Analysis

November 19, 2014

SMU Analysis: Housing Starts, Permits and Builder Confidence

Written by Peter Wright

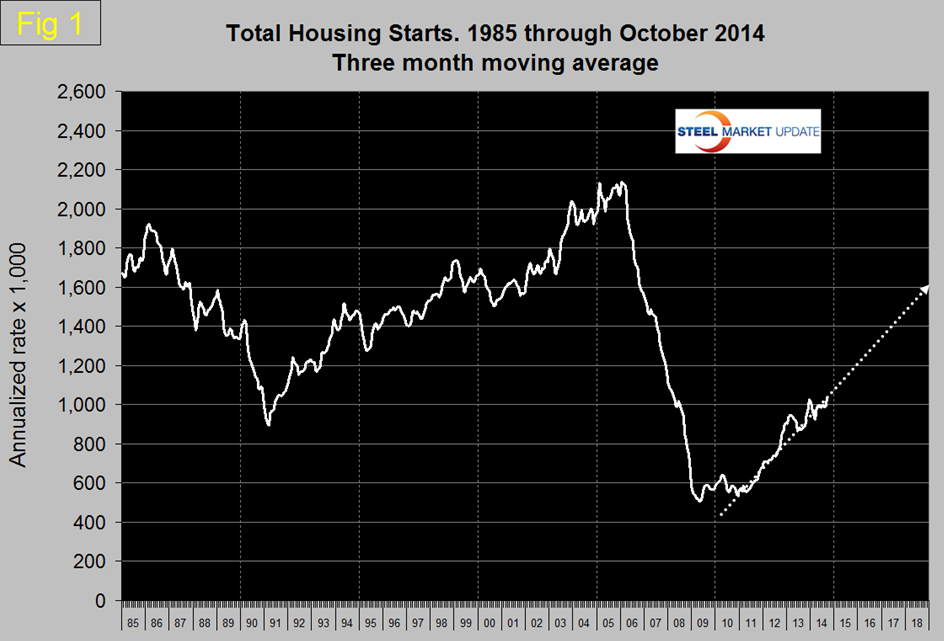

Starts in October fell to an annual rate of 1,009,000 units from 1,038,000 in September. The three month moving average (3MMA) decreased from 1,033,000 units to 1003,000, (Figure 1).

This was the second time since January that the 3MMA had exceeded a million units. The year over year growth rate of the 3MMA of total starts in October was 12.1 percent. Total starts are still on track to reach 1.6 million by the end of 2018.

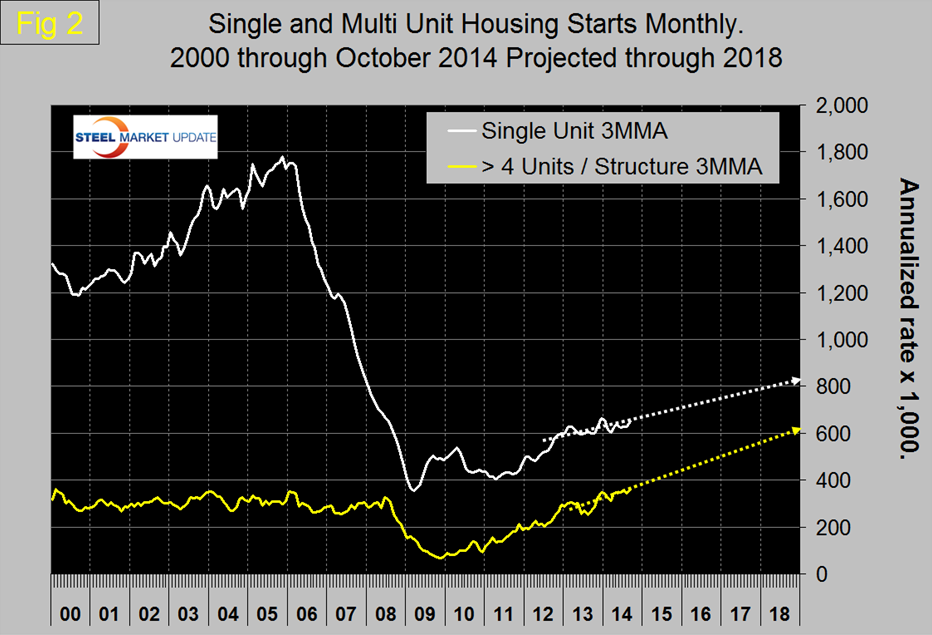

Multifamily starts are now beyond the pre-recession high of January 2006 but single family are still 62 percent below the level enjoyed at that time, (Figure 2).

