Analysis

November 5, 2014

Construction Expenditures through September 2014

Written by Peter Wright

Each month the Commerce Department issues its construction put in place (CPIP) data on the first working day covering activity two months earlier. September data was released on November 3rd. Construction put in place is based on spending work as it occurs, estimated for a given month from a sample of projects. In effect the value of a project is spread out from the project’s start to its completion. Construction starts data published by the Commerce Department for residential construction and by McGraw Hill / Dodge and Reed Construction for non-residential is completely different as in these cases the whole project is entered to the data base when ground is broken. The official CPIP press report gives a very limited view of expenditures and trends on a historical basis. The detail is hidden in the published data tables which we at SMU dissect to try to provide some meaningful guidance for those readers whose businesses target this industry. This is a very broad and complex subject therefore to make this monthly write up more comprehensible we are keeping the information format as consistent as possible.

Total Construction: Data is reported on both a seasonally adjusted and non-adjusted basis. In the SMU analysis we consider only the non-seasonally adjusted data and remove seasonality by the consideration of year over year (y/y) data. We also focus on rolling 3 and 12 months to remove the noise in single month numbers. Please note that the official news release from the Commerce Department may at first glance seem to conflict with the SMU analyses because the government commentary is all about seasonally adjusted numbers.

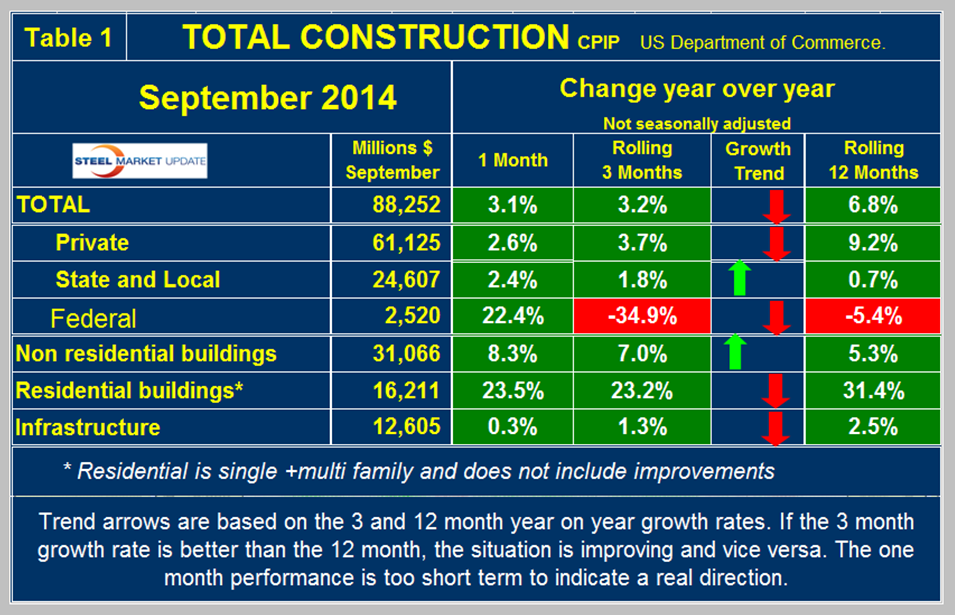

September expenditures were $88.3 billion which breaks down to $61.1 B of private work, $24.6 B of state and locally, (S&L) funded work and $2.5 B of federally funded, (Table 1).

