Market Data

November 25, 2014

Consumer Confidence Declines

Written by Peter Wright

The consumer confidence index as reported by the Conference Board declined in November and the October results were revised downwards. The composite fell from 94.1 to 88.7, the view of the present situation declined from 94.4 to 91.3 as expectations fell from 93.8 to 87.0.

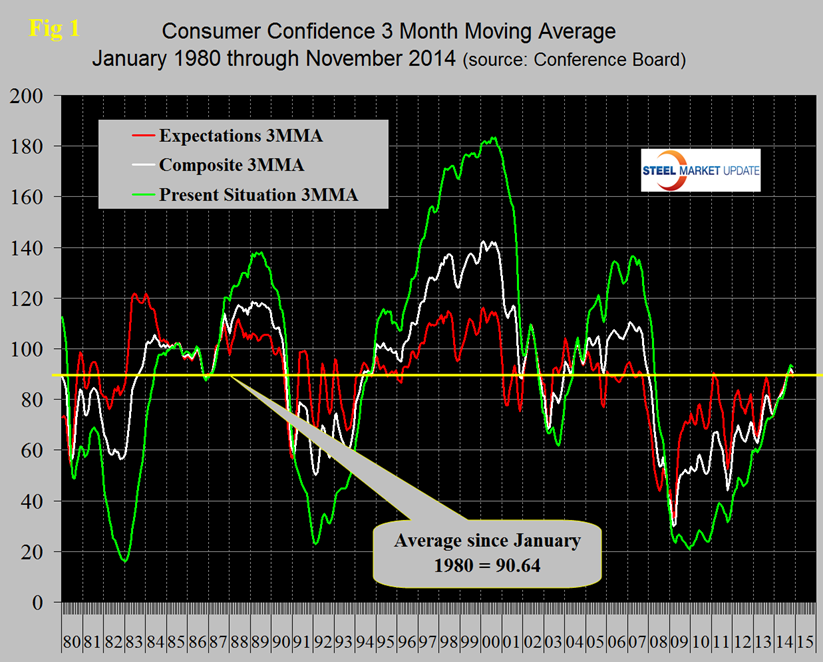

The three month moving averages (3MMA) also declined. The 3MMA of the composite is now exactly equal to the 35 year average since 1980 at 90.6. The 3MMA of the composite, the view of the present situation and expectations are shown in Figure 1.

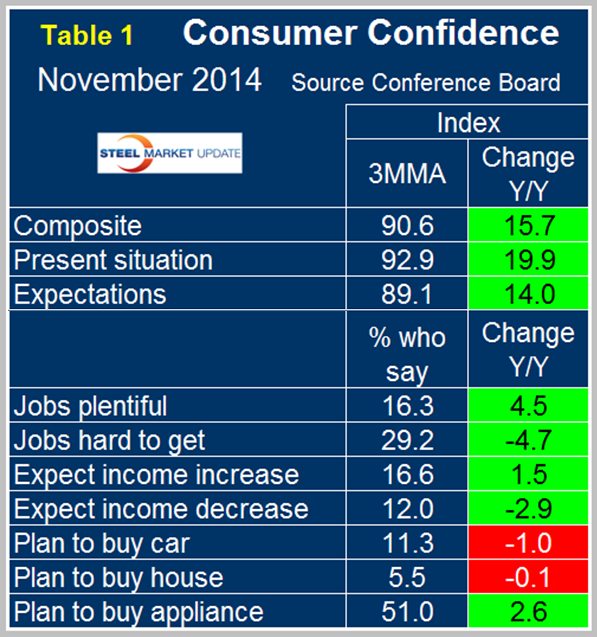

The present situation component has been much more volatile over each multiyear time span than expectations since our data began 34 years ago with higher highs and lower lows. The view of the present situation in November exceeded the view of expectations for the first time since we came out of the previous recession in 2004. If history continues to repeat itself, the view of the present situation will now move ahead and widen the differential between it and expectations. On a year over year basis using a 3MMA the composite is up by 15.7 led by consumer’s view of the present situation which is up by 19.9 (Table 1).

The employment sub-indexes, job availability and wage expectations, continue to improve. The pattern (color code) of auto, housing and appliance purchase intentions were unchanged for six months May through October but changed in November when automobiles became negative and appliances became positive. May was the first time in over a year that housing had been negative, and it has remained so ever since.

The official statement from the Conference Board reads as follows:

The Conference Board Consumer Confidence Index Declines

The Conference Board Consumer Confidence Index, which had rebounded in October, declined in November. The Index now stands at 88.7 (1985=100), down from 94.1 in October. The Present Situation Index declined from 94.4 to 91.3, while the Expectations Index decreased sharply to 87.0 from 93.8 in October.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was November 13.

Says Lynn Franco, Director of Economic Indicators at The Conference Board: “Consumer confidence retreated in November, primarily due to reduced optimism in the short-term outlook. Consumers were somewhat less positive about current business conditions and the present state of the job market: moreover, their optimism in the short-term outlook in both areas has waned. However, income expectations were virtually unchanged and gas prices remain low, which should help boost holiday sales.”

Consumers’ assessment of present-day conditions was moderately less favorable in November than in October. The proportion saying business conditions are “good” decreased from 24.7 percent to 24.0 percent, while those claiming business conditions are “bad” increased from 21.3 percent to 22.4 percent. Consumers’ assessment of the job market was slightly less favorable, with the proportion stating jobs are “plentiful” falling from 16.5 percent to 16.0 percent, and those claiming jobs are “hard to get” increasing marginally from 29.0 percent to 29.2 percent.

Consumers’ optimism, which had improved in October, retreated in November. The percentage of consumers expecting business conditions to improve over the next six months decreased from 19.4 percent to 17.6 percent, while those expecting business conditions to worsen rose from 8.9 percent to 10.7 percent. Consumers’ outlook for the labor market was also less optimistic. Those anticipating more jobs in the months ahead decreased from 16.0 percent to 15.0 percent, while those anticipating fewer jobs rose from 14.1 percent to 16.4 percent. The proportion of consumers expecting growth in their incomes edged down from 16.7 percent to 16.3 percent, while the proportion expecting a drop in income was virtually unchanged at 11.4 percent compared to 11.3 percent in October.