Analysis

November 3, 2014

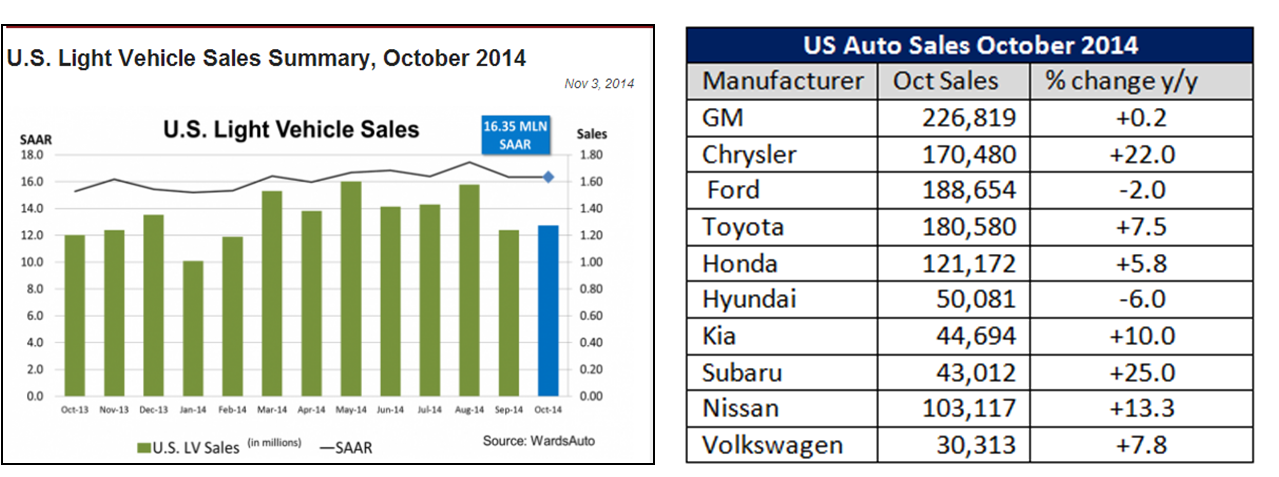

October US Auto Sales Up 6%

Written by Sandy Williams

October U.S. auto sales reached an annualized rate of 16.35 million according to WardsAuto with actual sales totaling 1,273,138 units. October deliveries were up 6 percent on a seasonally adjusted annual rate compared to October 2013.

“October was another strong month for the automotive sector, driven by a combination of low fuel prices, available credit and the ongoing pent-up demand factor. The average car on the road remains more than 11 years old,” said Karl Brauer, senior analyst at Kelley Blue Book.

Ford sales were down as expected due to plant changeovers for the aluminum 2015 F-150. Chrysler was a big winner for the month with sales up 22 percent year over year. General Motors sales were essentially flat with a 0.2 gain from October 2013.

Toyota sales were up 7.5 percent while Hyundai saw a decline of 6 percent. “While we struggled in a couple of segments, our compact and midsize-CUV’s continue to outpace the overall industry,” said Bob Pradzinski, vice president of US sales at Hyundai.

Volkswagen finally had a positive month with sales up 7.8 percent to 30,313 units.