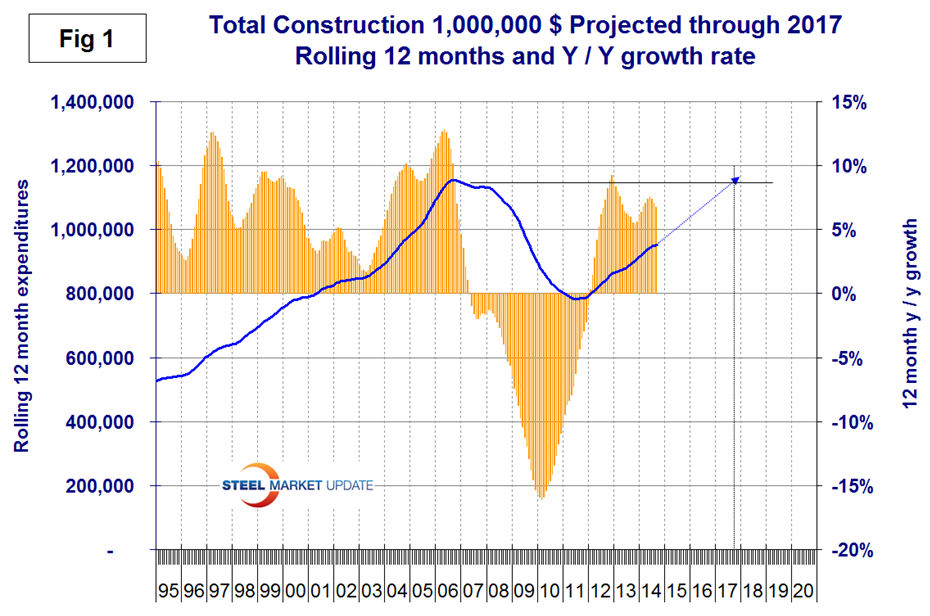

On a rolling three month basis total construction was up by 3.2 percent y/y, a decline from 3.9 percent in our last report. On a rolling 12 month basis y/y total construction was up by 6.8 percent, down from 7.0 percent in August. This means that total construction growth is decelerating slightly since the short term growth (3 months) is less than the long term, (12 months). We report this as negative momentum. Note this is not a seasonal effect because our y/y analysis removes seasonality. Private work had negative momentum in September but state and local momentum was positive, both trends the same as they were in the June, July and August results. We consider three sectors within total construction. These are non-residential, residential and infrastructure. On a rolling three month basis y/y non-residential is growing at 7.0 percent and accelerating. Residential is growing at 13.1 percent and slowing. Infrastructure grew 1.3 percent y/y and decelerated in the last three months with negative momentum. The growth of total construction improved from December through June but declined slightly in July, August and September as shown by the brown bars in Figure 1. At the current rate it will be Q3 2017 before the pre-recessionary peak is regained. The pre-recession peak of total construction on a rolling 12 month basis was $1,145 B in 12 months through February 2007. The low point was $768 B in 12 months through May 2011. The 12 month total through the latest data of September 2014 was $952.9 B.

We can get some idea of regional variations in total construction from the BEA employment reports. Construction employment expanded in 236 metro areas, declined in 53 and was stagnant in 50 between September 2013 and September 2014, according to a new analysis of federal employment data released by the Associated General Contractors of America. Association officials said that as firms expand their payrolls, many are finding a limited supply of available qualified workers.

“It is good news that construction employment gains have spread to more than two-thirds of the nation’s metro areas,” said Ken Simonson, chief economist for the association. “But there is a growing risk that contractors in many of these regions will have trouble finding qualified workers to complete the rising volume of projects.”

