Prices

October 12, 2014

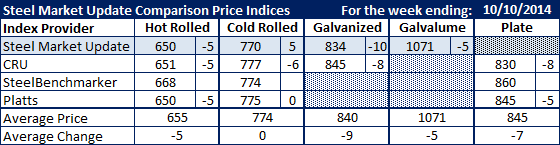

Comparison Price Indices: Flat Rolled Prices Faltering

Written by John Packard

Steel Market Update provides a comparison of a handful of flat rolled steel indices to not only check prices but also look for changes in price momentum. The four indexes reviewed are: CRU, Platts, SteelBenchmarker and our own SMU index.

Hot rolled prices dropped again this past week as all of the reporting indexes were down $5 per ton (SteelBenchmarker did not report new prices this past week). For the first time in a long time the CRU, Platts and SMU hot rolled coil averages were essentially the same at $651, $650 and $650.

Cold rolled averaged $774 per ton and was down $1 per ton based on all four indexes. The spread between high ($777 CRU) and the low ($770 SMU) has been compressing as of late.

Galvanized saw the biggest price movement with SMU down $10 per ton and CRU down $8 per ton. The average of the two was $840 per ton ($42.00/cwt) for .060″ G90 using a $69 per ton coating extra ($3.45/cwt).

Plate prices have also started to slip recently with CRU down $8 per ton and Platts down $5 per ton this week.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.