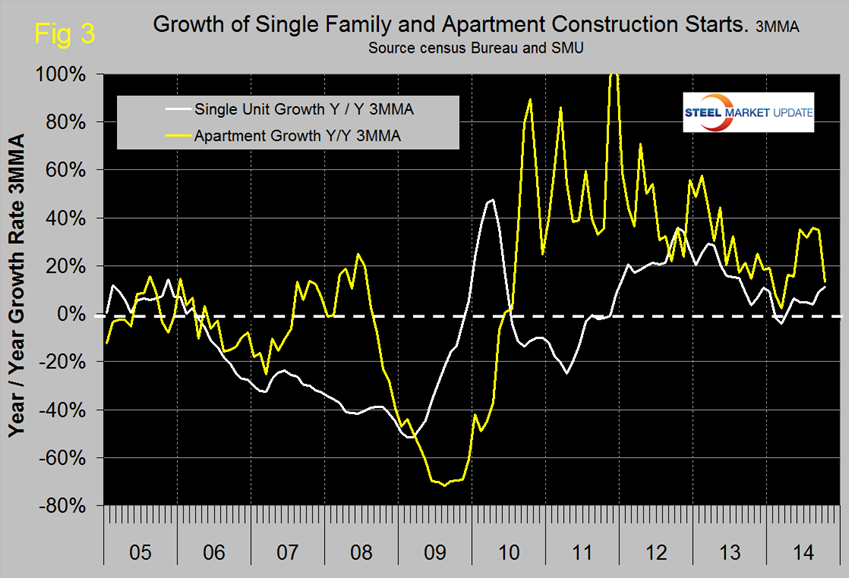

In October the growth rate of multifamily slowed from the mid-30s, which had prevailed since May, to 13.9 percent. Single family accelerated to an 11.3 percent growth rate, the first time to reach double digits in ten months, (Figure 3). Both on a 3MMA year over year basis.

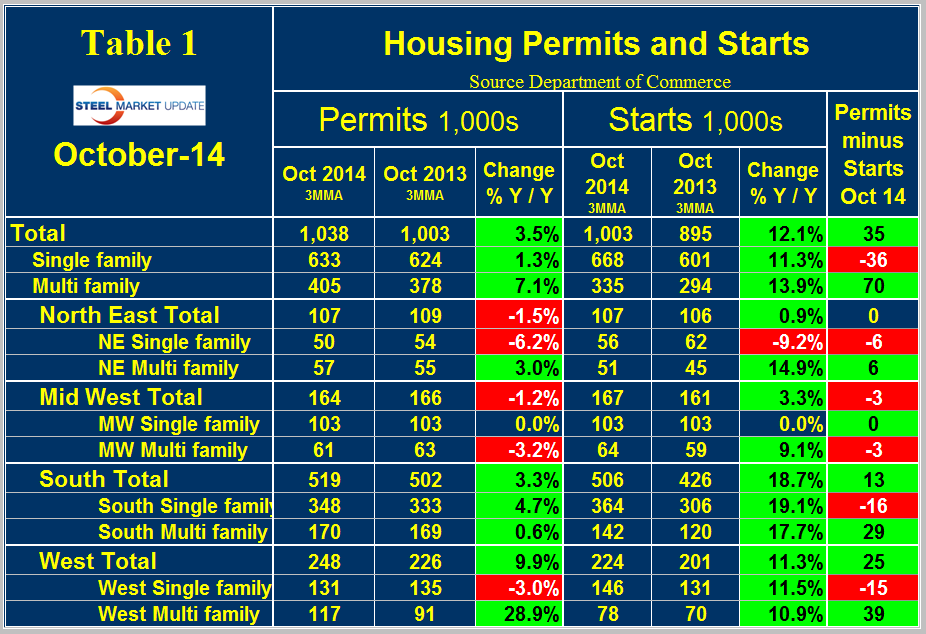

Permit data is useful to evaluate where future starts are headed. If permits exceed starts then we anticipate an acceleration and vice versa. Table 1 shows that total permits did exceeded starts by 35,000 in October on a 3MMA basis. However, the situation is dramatically different for single and multi-family units. Single family permits were 36,000 less than starts and multi-family permits were 70,000 more than starts. This signals a future acceleration in multi-family and a deceleration in single family.