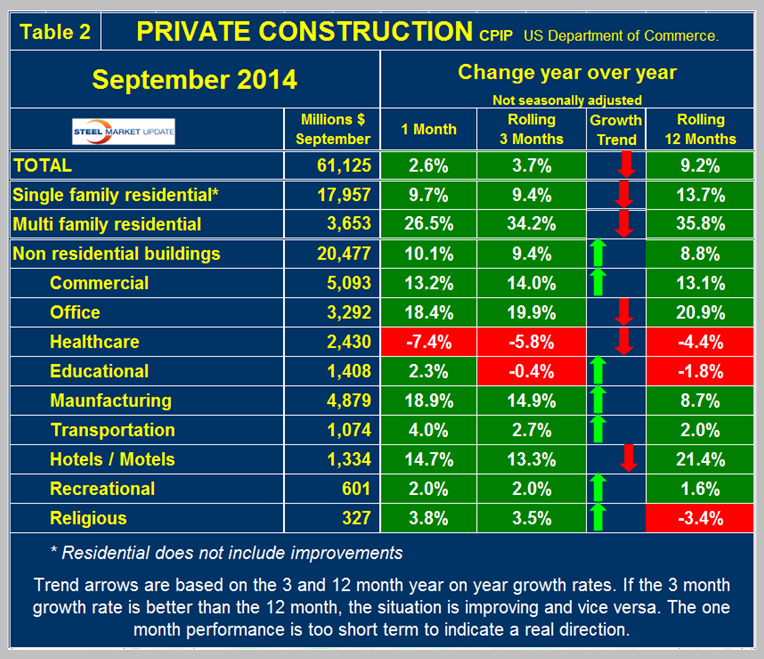

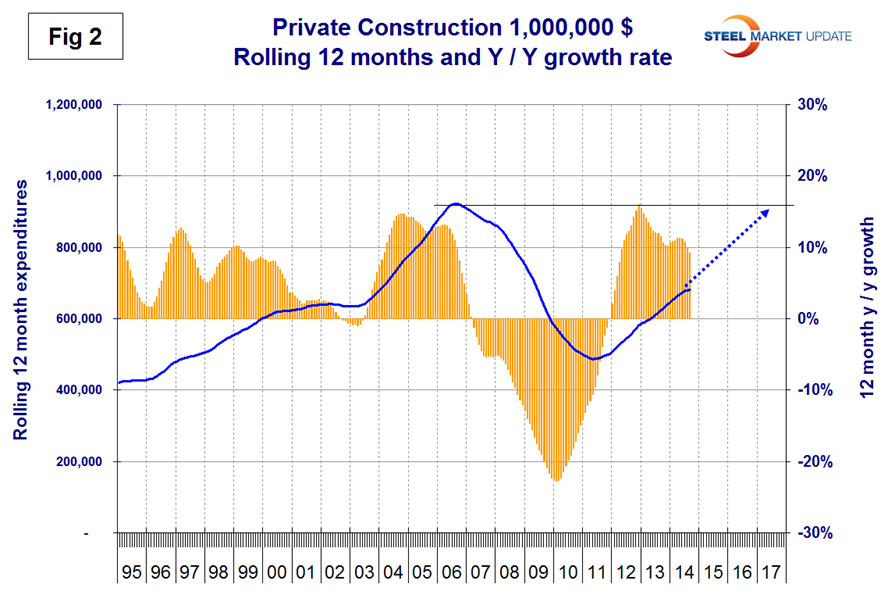

Private Construction: In the September CPIP data, private work decelerated significantly from a 9.2 percent growth rate in 12 months y/y to a 3.7 percent rate in 3 months y/y, (Table 2).

This was the first time for the 12 month growth to fall below 10 percent in 25 months as shown by the brown bars in Figure 2 and at the current rate it will be late 2017 before recovery is complete. Table 2 breaks down the private sector into project types. Residential buildings, both single and multi-family still have strong y/y growth but single family is slowing dramatically and multifamily also slowed slightly in three months through September. This data coincides well with the housing starts data from the Census Bureau which has single family growing at 4.5 percent rate and multifamily growing at 35.9 percent. Private non-residential buildings grew at a 9.4 percent rate in three months through September y/y with a positive momentum. Within private non-residential, only health care and educational had negative growth. Offices, manufacturing, hotels / motels and commercial continued to have strong year over year growth in three months through September.

