Market Data

November 20, 2014

Industrial Production 3MMA at Highest Value Ever

Written by Peter Wright

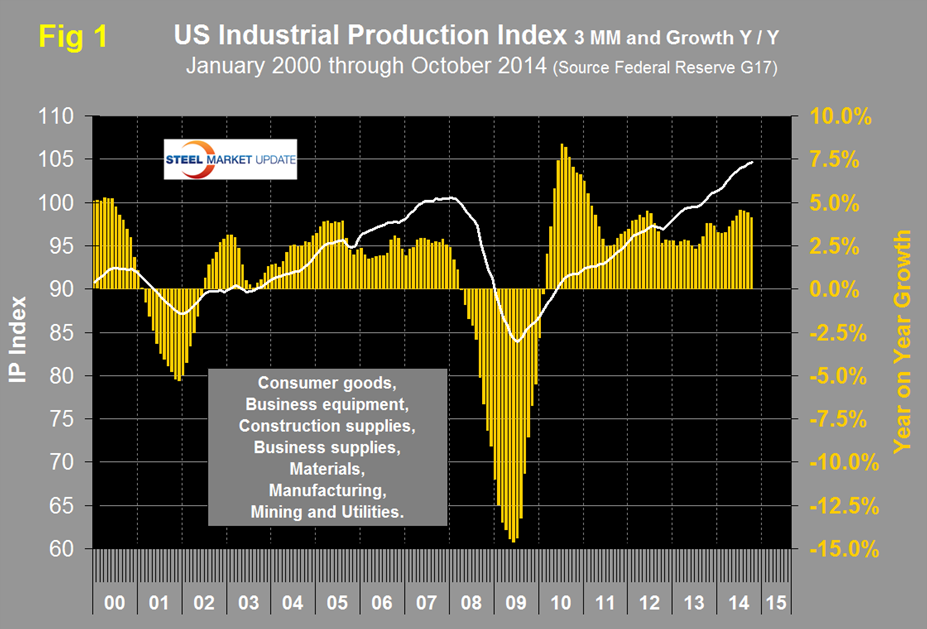

Industrial production and manufacturing capacity utilization, both of these data points are reported in the Federal Reserve G17 data base. The IP Index was reported as 104.86 for October a decline of 0.11 percent from September. This is another example where the individual months result can be misleading. The three month moving average (3MMA) was 104.65 which was the highest value ever and the fifth straight month where the growth of the 3MMA exceeded 4 percent year over year. This was the eleventh consecutive month for the index to exceed the pre-recession peak of September 2007. The 3MMA has expanded for 23 straight months and is up by 4.1 year over year. Data is seasonally adjusted. This index is based on the July 2007 level being defined as 100 (Figure 1).

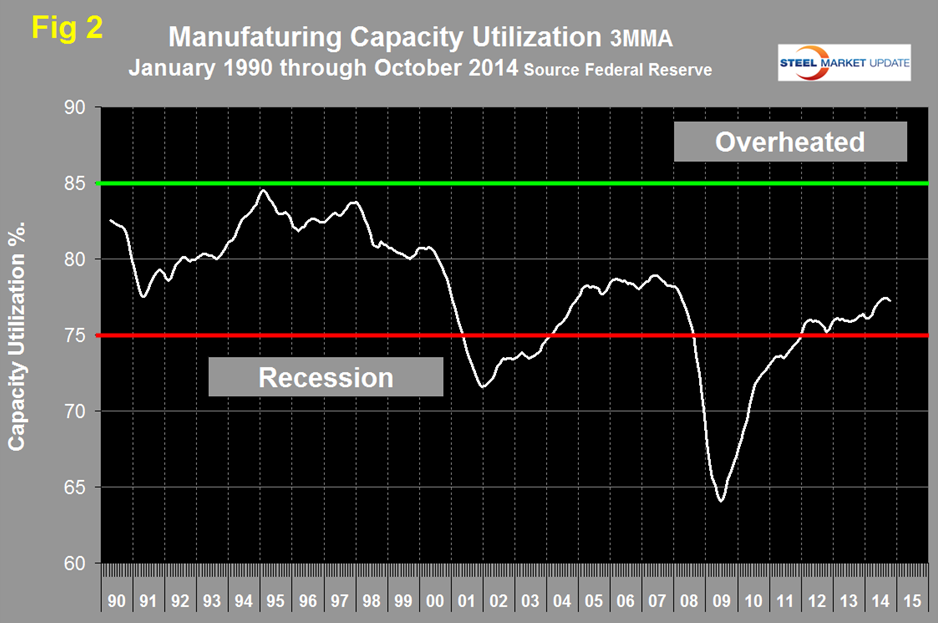

Manufacturing capacity utilization was 77.24 percent in October with a 3MMA of 77.25 percent, down slightly from 77.43 in September (Figure 2). September’s 3MMA was the highest since March 2008.

