Prices

November 16, 2014

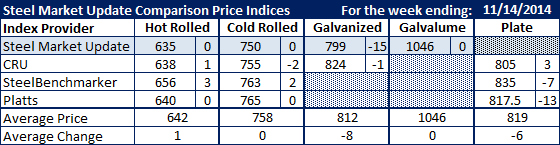

Comparison Price Indices: Changes to Momentum & Pricing

Written by John Packard

Late last week Steel Market Update (SMU) adjusted our galvanized range to take into consideration the growing number of base prices reaching down to the $35.00/cwt level. Our galvanized range is now $35.00/cwt-$38.00/cwt for new spot orders. Over the weekend we adjusted our hot rolled range to reflect the lower numbers we have been collecting at the lower end which we now identify as $610 with $660 being the top of the range. Our hot rolled coil price average is now $635 per ton ($31.75/cwt).

SMU is now of the opinion that prices will continue to erode from here over the next 30 days. We are therefore adjusting the SMU Price Momentum Indicator from Neutral and returning it to Lower. We had been at Neutral for a couple of weeks as we waited to see if the domestic steel mills would be able to shift momentum and push prices higher from here. What we have seen is an uneven attempt by the mills to insist on prices going higher. We believe this was complicated by the large drop in scrap prices, short lead times and mills still needing orders to complete their 2014 order books and the fact that there is quite a bit of supply (maintenance being completed on a number of blast furnaces) which will be returning to the market prior to the end of this year.

Here are the adjustments made by the various indexes followed by Steel Market Update on hot rolled, cold rolled, galvanized, Galvalume and plate steels as of today, November 16, 2014.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.