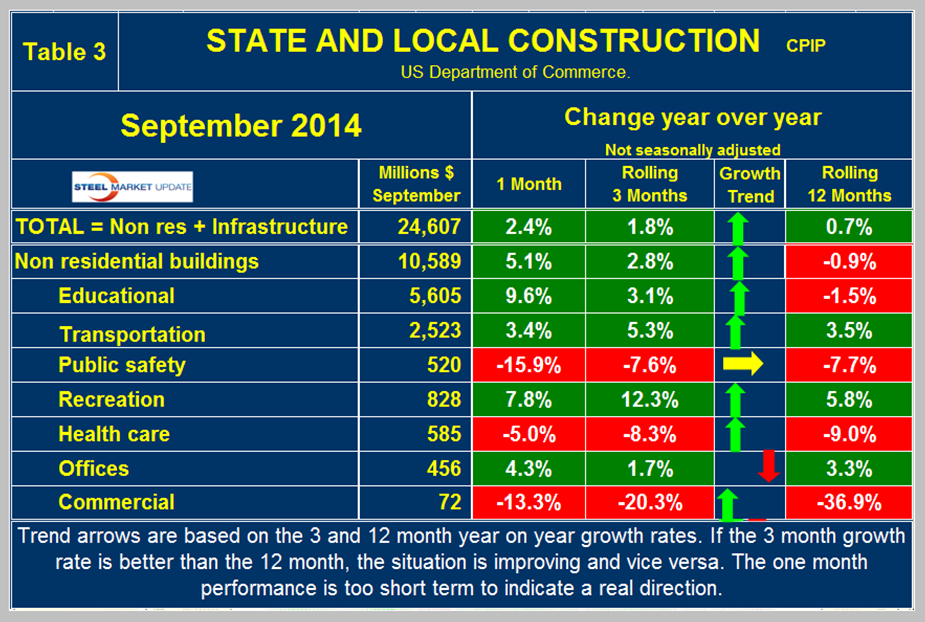

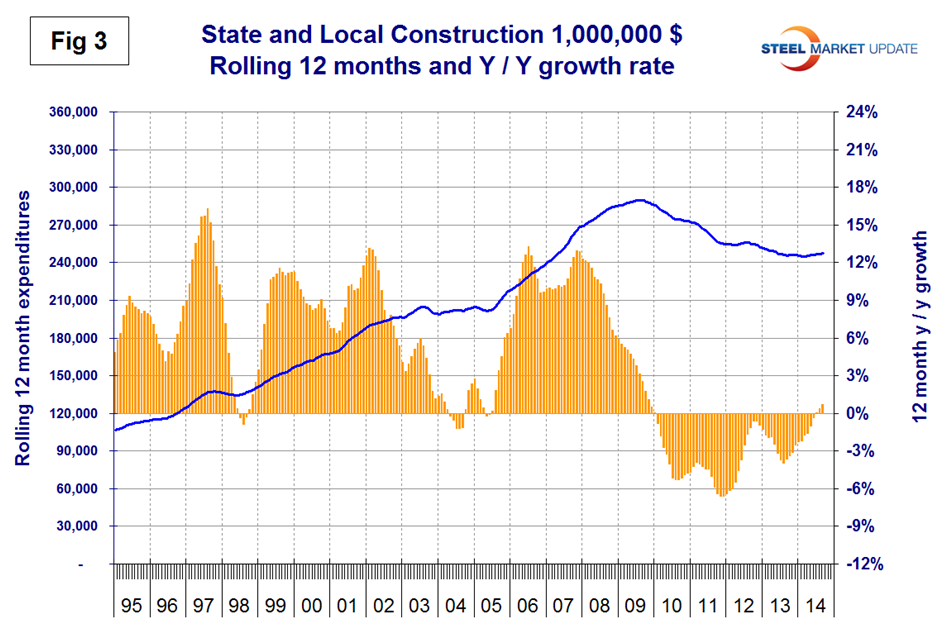

State and Local Construction: S&L work expanded by 2.4 percent in the single month of September y/y and grew by 1.8 percent in the rolling three months through September y/y. (Table 3). This was the fifth consecutive month of positive y/y growth on a rolling three months basis, the first time that has happened in four years and momentum is positive as indicated by the three month growth rate being higher than the twelve month.

Figure 3 shows two consecutive months of positive growth after 54 months of contraction. S&L non-residential building grew by 2.8 percent in three months through September y/y, and momentum continues to be positive. Educational buildings are about 75 percent funded by state and local governments and are by far the largest sub sector of S&L non-residential at almost $5.6 billion in September. Educational building construction expanded by 3.1 percent in three months through September, the best performance in 30 months. Recreational buildings have accelerated markedly in the last four months and grew by 12.3 percent in the latest data making this the strongest sector within State and Local. Transportation terminals continue to do well and offices had minimal though positive growth. Comparing Figures two and three it can be seen that S&L construction did not decline proportionately as much as private work during the recession. Many state and local governments are still far from healthy, as increased revenues have been more than offset by increased future obligations, including the need to replenish reserve and rainy-day funds and to service defined benefit liabilities, pensions and Medicaid foremost. In spite of these limitations S&L construction seems to have bottomed out and begun what will be a very long period of recovery to pre-recession levels.

Drilling down into the private and S&L sectors as presented in Tables 2 and 3 shows which project types should be targeted for steel sales and which should be avoided. There are some project types within S&L that are doing quite well but there are also major regional differences to be considered.