The latest Federal Reserve Beige Book released on October 15th reported as follows:

“Manufacturing activity increased in most Districts since the previous Beige Book. However, New York noted that manufacturing growth had stalled, and Boston indicated that their contacts cited weaker results than in the past few reports. The outlook for manufacturing was positive in a number of Districts. Within manufacturing, growth was reported across a broad range of products. Cleveland, Chicago, and San Francisco noted increased steel demand. The Chicago and St. Louis Districts noted strength in the aerospace sector; however, San Francisco reported that aerospace and defense capacity utilization declined. Demand for construction materials or equipment increased in Philadelphia, Cleveland, Chicago, and St. Louis. Manufacturers reported continued demand from the energy sector in the Philadelphia and Cleveland Districts. Richmond and San Francisco noted strong demand for medical equipment. San Francisco reported that worldwide semiconductor sales were up markedly over the previous year. In contrast, a food producer in the Richmond District said that demand was flat; St. Louis and Minneapolis reported layoffs or plant closures by food producers; and Kansas City noted slower activity at some food processing plants. Chicago reported weaker demand for agricultural and mining equipment.

The Beige book had this to say about residential and commercial construction:

“Reports on residential construction and real estate activity were mixed. New York noted that single-family construction was sluggish in some areas, but that multifamily construction increased. Philadelphia reported only slight growth in home construction. In August, single-family construction starts in the Cleveland District reached their highest level so far this year, though the number of starts year-to-date remained slightly lower than last year. Richmond noted that residential construction across the District increased slightly for custom homes. Atlanta reported that multifamily construction continued to increase across much of the District, while Chicago indicated that both single- and multi-family construction continued to expand. Residential real estate contacts in the Atlanta District indicated that existing home sales and prices remained ahead of last year’s levels and inventory levels were down from a year ago. Chicago noted that home sales were somewhat lower, and growth in home prices and residential rents slowed. San Francisco reported that sales of single-family homes were stable since the previous report.

Commercial construction and real estate activity grew in most Districts. Richmond, St. Louis, and San Francisco reported increased commercial construction, industrial construction, or both. Cleveland noted that a majority of commercial contractors saw increased construction activity relative to a year ago. Commercial contractors in the Atlanta District saw an increase in construction activity across many property types. In Minneapolis, however, commercial construction activity declined. Richmond reported that commercial real estate activity improved modestly over the past several weeks. The New York District noted that the New York City office market continued to strengthen. Atlanta noted that many commercial brokers saw growth in activity. Chicago noted that commercial real estate activity continued to expand. Kansas City indicated that commercial vacancy rates declined and absorption and sales increased. Boston noted that commercial real estate fundamentals are either holding steady or improving.”

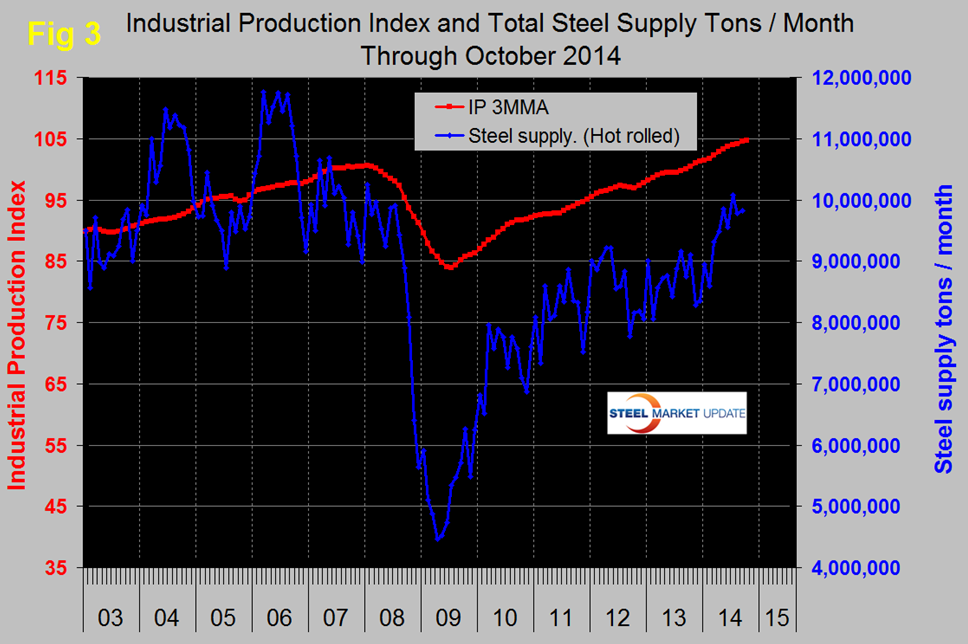

SMU Comment: We are encouraged by the continued growth in industrial production and the ISM manufacturing index. Prior to the recession there was a reasonable correlation between the industrial production index and steel supply though steel was very much more volatile in this comparison just as it is against GDP (Figure 3). We have many indicators that suggest that steel supply is lower than it should be at this stage of a recovery but there has been a recent surge which we attribute to both strength in manufacturing and to growth in total construction which has been >5 percent annualized for over two years. The gap between steel supply and the industrial production index is closing but slowly and it will in the 2017/2018 time frame before convergence. This is also when, as we have reported elsewhere, housing and non-residential construction at their present rates of growth will have recovered.