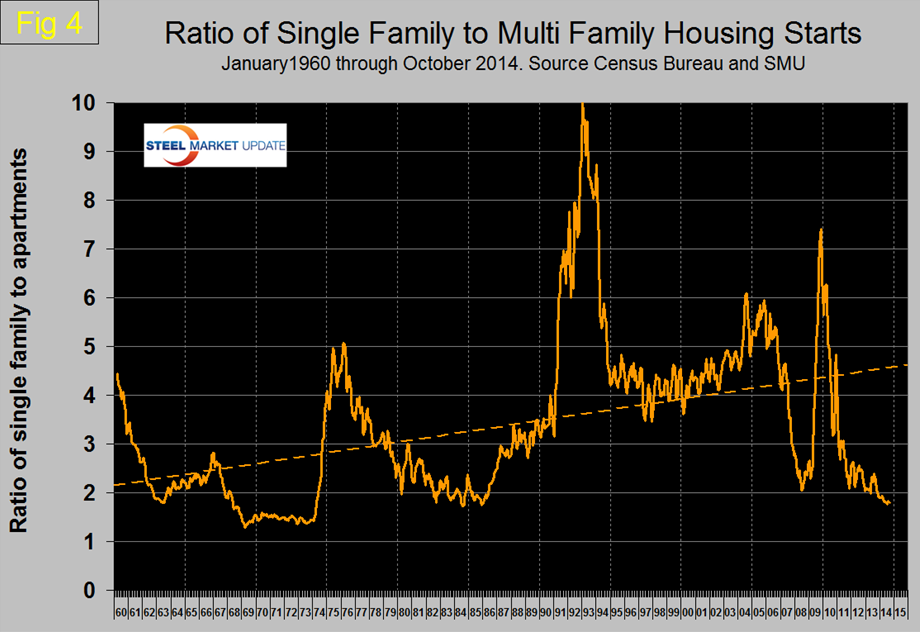

The ratio of the two sectors is shown in Figure 4 and demonstrates that single family compared to multifamily continues to be less desirable than at any time in the last 30 years. Based on permit data this trend will not change any time soon.

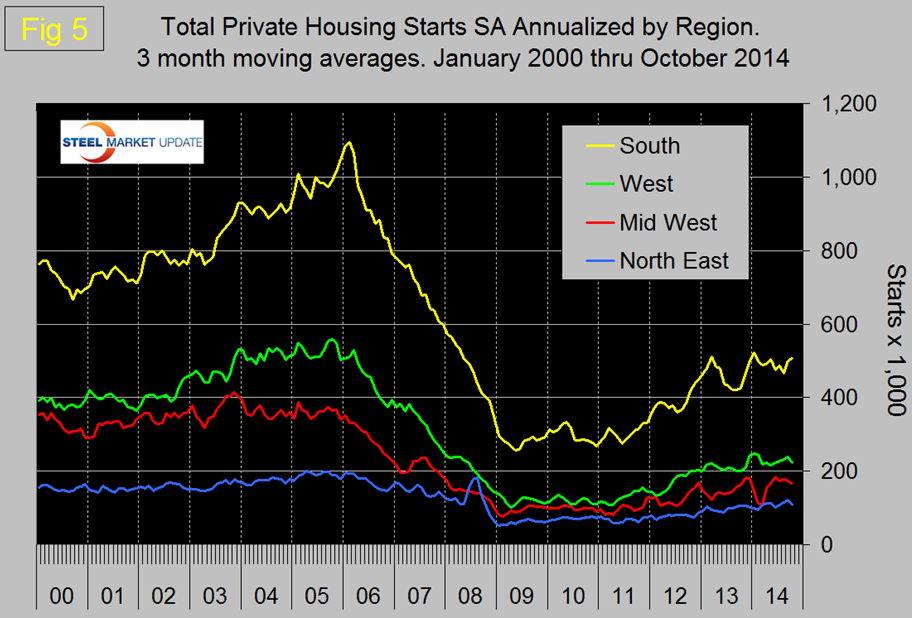

The situation in the four regions reported in the census Bureau report were not synchronous in October. The South and the West had an increase in total permits for both the month and the 3MMA, in both regions the improvement was in multifamily, single family was flat. The Northeast and Mid-West had a decline in total permits both in the month and in the 3MMA. In the NE the decline was only in the multifamily sector but in the Mid-West permits in both sectors declined. The South was the only region to have an increase in starts in October. Figure 5 shows the regional situation for total residential starts since January 2000. The dramatic change in the consumer’s view of how he/she wants to live is accelerating. Student loan debt exceeded $1.3 trillion in Q3 of 2014 for the first time. This must be impacting the young person’s view of other debt obligations and so, presumably, is the view that housing is not necessarily the great investment that it was once thought to be. In addition, uncertainty in the job market makes mobility desirable and promotes the idea of rent in preference to purchase.