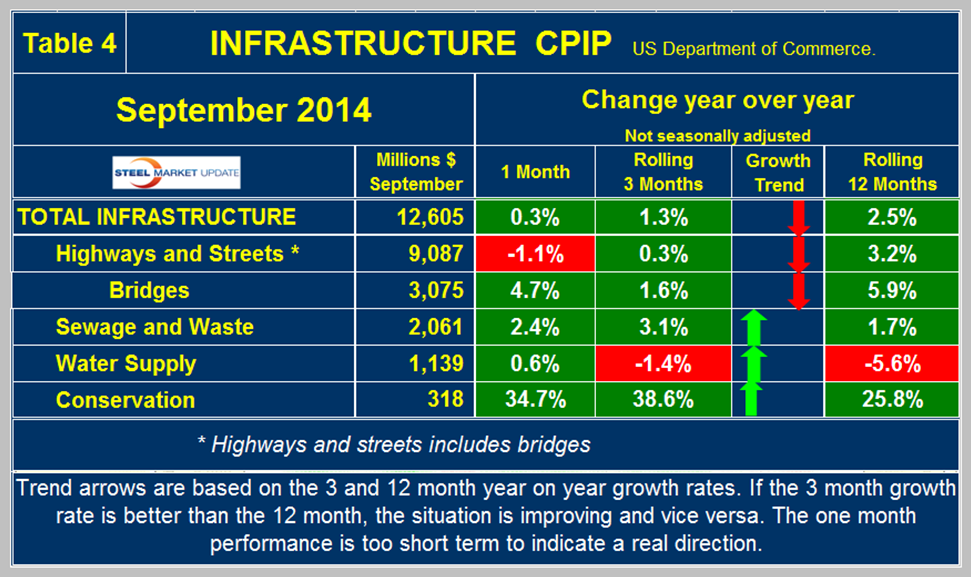

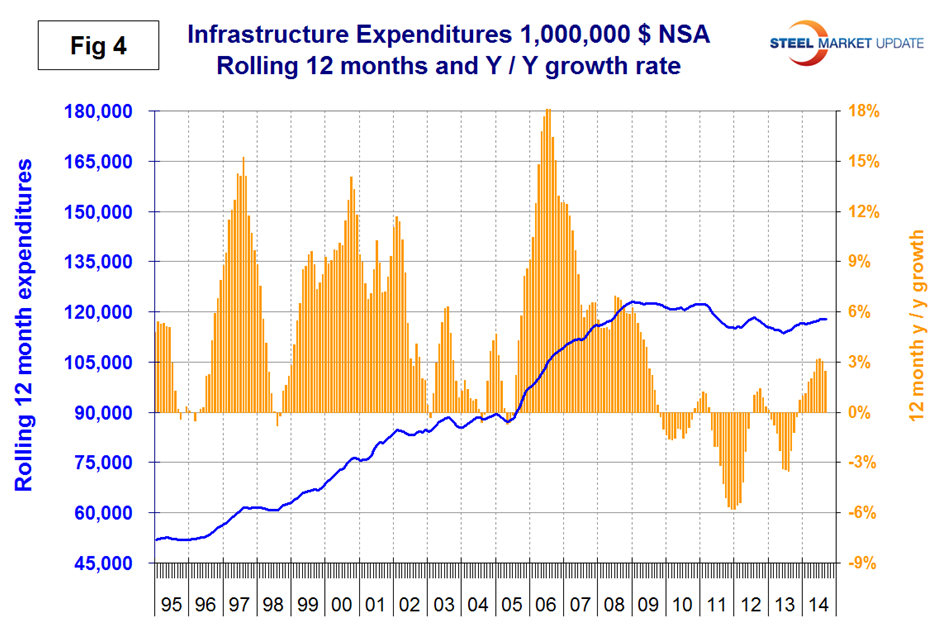

Infrastructure: expenditures have had positive growth in each of the last thirteen months through September on a rolling 3 months basis with a + 1.3 percent result in the latest data. The growth in three months is slower than that in 12 months meaning that momentum slowed as a result of protracted negotiations in Washington before the issue of highway trust fund had some limited resolution. Highway pavement expenditures contracted in August and September on a 3MMA basis y/y after 10 months of growth. This is a sub component of Highways and Streets as is bridges which have had positive growth for the last fifteen, (Table 4).

Water supply continued to contract through September though more slowly continuing a 10 month trend. There has been a surge in conservation expenditures this year but the outlays are relatively small. On a rolling 12 month basis, infrastructure expenditures are about where they were three years ago. (Figure 4).

The press release from the Commerce Department on Monday reads as follows:

September Construction at $950.9 Billion annual Rate

The U.S. Census Bureau of the Department of Commerce announced today that construction spending during September 2014 was estimated at a seasonally adjusted annual rate of $950.9 billion, 0.4 percent below the revised August estimate of $955.2 billion. The September figure is 2.9 percent above the September 2013 estimate of $924.2 billion. During the first 9 months of this year, construction spending amounted to $710.1 billion, 6.1 percent above the $669.3 billion for the same period in 2013.

Private Construction

Spending on private construction was at a seasonally adjusted annual rate of $680.0 billion, 0.1 percent below the revised August estimate of $680.8 billion. Residential construction was at a seasonally adjusted annual rate of $349.1 billion in September, 0.4 percent above the revised August estimate of $347.7 billion. Nonresidential construction was at a seasonally adjusted annual rate of $331.0 billion in September, 0.6 percent below the revised August estimate of $333.0 billion.

Public Construction

In September, the estimated seasonally adjusted annual rate of public construction spending was $270.9 billion, 1.3 percent below the revised August estimate of $274.4 billion. Educational construction was at a seasonally adjusted annual rate of $62.8 billion, 0.1 percent above the revised August estimate of $62.8 billion. Highway construction was at a seasonally adjusted annual rate of $79.9 billion, 3.7 percent below the revised August estimate of $82.9 billion.