Market Data

December 2, 2014

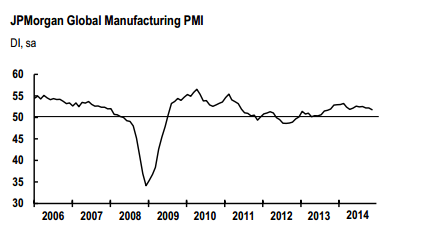

Global Manufacturing PMI Slows to 14-Month Low

Written by Sandy Williams

Manufacturing expansion slowed around the globe in November. The JP Morgan Global Manufacturing PMI dropped to 51.8 indicating the slowest pace of growth in 15 months. New order growth posted a 16 month low as international trade languished.

Commenting on the survey, David Hensley, Director of Global Economics Coordination at JPMorgan, said: “The global manufacturing PMI fell to a 14-month low in November, as growth of production and new orders moderated and international trade stagnated. The Output PMI is now consistent with growth of global IP close to 3.3% annualized, a solid pace but not so strong as what was implied by the survey earlier in the year.”

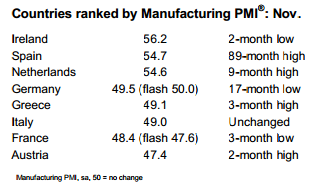

In the Eurozone, Ireland Spain and the Netherlands showed solid growth with PMIs in the mid 50s range. The rest of the region contracted with Germany hitting a 17 month low at 49.6. Output and new orders both fell in November. Output and input charges dropped moderately with only Italy reporting increases in selling prices.

Manufacturing conditions were mixed in Asian countries. Japan registered manufacturing growth for the sixth consecutive month with a PMI reading of 52.0. Production levels rose from launch of new products and stronger new orders domestically and abroad. The depreciation of the yen led to a sharp rise in input costs in November that heralded higher selling prices. Philip Leake, Economist at Markit commented, “The outlook for Japanese goods producers remains uncertain amid the weakening currency, the postponement of the planned sales tax increase and the upcoming election.”

In China, manufacturing lost momentum, according to HSBC, with output declining for the first time since May. New orders, however, continue to grow but at a weaker rate due to softened demand from abroad. Input costs declined which led to a reduction in output charges. Monetary and fiscal easing is expected to offset downside risks to growth, said HSBC. The HSBC China PMI registered 50.0 in November.

Manufacturing conditions in South Korea contracted for the third consecutive month. Production output dropped for the eighth consecutive month due to weaker demand from domestic and international markets. The HSBC PMI for November posted a reading of 49.0, up from 48.7 in October.

Russia experienced stronger output and new order growth in November reaching a PMI of 51.7, a 13 month high. The weak ruble, however, drove input prices up for manufacturers. “Input prices surged at a rate not yet seen in this century,” said HSBC Chief Economist (Russia and CIS) Alexander Morozov. “In combination with the stronger demand and output growth in November, rising prices at manufacturers predicts the continuation of fast growth on consumer prices as well. Thus, prospects of the emergence of double-digit inflation in the coming months become more solid. So does the probability of another policy rate hike, if the Central Bank keeps setting its key policy rate at or above annual headline inflation.”

In South America, conditions in Brazil deteriorated for the seventh time in the past eight months. The HSBC PMI fell to 48.7 in November from 49.1 the previous month. Output, order book volumes, and exports all declined during the month while cost inflation escalated. Higher input costs were blamed on appreciation of the US Dollar against the Brazilian real.