Prices

November 2, 2014

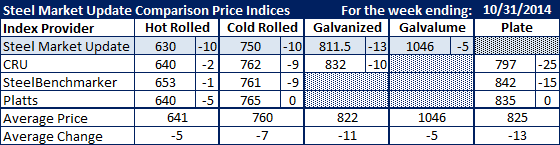

Comparison Price Indices: Slide Continues

Written by John Packard

Prices dropped on all of the indexes and all of the products followed by Steel Market Update. The average for hot rolled, based on the four indexes, was $641 per ton. Steel Market Update saw the market as being down to an average of $630 per ton just prior to the AK Steel announcement. The other indexes saw the market as being down but not by quite as much or as low. Part of this difference is the way the other indexes capture their data. For example, Platts does not allow purchases of more than 500 tons into their numbers which eliminates most of the less than $620 per ton numbers that have been out there.

We also saw reductions on cold rolled, galvanized, Galvalume and Plate with all of the indexes except Platts (CR and plate) moving lower on these products.

Steel Market Update is catching much lower prices on coated products in the South than Midwest and Mid-Central regions of the country. We are being told the reason for the differences are due to the large influx of foreign steel at the Southern ports.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.