Prices

August 19, 2014

TransCanada Answers SMU Questions About Keystone XL Pipeline

Written by Sandy Williams

TransCanada’s Keystone XL Pipeline has been on hold since 2008 waiting for U.S. presidential approval of the permit to allow the pipeline to cross the U.S./Canada border. President Obama has said he would approve the pipeline only if it did “not significantly exacerbate the climate problem.” Opponents of the pipeline are concerned the pipeline will reduce the cost of oil, thereby increasing consumption and spurring new carbon dioxide emissions. Others are concerned about potential pipeline breakage contaminating ground water and crops.

In response, pipeline advocates say the oil from Canada will not affect supply and that it will get to market whether by pipeline or rail. Pipeline safety has been addressed by TransCanada by upgraded safety measures that include using 36 inch diameter with a wall thickness of 0.72 design factor. Recent rail tank car spills have shown than petroleum transported rail is not necessarily a safer option. Tankers carrying oil are now being replaced and/or retrofitted with new safeguards that will take years to complete.

Sen. Al Franken (D-Minn.) and Republican challenger Mike McFadden introduced the “made in the U.S” issue to the argument. The Senate seat contenders have accused each other of choosing Chinese steel, if it’s cheaper, to build the pipeline. McFadden was under fire from Minnesota politicians and union leaders for making such a statement. McFadden says Franken voted for a loophole that allows for Keystone XL to be built with non-US steel. Franken spokesperson Alexandra Fetissoff said the vote allowed for Chinese steel only if domestic steel increased the cost by more than 25 percent. Franken is for American steel, said Fettisoff, and wants the pipeline built from it. The debate is a moot point and just political posturing since TransCanada has already lined up its vendors for the steel products it will be using (see below). None of the pipe listed by TransCanada is made in China.

Sen. Mary Landrieu (D-La) and Sen. John Hoeven (R-ND) introduced a bill earlier in the year that would grant approval for the permit bypassing the State Department. So far the bill has not seen any action since it requires Senate Majority Leader Harry Reid (D-Nev) to bring it to a vote. Even if the bill would pass Congress it would still require the President’s signature to be signed into law. So the ultimate decision on the Keystone XL will continue to remain in presidential hands.

Steel Market Update wanted to know what TransCanada had to say about the Keystone XL Pipeline project and the issues and arguments surrounding it. The following is from Shawn Howard, media spokesperson at TransCanada.

What is the current status of the project in regards to US approval?

The Keystone XL Pipeline project is waiting for a determination from the U.S. Department of State regarding whether or not this project is in America’s national interest, and subsequent approval of a Presidential Permit which was originally applied for in 2008. This project has been studied for nearly six years and has had one of the most detailed and exhaustive environmental reviews of any pipeline project in history which includes:

– Five separate environmental impact statements,

– Over 17,000 pages of scientific analysis, and

– Input from dozens of state and federal agencies.

How much of the Keystone XL pipeline in the US is already in the ground?

None. Keystone XL still requires a Presidential Permit in order for construction to begin.

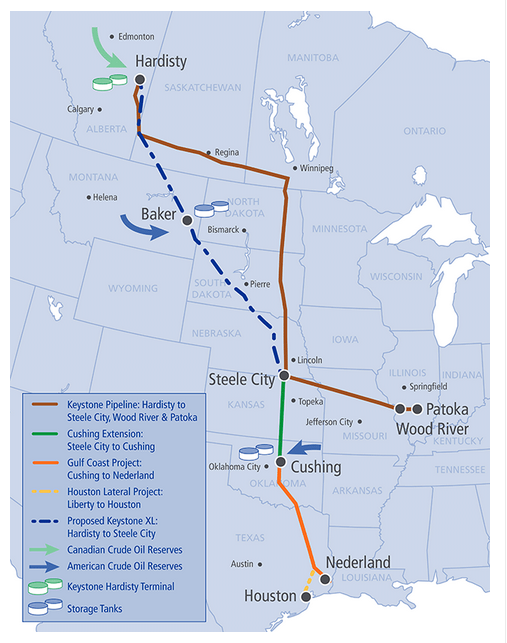

With respect to the three other sections of the Keystone Pipeline System; The Keystone Pipeline System is a 2,639-mile (4,247-kilometre) pipeline system that transports crude oil from Hardisty, Alta., to markets in the American Midwest and the U.S. Gulf Coast. The Canadian portion of the pipeline runs from Hardisty east into Manitoba where it turns south and crosses the border into North Dakota. From North Dakota, the pipeline runs south through South Dakota and Nebraska. At Steele City, Neb., one arm of the pipeline runs east through Missouri for deliveries into Wood River and Patoka, Illinois; another arm runs south through Oklahoma for deliveries into Cushing and continues south for deliveries into Port Arthur, Texas.

Does TransCanada have a preference as to domestic or foreign steel? Would you support use of US produced pipe in the US sections?

![]() Seventy-five per cent of the steel used to construct Keystone XL (and the Gulf Coast Project) was manufactured in North America. This was the capacity of North American mills at the time.

Seventy-five per cent of the steel used to construct Keystone XL (and the Gulf Coast Project) was manufactured in North America. This was the capacity of North American mills at the time.

It is important to understand pipeline companies do not purchase raw steel. Rather, we purchase sophisticated manufactured products such as high strength steel pipe and pumps that are fabricated from steel and other metals. It is the responsibility of the manufacturers of these products to source the necessary raw materials and to produce a product that meets all relevant regulations, codes and our internal specifications.

We estimate 821,000 tons of high strength line pipe will be used on the project in Canada and the U.S. TransCanada has estimated it will use 660,000 tons of steel for the U.S. portion of the Keystone XL pipeline. The following are the line pipe mills who are manufacturing the pipe:

– Welspun – Little Rock, Arkansas, USA 332,800 tons 50%

– Evraz – Regina, Saskatchewan, Canada 156,266 tons 24%

– ILVA – Italy 103,147 tons 16%

– Welspun – India 69,457 tons 10%

There are a number of materials and equipment items containing steel, which would amount to approximately 35,000 additional tons of steel to be sourced. The major items are as follows:

– Houston lateral and Nebraska re-route – line pipe and associated materials such as fittings, valves, etc.

– Cushing, Oklahoma and Baker, Montana Terminals – steel will be required for the construction of tanks plus the steel required for the other materials related to the terminal such as tanks, piping, pumps.

– Pump stations – pumps, motors and other related materials such as valves, fittings, etc. to be added at each location in the U.S.

Virtually all of the 35,000 tons of steel products described above will be purchased from North American mills and manufacturers. TransCanada has already entered into contracts to purchase over $800 million of finished pipe and other products from United States manufacturers for Keystone XL. We anticipate purchasing additional products from United States manufacturers as we complete procurement for the project.

How much pipe is still needed to complete the project?

The remaining section of the Keystone Pipeline System, Keystone XL, is 1,179-mile (1,897 km), beginning in Hardisty, Alta., and extending south to Steele City, Neb.

What is the wall thickness and diameter of the pipe that is used?

Keystone XL will be a 36-inch-diameter strength carbon steel crude oil pipeline with a wall thickness of 0.72 design factor. For more on steel quality and specifications see the 57 Special Conditions TransCanada has voluntarily agreed to in order to make this pipeline the safest ever built on U.S. soil.