Market Data

October 23, 2014

LNG Exports a Game Changer for U.S. Economy

Written by John Packard

Paul Lowrey of Steel Research Associates was discussing the size of the market segments with SMU back in September during our Steel Summit Conference in Atlanta. He was making sure that we were aware that the energy markets are now the largest steel consuming segment of the steel industry, especially if you take into consideration some of the major construction projects associated with natural gas. Mr. Lowrey has promised to provide data supporting his contention in a future edition of our newsletter.

On Wednesday of this week, Steel Market Update attended an energy conference sponsored by Louisiana State University (LSU) in Baton Rouge, LA. The focus of the conference was on the status of the tight gas and shale oil plays with special emphasis on those areas located close to, or within the borders of, Louisiana.

The segment that we were specifically interested in learning more about was the LNG (liquid natural gas) export projects. We did not leave disappointed but rather were amazed at the size and scope of the projects under construction.

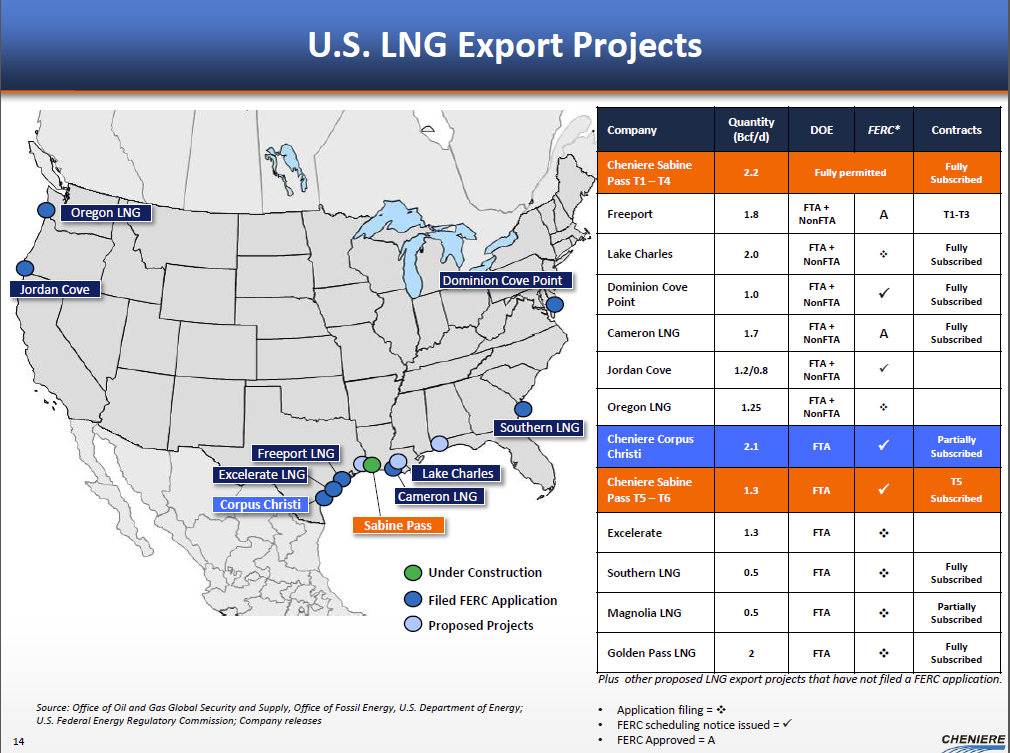

Cheniere is the company which is closest to being able to actually begin exporting LNG. The company is taking a plant in Louisiana which was originally intended to import LNG and building out the infrastructure to produce LNG and reverse the process. The initial plant was completed in 2008, probably the worst timing possible as the energy revolution was moving into high gear and the need for importing LNG was quickly disappearing.

Cheniere is investing $20 billion in the Cameron Parrish, LA plant and the first four “trains” are already fully subscribed (sold out) for the next 20 years. If we heard Matt Barr of Cheniere correctly, the plant should begin to export LNG by the end of 2015. This one plant will ship $60 billion of LNG per year once all six trains are running and will reduce the United States foreign trade deficit by $7 billion.

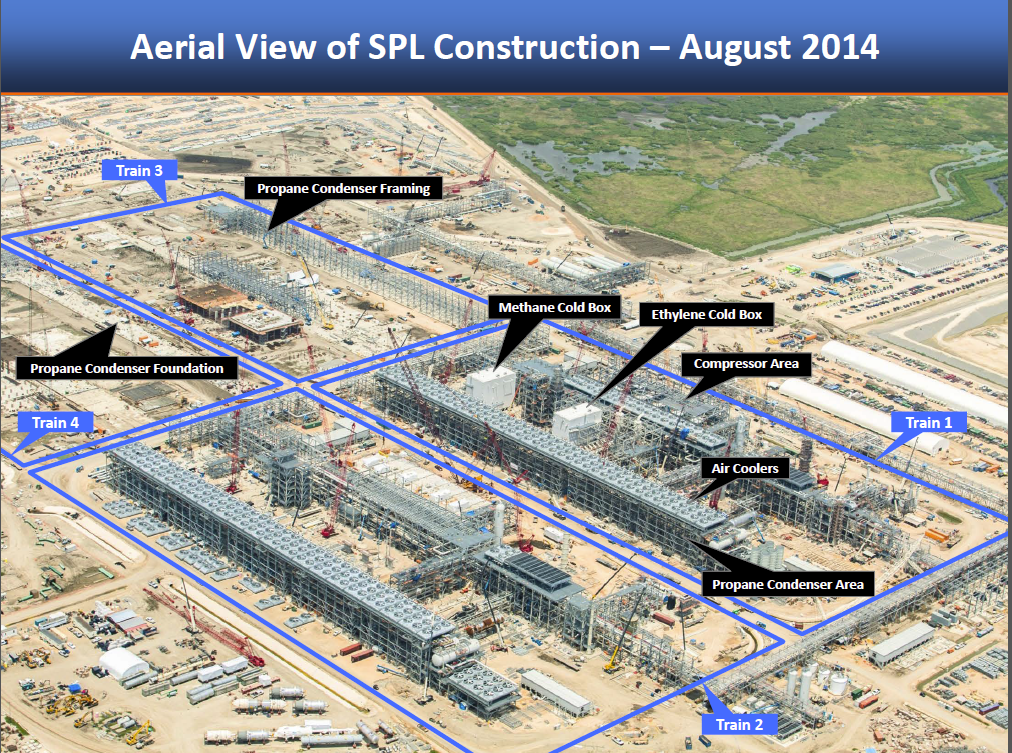

One “train” (see photo) – which is one of the facilities used to produce liquid natural gas by taking the temperature of the gas down to minus 260 degrees – contains 14,000 tons of structural steel. At Cheniere there are 6 trains under construction.

They have a second plant going through the permitting process in Corpus Christi, Texas. The second plant will cost $30 billion to complete.

There are 5 similar projects which have been announced for the East Texas and Louisiana area with the total dollar investment projected to be $44.6 billion. By the year 2035 the number of jobs directly related to these LNG export plants is forecast to be 75,000.

One of the holdups in the construction of more facilities is the government red tape and all of the permits needed to build and then export LNG. Our Energy Moment points out on their website that the two major competitors to the United States for LNG to be exported around the world are Russia and Iran.

“According to the McKinsey Global Institute, approving pending LNG export applications would increase U.S. exports by between $11 billion and $27 billion each year.” (Source: Our Energy Moment)