Market Data

November 27, 2014

Durable Goods Shipments, Inventories and Orders in October 2014

Written by Peter Wright

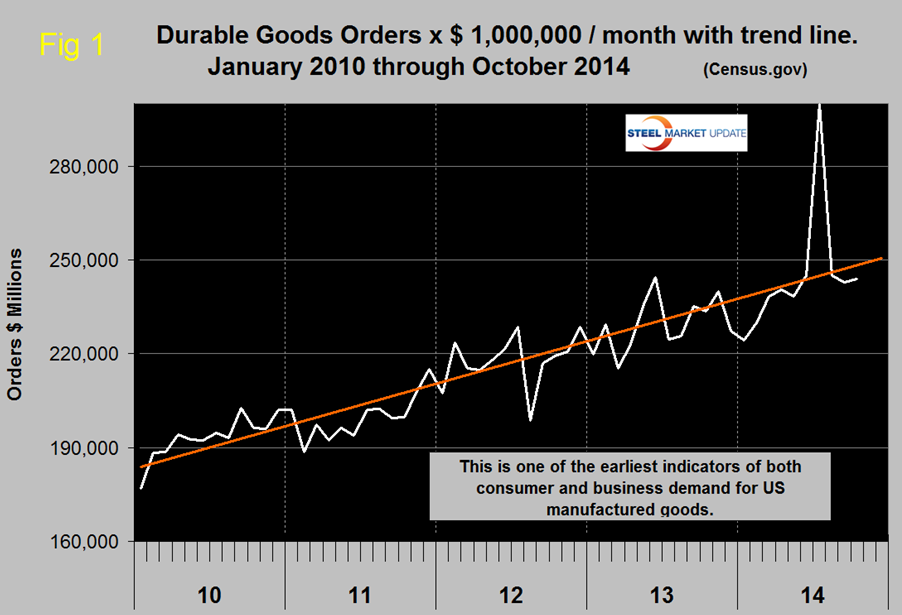

Durable goods orders in October rose by 0.4 percent from September to $243.8 billion but the three month moving average (3MMA) declined by 7.1 percent. The problem with the 3MMA was that the huge surge in July which was driven by civil aircraft fell out of the calculation. The October result is close to the trend line that has pertained since the recession, (Figure 1).

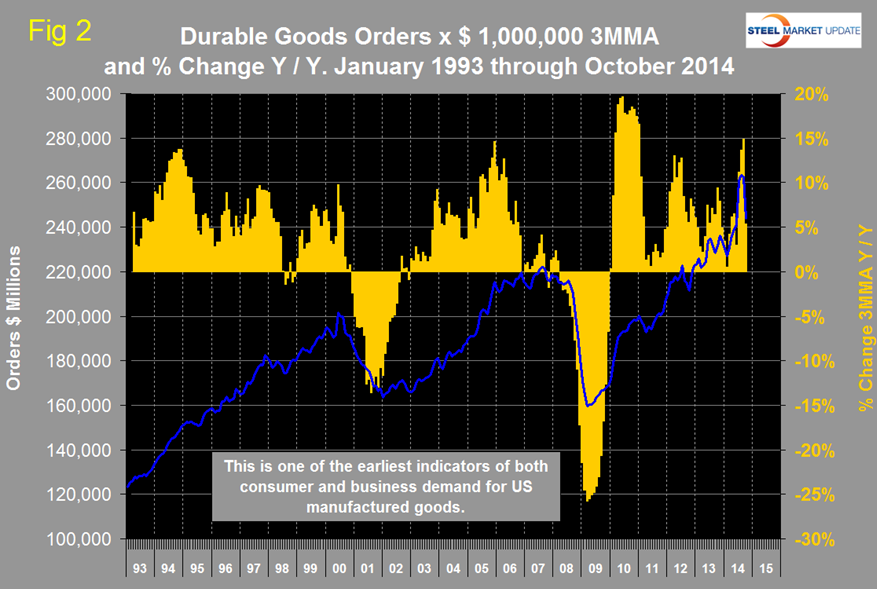

The three month moving average, is shown in Figure 2 for the period January 1993 through October 2014. The year over year growth rate of the 3MMA was 5.4 percent which excluding the July surge is back in line with its performance since mid-2012.

