Market Data

September 30, 2014

Canadian GDP Flat in July

Written by Sandy Williams

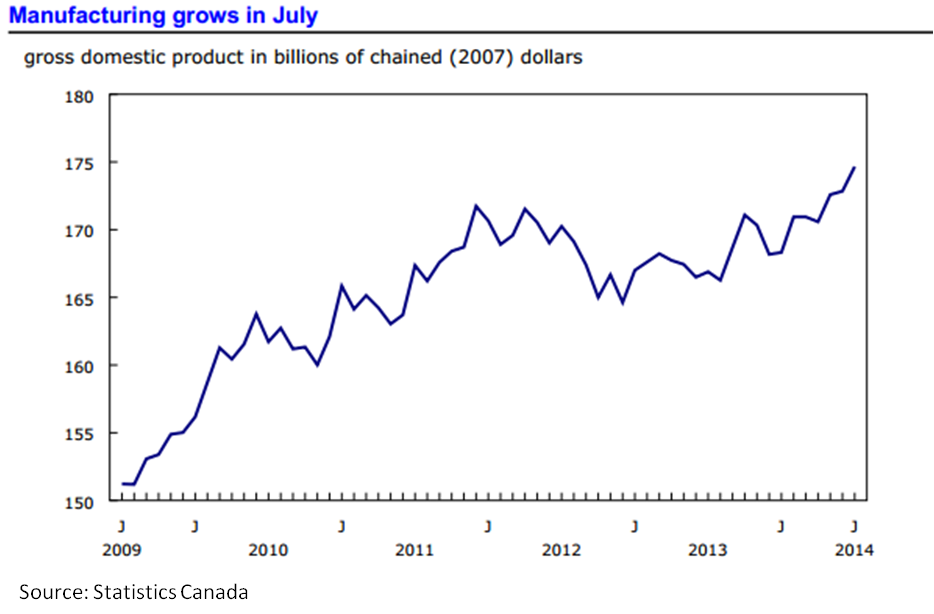

The Canadian economy was flat in July following six months of gains according to data released by Statistics Canada on Sept. 30, 2014. GDP growth was unchanged, failing to meet economist forecasts of 0.2 to 0.3 percent growth.

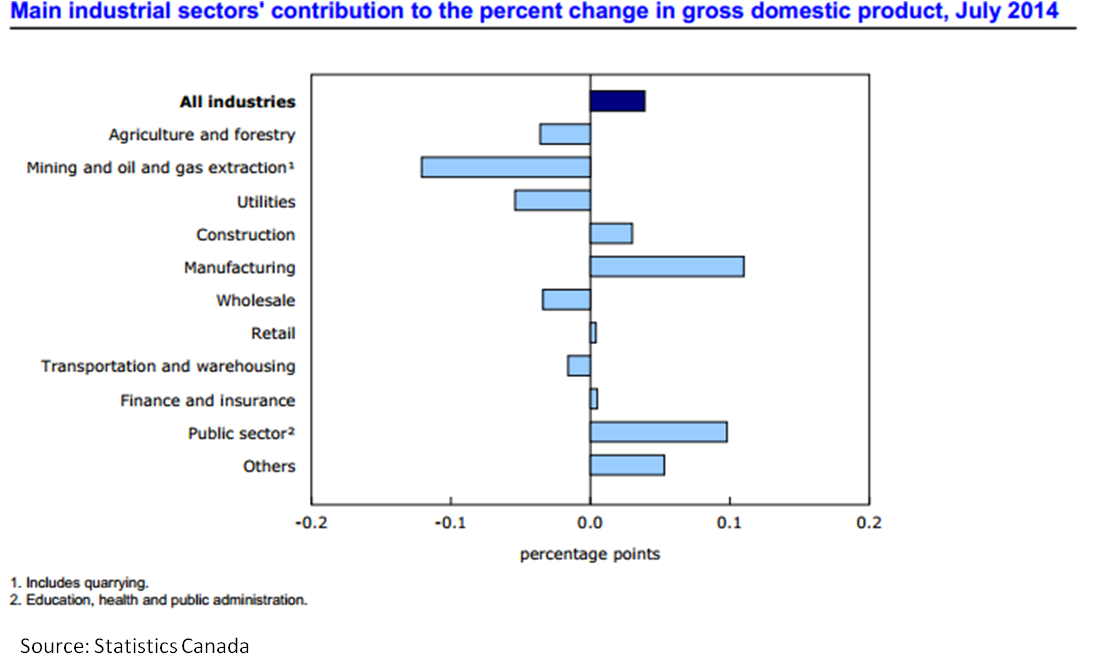

Manufacturing output grew by 1 percent. Durable goods rose 1.6 percent with notable increases in transportation equipment, computer and electronic products. Non-durable goods manufacturing increased by 0.4 percent. Manufacture of chemical, petroleum and coal products fell.

The public sector rose by 0.6 percent due to gains in educational services. Construction, bolstered by residential building and repair grew 0.4 percent.

The public sector rose by 0.6 percent due to gains in educational services. Construction, bolstered by residential building and repair grew 0.4 percent.

The small gains in July were offset by declines in energy and utilities. Mining, quarrying and oil and gas extraction fell 1.5 percent while utilities dropped 2.3 percent.

Following the GDP report on Tuesday, the Canadian dollar weakened to 89.27 U.S. cents. Interest rates have been steady at 1 percent since September 2010, but economists are expecting Bank of Canada to begin raising rates in mid-2015.

“The latest GDP data suggests that the economy had less underlying momentum at the start of this quarter than most had expected,” said David Madani of Capital Economics. “Accordingly, this reinforces our view that the Bank of Canada will be in no hurry to raise interest rates anytime soon.”

“The latest GDP data suggests that the economy had less underlying momentum at the start of this quarter than most had expected,” said David Madani of Capital Economics. “Accordingly, this reinforces our view that the Bank of Canada will be in no hurry to raise interest rates anytime soon.”