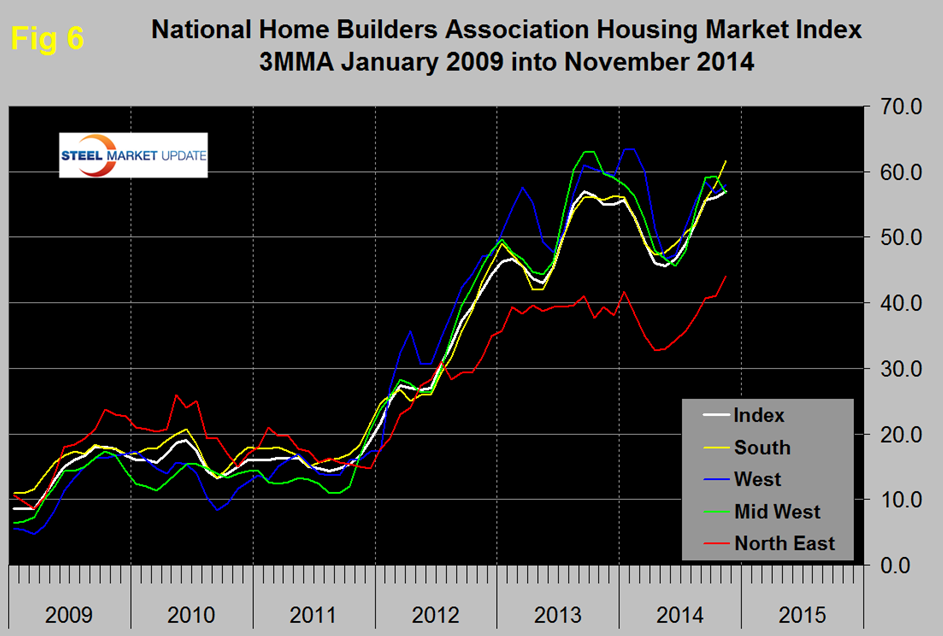

The National Association of Home Builders (NAHB) confidence report was released on Tuesday, (Figure 6). Any value above 50 indicates an overall positive business confidence. The index regained the four points lost in October and the 3MMA continued to advance reaching 57, equal to October last year and higher than any other month since before the recession. The composite index, signals that homebuilders are generally positive in their views of the market.

The official release from the NAHB read as follows:

Business Confidence Rises Four Points in November

November 18, 2014 – Builder confidence in the market for newly built single-family homes rose four points to a level of 58 on the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), released today.

“Growing confidence among consumers is what’s fueling this optimism among builders,” said NAHB Chairman Kevin Kelly, a home builder and developer from Wilmington, Del. “Members in many areas of the country continue to see increasing buyer traffic and signed contracts.”

“Low interest rates, affordable home prices and solid job creation are contributing to a steady housing recovery,” said NAHB Chief Economist David Crowe. “After a slow start to the year, the HMI has remained above the 50-point benchmark for five consecutive months, and we expect the momentum to continue into 2015.”

Derived from a monthly survey that NAHB has been conducting for 30 years, the NAHB/Wells Fargo Housing Market Index gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores from each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three HMI components increased in November. The index gauging current sales conditions rose five points to 62, while the index measuring expectations for future sales moved up two points to 66 and the index gauging traffic of prospective buyers increased four points to 45.

Looking at the three-month moving averages for regional HMI scores, the Northeast rose three points to 44, the South posted a four-point gain to 62, and the West edged up one point to 58. The Midwest registered a two-point loss to 57.

Editor’s Note: The NAHB/Wells Fargo Housing Market Index is strictly the product of NAHB Economics, and is not seen or influenced by any outside party prior to being released to the public. HMI tables can be found here. More information on housing statistics is also available here.

SMU Comment: Even though the steel content of housing is only a small proportion of total steel consumption, housing is a leading indicator of many construction sectors such as non-residential and sub sectors of infrastructure and has a large multiplier effect in the economy as a whole. To the extent that readers businesses are influenced by the relative size of the two housing sectors, they should plan for further continued growth of apartment construction and a single family sector that continues to struggle.