Prices

November 9, 2014

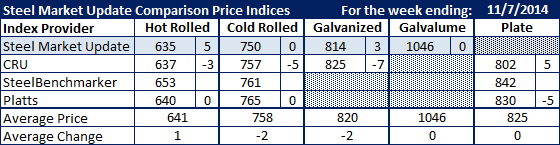

Comparison Price Indices: Steel Prices Begin to Stabilize

Written by John Packard

Flat rolled steel prices began to stabilize this past week after having peaked in the middle of August at $675 per ton (hot rolled) and then slowly sliding to a low of $630 per ton during the week ending November 1, 2014. The SMU HRC average actually rose slightly to $635 per ton this past week while CRU dropped $3 to $637 and Platts remained unchanged at $640 per ton. SteelBenchmarker did not report new prices this past week.

With the price announcements starting to sink in, SMU anticipates prices to stabilize at the current levels over the next week or two. We need to see lead times move into January, evaluate service center inventories (which we have forecast to grow due to the amount of foreign arriving) and then demand as we move into the New Year. We have already heard from the domestic mills that they do not anticipate any issues with their blast furnaces as we move into 2015 and all of them should be running in the U.S. (one furnace at Essar Steel Algoma is still not yet running).

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.