Market Data

September 30, 2014

Consumer Confidence Dropped in September

Written by Peter Wright

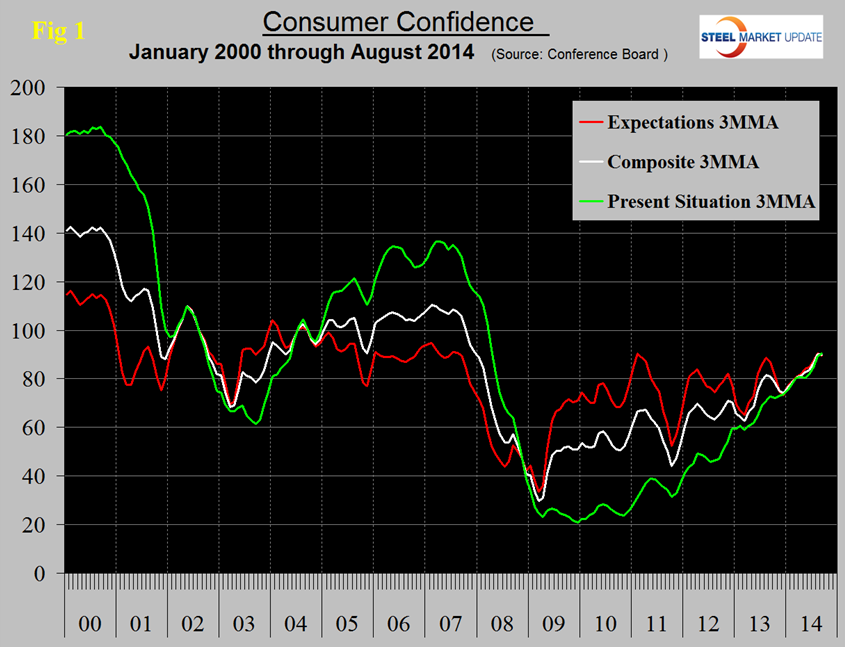

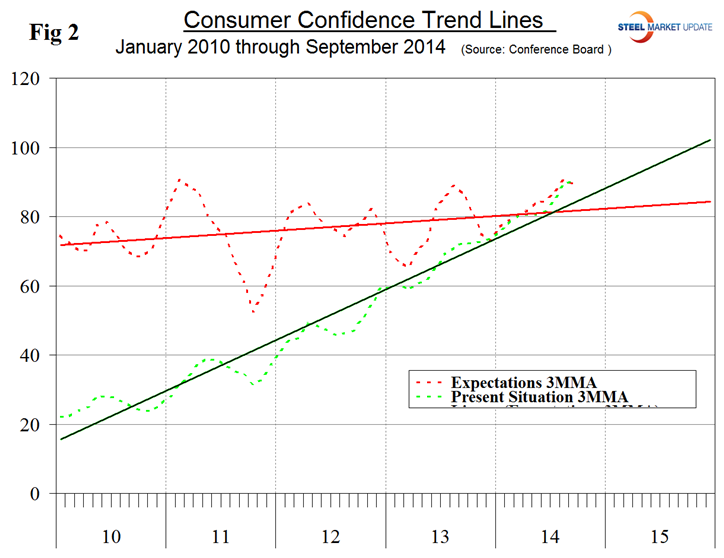

The Consumer Confidence Index as reported by the Conference Board declined sharply in September, particularly in the expectations component. The composite fell from 93.4 to 86.0, the view of the present situation fell from 93.9 to 89.4 as expectations declined from 93.1 to 83.7. In closer examination, it looks as though the August view of the present situation was an outlier as may be the September view of expectations. The three month moving averages (3MMA), provide a much more hopeful picture as shown in Figure 1 and both the view of the present situation and expectations are above their long term trend line as shown in the bold lines in Figure 2.

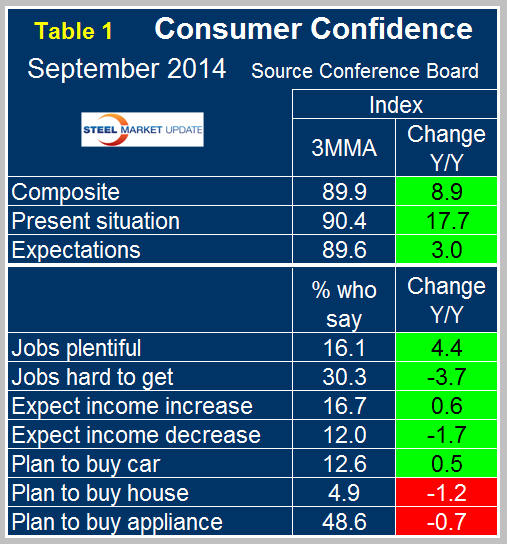

On a year over year basis using a 3MMA the composite is up by 8.9 lead by consumers view of the present situation which is up by 17.7, (Table 1). The employment sub-indexes, job availability and wage expectations, are improving. Intentions to buy both a house and an appliance became negative in May year over year and continued to be negative each month since then. May was the first time in over a year that housing had been negative, intentions regarding appliances tend to be more erratic.

The official statement from the Conference Board reads as follows:

The Conference Board Consumer Confidence Index Declines

The Conference Board Consumer Confidence Index, which had increased in August, declined in September. The Index now stands at 86.0 (1985=100), down from 93.4 in August. The Present Situation Index decreased to 89.4 from 93.9, while the Expectations Index dropped to 83.7 from 93.1 in August.

The monthly Consumer Confidence Survey, based on a probability-design random sample, is conducted for The Conference Board by Nielsen, a leading global provider of information and analytics around what consumers buy and watch. The cutoff date for the preliminary results was September 18.

Says Lynn Franco, Director of Economic Indicators at The Conference Board: “Consumer confidence retreated in September after four consecutive months of improvement. A less positive assessment of the current job market, most likely due to the recent softening in growth, was the sole reason for the decline in consumers’ assessment of present-day conditions. Looking ahead, consumers were less confident about the short-term outlook for the economy and labor market, and somewhat mixed regarding their future earnings potential. All told, consumers expect economic growth to ease in the months ahead.”

Consumers assessed current conditions less favorably in September compared to a month ago. Their view of business conditions was virtually unchanged: those saying conditions are “good” fell minutely, from 23.5 to 23.4 percent, while those claiming business conditions are “bad” held constant at 21.3 percent. Consumers’ appraisal of the job market declined more appreciably, with the proportion stating jobs are “plentiful” falling from 17.6 percent to 15.1 percent. Those claiming jobs are “hard to get” was barely changed, at 30.1 percent versus 30.0 percent in August.

Consumers’ optimism about the short-term outlook declined considerably in September. The percentage of consumers expecting business conditions to improve over the next six months fell from 20.8 percent to 18.6 percent, while those expecting business conditions to worsen rose from 9.9 percent to 12.0 percent. Consumers’ outlook for the labor market likewise took a downturn. Those anticipating more jobs in the months ahead fell from 17.8 percent to 15.2 percent, while those anticipating fewer jobs rose from 15.2 percent to 17.8 percent. The proportion of consumers expecting growth in their incomes rose in September to 16.8 percent, compared to 15.5 percent in August. However, the proportion expecting a drop in income also rose—to 13.4 percent versus 11.6 percent a month ago. (Sources: the Conference Board and SMU Analysis)