Market Data

October 23, 2014

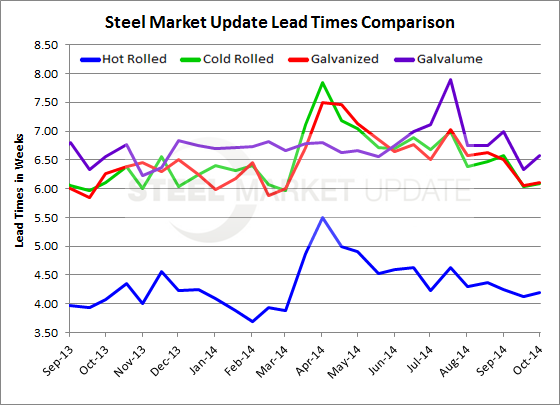

Steel Mill Lead Times Flat W-O-W and Y-O-Y

Written by John Packard

Steel Market Update (SMU) conducted our mid-October flat rolled steel market survey this week. Based on the results of that survey, we found lead times essentially unchanged from one week ago and basically the same as one year ago.

Hot rolled averages 4.2 weeks, cold rolled 6.09 weeks, galvanized 6.11 weeks and Galvalume 6.58 weeks. All lead times are below the high for the past 3 months by anywhere from a half a week (hot rolled) to as much as 1.3 weeks on Galvalume.