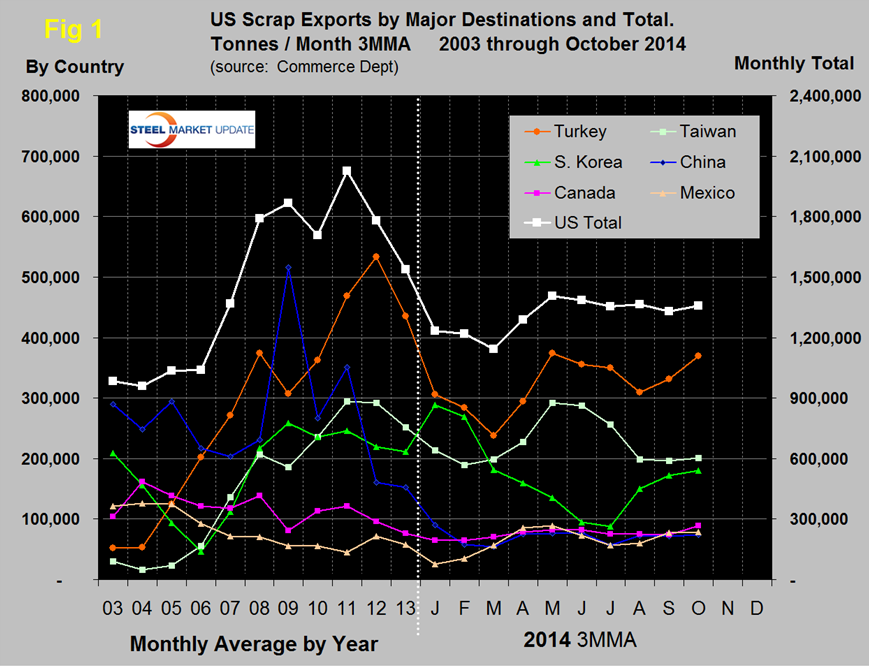

Scrap Exports from the US through October

Written by Peter Wright

In the first ten months of 2014, scrap exports totaled 12,905,000 metric tons, down by 17.6 percent from the same period in 2013. In the single month of October exports were 1,337,000 tons. Figure 1 shows that the three month moving average has been fairly consistent for the last six months through October and continued to be lower than the average in any year from 2008 through 2013. The most obvious trends so far this year has been that Taiwan and Korea have been almost mirror images of each other. Turkey’s tonnage picked up in September and October in spite of all we read about them preferring Black Sea sources. Year to date Turkey is down by 1.3 million tons or 28.5 percent. China’s tonnage has been quite consistently low this year on a 3MMA basis ranging from 53,000 to 90,000 tons per month. This is compared to over 500,000 tons per month in 2009 when they were the highest volume importer.

AMM reported on November 25th that scrap exporters just suffered another dismal week as demand and bid prices from major buyers remained weak. No bulk sales were reported into Turkey or Asia in the latest week which means that US exporters have sold only three cargoes in the first three weeks of November, two to South Korea and one to Turkey.

In YTD 2014 compared to the same period in 2013, the Far East as a whole is now down by only 0.6 percent as increases to Indonesia and Thailand have balanced the decreases to China, Malaysia and South Korea. The decline of the Japanese Yen is a big factor in Far East trade in general though at this point we don’t know to what extent it is influencing international scrap trade. Other nations not considered in this analysis because they have been historically minor purchasers were down in total by 191,000 tons YTD. Some nations have taken more tonnage this year than last, Indonesian purchases are up by 72 percent and Thailand which took almost nothing last year is up by a factor of ten at 409,000 tons, Mexico is up by 45,000 tons and Vietnam by 72,000 tons. Tonnage moving North over the Canadian border in October was the highest of the year though YTD was down by 8,600 tons from last year.

Scrap export prices are reported by the AMM every Tuesday for an 80:20 mix of #1 and #2 heavy melt in US $ per tonne FOB New York and Los Angeles for bulk tonnage sales. Prices on the both coasts were in free fall from August 25th until November 10th but in the five weeks through December 8th remained unchanged at $281.36 for east coast exports and $277.50 on the West coast. Shredded FOB the East coast is now $39.13 below Chicago.