Market Data

December 4, 2014

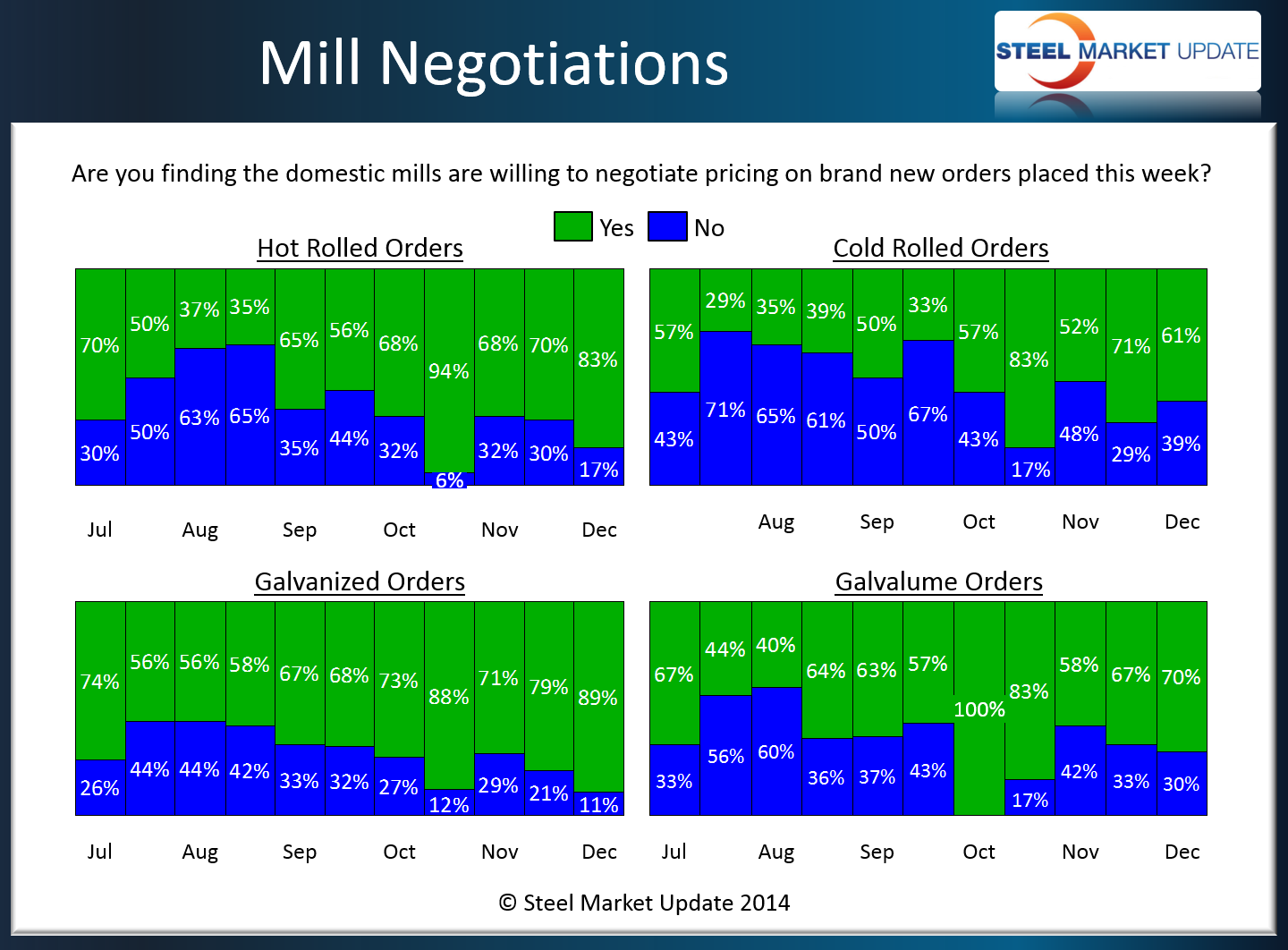

SMU Survey Results: Steel Mills Willing to Negotiate Pricing

Written by John Packard

Based strictly on the results from our Steel Market Update flat rolled market survey results, domestic steel mills are willing to negotiate prices on hot rolled, cold rolled, galvanized and Galvalume products. This is something that we see on a regular basis as lead times slip and the need for orders increases at the domestic mills.

Eighty-three percent of those surveyed reported the domestic steel mills as willing to negotiate hot rolled prices this week, this represents an increase of 13 percent from the middle of November. What a difference a year makes! In the first week of December last year, 35 percent reported the mills as being willing to negotiate HRC pricing.

The percentages reporting cold rolled pricing as negotiable actually declined from 71 percent in mid-November to 61 percent this week. In December 2013 only 19 percent reported the mills as willing to negotiate CR pricing.

Galvanized, on the other hand, increased to 89 percent from 79 percent. This is the highest level we have seen since the middle of May 2013. One year ago only 41 percent reported the domestic mills as willing to negotiate GI pricing.

Galvalume came in at 70 percent, up 3 percent from mid-November. One year ago only 22 percent reported the domestic mills as willing to negotiate pricing.

Below is an interactive graphic of our Negotiations History, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”113″ SMU Negotiations by Product- Survey}