Prices

October 19, 2014

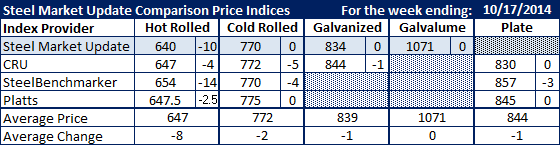

SMU Comparison Price Indices: Prices Continue Move Lower

Written by John Packard

On Friday, Steel Market Update adjusted our hot rolled coil price range to $620-$660 per ton and our average was adjusted to $640 per ton. All of the other indexes also moved lower on hot rolled coil and the average of the four steel price indexes moved lower by $8 per ton to $647 per ton ($32.35/cwt).

Cold rolled prices are in a tight range ($770-$775 per ton) down $3 per ton for the week (average of all indexes).

Galvanized prices were relatively stable (down $1 per ton) and Galvalume remained the same.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.