Prices

October 23, 2014

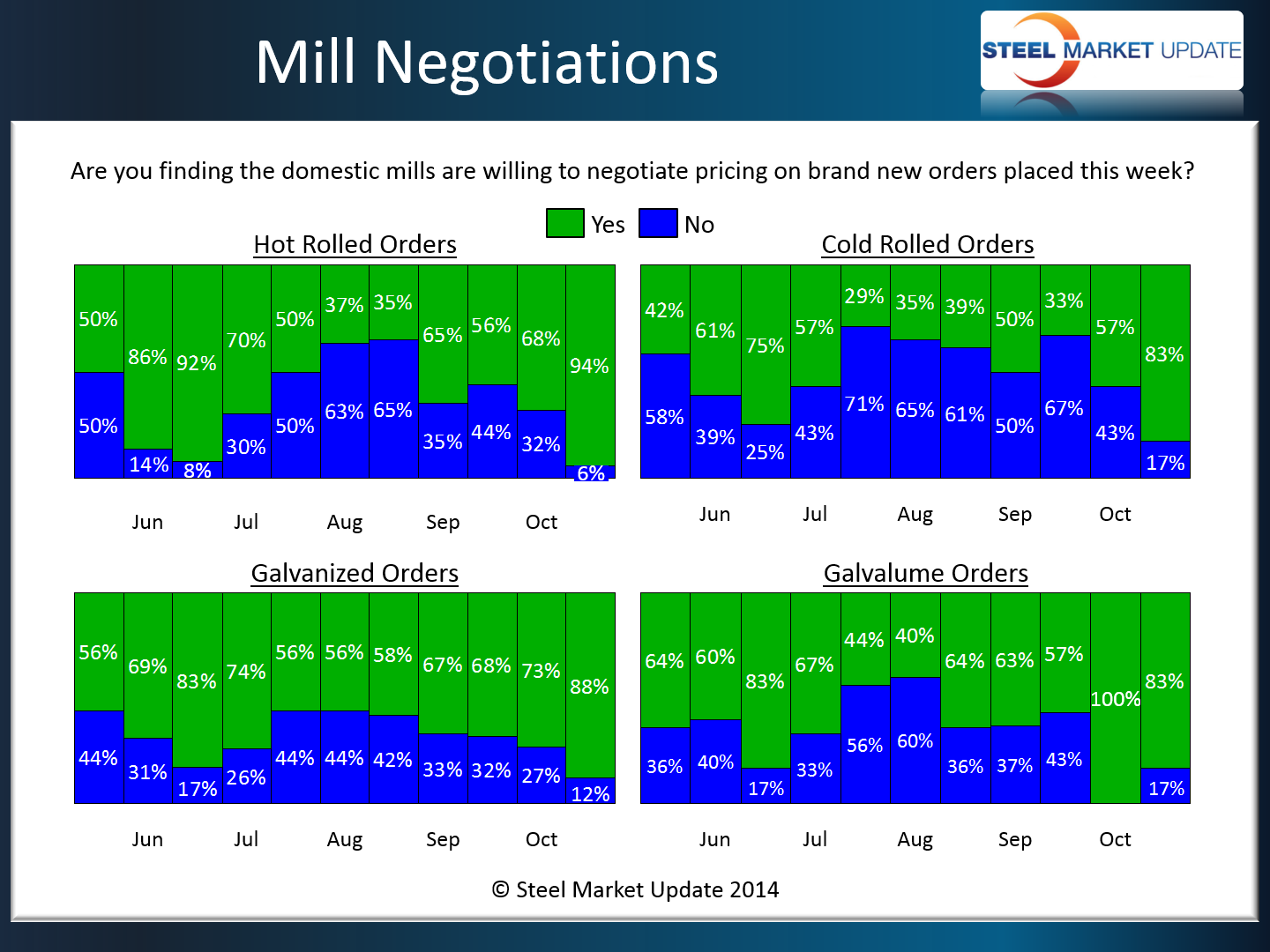

Domestic Mills Continue to be Receptive to Price Negotiations

Written by John Packard

Buyers and sellers of flat rolled steel are advising Steel Market Update that the domestic steel mills are receptive to negotiating prices on all products. Based on the most recent SMU flat rolled steel market survey results, 94 percent of the respondents reported the mills as willing to discuss hot rolled pricing. This is up from 68 percent reported in our last survey at the beginning of this month.

Those reporting cold rolled pricing as being in play rose from 57 percent at the beginning of October to 83 percent this week.

Galvanized also saw the percentage of those reporting the mills as willing to negotiate rise from 73 percent at the beginning of the month to 88 percent now.

Galvalume is the only product that saw a slight reversal as 100 percent reported the mills as willing to negotiate at the beginning of the month with only 83 percent reporting the same now.