Moody’s Economy.com reported as follows: “New orders for durable goods moved 0.4 percent higher in October, a modest rebound following September’s 0.9 percent decline. A 45.3 percent increase in the volatile defense aircraft and parts segment powered gains. Other details of the report were mixed. Orders for motor vehicles and parts gained, as did some business-related product groupings, but core capital orders fell 1.3 percent. Shipments data told the same story; shipments rose 0.1 percent but nearly all of the gain was driven by a 0.5 percent increase in transportation shipments.

October’s report was a somewhat disappointing start to the fourth quarter. Core capital goods shipments are key source data used by the government to estimate equipment spending in the GDP accounts, and the latest data suggest a modest slowdown in real equipment spending growth. This is concerning, as capital investment is essential to long-term growth.

Stabilizing equipment purchases are good for growth in coming years, but firms are just now getting back to the pace of investment that prevailed in the middle of last year. Manufacturers have added to payrolls every month this year and fundamentals favor additional investment and hiring in the coming months.

The Census Bureau press release issued on Wednesday read as follows:

Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders October 2014

New orders for manufactured durable goods in October increased $1.0 billion or 0.4 percent to $243.8 billion, the U.S. Census Bureau announced today. This increase, up following two consecutive monthly decreases, followed a 0.9 percent September decrease. Excluding transportation, new orders decreased 0.9 percent. Excluding defense, new orders decreased 0.6 percent. Transportation equipment, also up following two consecutive monthly decreases, drove the increase, $2.5 billion or 3.4 percent to $76.3 billion.

Shipments of manufactured durable goods in October, up four of the last five months, increased $0.3 billion or 0.1 percent to $246.5 billion. This followed a 0.3 percent September increase. Transportation equipment, also up four of the last five months, drove the increase, $0.4 billion or 0.5 percent to $72.9 billion.

Unfilled orders for manufactured durable goods in October, up eighteen of the last nineteen months, increased $5.0 billion or 0.4 percent to $1,174.0 billion. This was at the highest level since the series was first published on a NAICS basis in 1992 and followed a 0.4 percent September increase. Transportation equipment, up thirteen of the last fourteen months, led the increase, $3.4 billion or 0.5 percent to $746.3 billion.

Inventories of manufactured durable goods in October, up eighteen of the last nineteen months, increased $2.0 billion or 0.5 percent to $406.8 billion. This was at the highest level since the series was first published on a NAICS basis and followed a 0.5 percent September increase. Transportation equipment, also up eighteen of the last nineteen months, led the increase, $0.9 billion or 0.7 percent to $131.7 billion.

Non-defense new orders for capital goods in October decreased $0.1 billion or 0.1 percent to $82.2 billion. Shipments decreased $0.6 billion or 0.8 percent to $80.1 billion. Unfilled orders increased $2.1 billion or 0.3 percent to $735.1 billion. Inventories increased $0.9 billion or 0.5 percent to $185.9 billion. Defense new orders for capital goods in October increased $1.1 billion or 11.2 percent to $10.5 billion. Shipments increased $0.1 billion or 1.4 percent to $9.8 billion. Unfilled orders increased $0.7 billion or 0.4 percent to $158.6 billion. Inventories increased $0.2 billion or 1.0 percent to $23.9 billion.

SMU Comment: Even though the durable goods reports are wildly erratic due to the high value of both civil and military aircraft it remains a fact that steel goods are also buried in the reported result. We therefore continue to review this data every couple of months and believe that the trend line is a useful reality check for other manufacturing data such as the industrial production index and the ISM manufacturing index.